FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

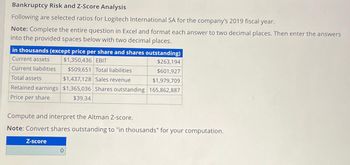

Transcribed Image Text:Bankruptcy Risk and Z-Score Analysis

Following are selected ratios for Logitech International SA for the company's 2019 fiscal year.

Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers

into the provided spaces below with two decimal places.

in thousands (except price per share and shares outstanding)

$1,350,436 EBIT

$263,194

$509,651 Total liabilities

$601,927

$1,437,128 Sales revenue

$1,979,709

165,862,887

$1,365,036 Shares outstanding

$39.34

Current assets

Current liabilities

Total assets

Retained earnings

Price per share

Compute and interpret the Altman Z-score.

Note: Convert shares outstanding to "in thousands" for your computation.

Z-score

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Barger Corporation has the following data as of December 31, 2024: Total Stockholders' Equity Total Current Liabilities Total Current Assets $ 36,210 58,200 181,630 Other Assets Long-term Liabilities Property, Plant, and Equipment, Net Compute the debt to equity ratio at December 31, 2024. (Round your answer to two decimal places, X.XX.) = = C $? 45,600 269,640 Debt to equity ratioarrow_forwardChanges in Various Ratios Presented below is selected information for Turner Company: Sales revenue Cost of goods sold Interest expense Income tax expense Net income Cash flow from operating activities Capital expenditures Accounts receivable (net), December 31 Inventory, December 31 Stockholders' equity, December 31 Total assets, December 31 2019 2018 $950,000 $850,000 575,000 545,000 20,000 20,000 27,000 30,000 65,000 55,000 70,000 60,000 45,000 45,000 126,000 120,000 196,000 160,000 450,000 400,000 750,000 675,000 Required Calculate the following ratios for 2019. The 2018 results are given for comparative purposes. Round answers to one decimal place. Use 365 days in a year. 2018 35.9% 8.3% 6.5% 1. Gross profit percentage 2. Return on assets 3. Return on sales 4. Return on common stockholders' equity (no preferred stock was outstanding) 5. Accounts receivable turnover 6. Average collection period 13.9% 8.0 45.6 days 2019 0 % 0 % 0 % 0 % 0 0 daysarrow_forwardTotal debt to total assets% ratio: ?? Round your answer to the nearest hundredth percent Return on equity% ratio: ?? Round your answer to the nearest hundredth percent Asset turnover ratio: ?? Round your answer to the nearest centarrow_forward

- Assume General Motors announced a quarterly profit of $119 million for 4th quarter 2019. Below is a portion of its balance sheet. Conduct a horizontal analysis of the following line items. (Negative answers should be indicated by a minus sign. Round the "percent" answers to the nearest hundredth percent.) 2019 (dollars in millions) 2018 (dollars in millions) Difference % CHG Cash and cash equivalents $ 15,980 $ 15,499 Marketable securities 9,222 16,148 Inventories 13,642 14,324 Goodwill 1,278 Total liabilities and equity $ 103,249 $ 144,603arrow_forwardThe comparative accounts payable and long-term debt balances for a company follow. Current Year Previous YearAccounts payable $114,240 $102,000Long-term debt 127,200 120,000 Based on this information, what is the amount and percentage of increase or decrease that wouldbe shown on a balance sheet with horizontal analysis?arrow_forwardComputing Financial Statement Measures The following pretax amounts are taken from the adjusted trial balance of Mastery Inc. on December 31, 2020, its annual year-end. Assume that the income tax rate for all items is 25%. The average number of common shares outstanding during the year was 20,000. Balance, retained earnings, December 31, 2019 $ 45,000 Sales revenue 300,000 Cost of goods sold 105,000 Selling expenses 36,000 Administrative expenses 34,000 Gain on sale of investments 10,000 Unrealized holding gain on debt investments, net of tax 4,250 Prior period adjustment, understatement of depreciation from prior period (2019) 20,000 Dividends declared and paid 16,000 Required Compute the following amounts for the year-end financial statements of 2020. Do not use negative signs with any of your answers. Round the per share amount to two decimal places. Item Amount a. Gross profit (2020). b. Operating income (2020). c. Net…arrow_forward

- Balance Sheet Nicole Corporation's year-end 2019 balance sheet lists current assets of $753,000, fixed assets of $603,000, current liabilities of $542,000, and long-term debt of $697,000. What is Nicole's total stockholders' equity? Multiple Choice О о $117,000 $1,356,000 There is not enough information to calculate total stockholder's equity. $1,239,000arrow_forwardDebt to Equity Total Debt Ratio Times Interest Earnedarrow_forwardBankruptcy Risk and Z-Score Analysis Following are selected ratios for Logitech International SA for the company's 2019 fiscal year. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. in thousands (except price per share and shares outstanding) $1,350,436 EBIT $488,117 Total liabilities i Current assets Current liabilities Total assets $263,194 $576,494 $1,376,404 Sales revenue $1,896,059 Retained earnings $1,365,036 Shares outstanding 165,862,887 Price per share $39.34 Compute and interpret the Altman Z-score. Note: Convert shares outstanding to "in thousands" for your computation. Z-scorearrow_forward

- Bankruptcy Risk and Z-Score Analysis Following are selected ratios for Tesla for two recent fiscal years. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Ratio Current ratio Working capital to total assets Retained earnings to total assets EBIT to total assets EBITDA to total assets Market value of equity to total liabilities Sales to total assets Compute and interpret Altman Z-scores for the company for both years. Year Z-score 2017 2018 2018 2017 1.135 0.831 0.642 0.5430 (0.177) (0.1788) (0.002) (0.0549) 0.061 0.0527 3.490 2.8830 1.316 0.9950 0 0 Check Is the company's bankruptcy risk increasing or decreasing over this period? Increasing Decreasing ◆arrow_forwardCalculate the Debt to Equity ratio for Urban Outfitters for both 2018 and 2019. Be sure to round your answer to 2 decimal place.arrow_forwardView Policies Current Attempt in Progress Using the following balance sheet and income statement data, what is the debt to assets ratio? Current assets $31500 Net income $41100 Stockholders' Current liabilities 15400 79400 equity Average assets 162500 Total liabilities 42300 Total assets 114000 Average common shares outstanding was 15500. 37 percent O 70 percent O 15 percent O 28 percent Attempts: 0 of 1 used Save for Laterarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education