FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

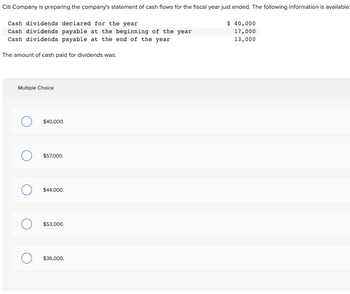

Transcribed Image Text:Citi Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available:

Cash dividends declared for the year

Cash dividends payable at the beginning of the year

Cash dividends payable at the end of the year

The amount of cash paid for dividends was:

Multiple Choice

O $40,000.

O $57,000.

O $44,000.

O $53,000.

$36,000.

$ 40,000

17,000

13,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please show working.arrow_forwardDuring the current year, Royal Industries sold treasury stock for $32,000 cash. The treasury stock was purchased last year for $28,000. The company also issued bonds payable for $430,000 cash and declared and paid dividends of $40,000. What amount did Royal report on its statement of cash flows for cash provided by financing activities? O $390,000 O $394,000 O $422,000 O $434,000arrow_forwardThe accountant for Sysco Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available: Net income for the year 285,000 Cash dividends declared for the year 53,000 Cash dividends payable at the beginning of the year 12, 200 Cash dividends payable at the end of the year 14, 300 What is the amount of cash dividends paid that should be reported in the financing section of the statement of cash flows?arrow_forward

- Cash Flow RatiosSpencer Company reports the following amounts in its annual financial statements: Cash flow from operating activities $90,000 Capital expenditures $59,500* Cash flow from investing activities (68,000) Average current assets 136,000 Cash flow from financing activities (8,500) Average current liabilities 102,000 Net income 42,500 Total assets 255,000 * This amount is a cash outflowa. Compute Spencer's free cash flow.b. Compute Spencer's operating-cash-flow-to-current-liabilities ratio.c. Compute Spencer's operating-cash-flow-to-capital-expenditures ratio. Round ratios to two decimal points. a. Free cash flow Answer b. Operating-cash-flow-to-current-liabilities ratio Answer c. Operating-cash-flow-to-current-expenditures ratio Answerarrow_forwardFor the year ended December 31, Year 1, Fields Company made cash payments of $53,200 for dividends, paid interest of $22,000, paid $31,200 cash to suppliers, and purchased equipment for $69,200 cash. What is the net cash used by investing activities for Year 1? Multiple Choice $175.600 $113.200 $69.200 $75.200arrow_forwardatio of Cash to Monthly Cash Expenses Financial data for Abrams Company follow: For Year EndedDecember 31 Cash on December 31 $54,270 Cash flow from operations (97,200) a. Compute the ratio of cash to monthly cash expenses. Round your answer to one decimal place.fill in the blank 1 months b. Interpret the results computed in (a).arrow_forward

- The accountant for Robinson Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available: RETAINED EARNINGS BALANCE AT BEGINNING OF YEAR $156,000 CAHS DIVIDENS DECLARED FOR THE YEAR $46,000 PROCEEDS FROM SALE OF EQUIPMENT $81,000 GAIN ON SALE OF EQUIPMENT $7,000 CASH DIVIDENDS PAYABLE BEGINNING OF YEAR $18,000 CASH DIVIDENDS PAYABLE ENDING OF YEAR $40,000 NET INCOME $92,000 The amount of cash dividends paid during the year would be:arrow_forwardOn May 1, Year 3, Love Corporation declared a $74,100 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1 and May 31 in the following horizontal statements model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Date May 01 May 31 Assets Balance Sheet Liabilities Common Stock LOVE CORPORATION Horizontal Statements Model Retained Earnings Revenue Income Statement Expenses Net Income Statement of Cash Flowsarrow_forwardThe accountant for Crusoe Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available Retained earnings balance at the beginning of the year Cash dividends declared for the year Proceeds from the sale of equipment Gain on the sale of equipment Net income for the year What is the ending balance for retained earnings? Multiple Choice O $218,000 O $170,000 O $352.000 $172,000 $179,000 $ 126,000 46,000 81,000 7,000 92,000arrow_forward

- Barclays Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available: Retained earnings balance at the beginning of the year $ 328,000 Cash dividends declared for the year 73,750 Proceeds from the sale of equipment 126,800 Gain on the sale of equipment 7,350 Cash dividends payable at the beginning of the year 32,450 Cash dividends payable at the end of the year 39,500 Net income for the year 162,250 The amount of cash paid for dividends was:arrow_forwardmin.4arrow_forwardThe accountant for Robinson Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available: RETAINED EARNINGS BALANCE AT BEGINNING OF YEAR $156,000 CAHS DIVIDENS DECLARED FOR THE YEAR $46,000 PROCEEDS FROM SALE OF EQUIPMENT $81,000 GAIN ON SALE OF EQUIPMENT $7,000 CASH DIVIDENDS PAYABLE BEGINNING OF YEAR $18,000 CASH DIVIDENDS PAYABLE ENDING OF YEAR $40,000 NET INCOME $92,000 The amount of cash dividends paid during the year would be:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education