FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

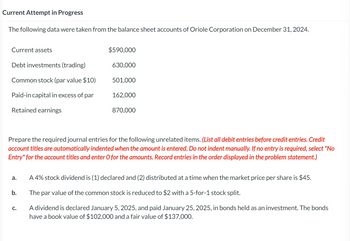

Transcribed Image Text:Current Attempt in Progress

The following data were taken from the balance sheet accounts of Oriole Corporation on December 31, 2024.

Current assets

Debt investments (trading)

Common stock (par value $10)

Paid-in capital in excess of par

Retained earnings

a.

b.

$590,000

630,000

C.

501,000

Prepare the required journal entries for the following unrelated items. (List all debit entries before credit entries. Credit

account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No

Entry" for the account titles and enter O for the amounts. Record entries in the order displayed in the problem statement.)

162,000

870,000

A 4% stock dividend is (1) declared and (2) distributed at a time when the market price per share is $45.

The par value of the common stock is reduced to $2 with a 5-for-1 stock split.

A dividend is declared January 5, 2025, and paid January 25, 2025, in bonds held as an investment. The bonds

have a book value of $102,000 and a fair value of $137,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (Related to Checkpoint 4.2) (Capital structure analysis) The liabilities and owners' equity for Campbell Industries is found here: E a. What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.1 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? a. What percentage of the firm's assets does the firm finance using debt (liabilities)? The fraction of the firm's assets that the firm finances using debt is %. (Round to one decimal place.)arrow_forward1c. Journalize the entries to record the 203 transactions. Refer to the Chart of Accounts for exact wording of account titles. Round all amounts to the nearest dollar.arrow_forwardTamarisk Corp. carries an account in its general ledger called Investments, which contained debits for investment purchases, and no credits, with the following descriptions. F-b. 1.2025 July 1 (a) (5) Sharapova Company common stock, $100 par, 200 shares U.S. government bonds, 11%, due April 1, 2035, interest payable April 1 and October 1, 108 bonds of 31000 par cách McGrath Company 12% bonds, par $54,100, dated March 1, 2025, purchased at 104 plus accrued interest, interest payable annually on March 1, due March 1, 2045 Your answer is partially correct. Prepare the entry to record the accrued interest and the amortization of premium on December 31, 2025, using the straight-line method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. Ifna entry is required, select "No Entry for the account titles and enter Ofor the amounts. Round answers to 0 decimal places. 5.19251 Date Account Titles and…arrow_forward

- Required Information [The following Information applies to the questions displayed below.] On January 1, 2021, the general ledger of ACME Fireworks Includes the following account balances: Accounts Cash Debit. Credit Accounts Receivable Allowance for Uncollectible Accounts $ 27,100 50,200 $ 6,200 Inventory 22,000 Land 66,000 Equipment 25,000 Accumulated Depreciation 3,500 Accounts Payable 30,500 Notes Payable (6%, due April 1, 2022) 70,000 Common Stock 55,000 Retained Earnings 25,100 Totals $190,300 $190,300 During January 2021, the following transactions occur: January 2 Sold gift cards totaling $12,000. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $167,000. January 15 Firework sales for the first half of the month total $155,000. All of these sales are on account. The cost of the units sold is $83,800. January 23 Receive $127,400 from customers on accounts receivable. January 25 Pay $110,000 to…arrow_forwardPlease answer complete and properlyarrow_forwardThe bookkeeper for Novak Corp. has prepared the following statement of financial position as at July 31, 2023: Cash Accounts receivable (net) Inventory Equipment (net) Patents (net) 1. Novak Corp. Statement of Financial Position As at July 31, 2023 2. $84,000 39,800 72,000 217,000 23,000 $435,800 The following additional information is provided: Notes and accounts payable Long-term liabilities Shareholders' equity $52,000 83,000 300,800 $435,800 Cash includes $1,700 in a petty cash fund and $29,000 in a bond sinking fund. The net accounts receivable balance is composed of the following three items: (a) accounts receivable debit balances =SUPPORTarrow_forward

- American Laser, Inc., reported the following account balances on January 1. Accounts Receivable Accumulated Depreciation. Additional Paid-in Capital Allowance for Doubtful Accounts Bonds Payable Buildings. Cash Common Stock, 10,000 shares of $1 part Notes Payable (long-term) Retained Earnings Treasury Stock TOTALS Requirement View transaction list General Journalarrow_forwardAmerican Laser, Inc., reported the following account balances on January 1. Accounts Receivable Accumulated Depreciation. Additional Paid-in Capital Allowance for Doubtful Accounts Bonds Payable Buildings. Cash Common Stock, 10,000 shares of $1 part Notes Payable (long-term) Retained Earnings Treasury Stock TOTALS Requirement View transaction list General Journalarrow_forwardes C11-1 (Algo) Financial Reporting of Depreciation, Write-off, Bond Issuance and Common Stock Issuance, Purchase, Reissuance, and Cash Dividends [Chapters 4, 8, 9, 10, and 11) [LO 4-2, 4-5, 8-2, 9-3, 10-3, 11-2, 11-3] Bender Industries, reported the following account balances on January 1. Credit Accounts Receivable Accumulated Depreciation Additional Paid-in Capital Allowance for Doubtful Accounts Bonds Payable Buildings Cash Common Stock, 10,000 shares of $1 par Notes Payable (long-term) Retained Earnings Treasury Stock TOTALS Debit $ 5,000 249,000 10,500 0 $ 264,500 30,000 92,000 2,000 0 10,000 10,500 120,000 The company entered into the following transactions during the year. January 15 Issued 6,000 shares of $1 par common stock for $52,000 cash. January 31 Collected $3,000 from customers on account. February 15 Reacquired 3,020 shares of $1 par common stock into treasury for $33,220 $ 264,500 cash. March 15 Reissued 2,020 shares of treasury stock for $24,220 cash. August 15…arrow_forward

- The following balance sheet for the Hubbard Corporation was prepared by the company: HUBBARD CORPORATION Balance Sheet At December 31, 2021 Assets Buildings Land Cash Accounts receivable (net) Inventory Machinery Patent (net) Investment in equity securities Total assets Liabilities and Shareholders' Equity Accounts payable Accumulated depreciation Notes payable Appreciation of inventory Common stock (authorized and issued no par stock) 106,000 shares Retained earnings Total liabilities and shareholders' equity $ 756,000 268,080 66,080 132,080 252,000 286,000 106,000 72,000 $1,938,000 $ 221,000 261,080 512,080 86,080 424,000 434,000 $1,938,000 Additional information: 1. The buildings, land, and machinery are all stated at cost except for a parcel of land that the company is holding for future sale. The land originally cost $56,000 but, due to a significant increase in market value, is listed at $132,000. The Increase in the land account was credited to retained earnings. 2. The…arrow_forwardBelow are the titles of a number of debit and credit accounts as they might appear on the statement of financial position of Hayduke ASA as of October 31, 2022. Select the Current Asset, Current Liability, Borderline, and Not a Current Item from among these debit and credit accounts. Debit Interest Accrued on Government Securities Notes Receivable Petty Cash Fund Government Securities Treasury Shares Current Asset Current Liability Borderline Not a Current Item Credit Share Capital-Preference 6% First Mortgage Bonds, due in 2029 Preference Dividend, payable Nov. 1,2022 Allowance for Doubtful Accounts Customers' Advances (on contracts to be completed next year)arrow_forwardAccounting A company purchases corporate bonds for $1,000,000 and categorizes them as AFS. At year-end, their market value is $750,000. $100,000 of the decline in value is attributed to a rise in market interest rates, and $150,000 of the decline is attributed to credit losses. Prepare the year-end adjusting entry in either a T-account or spreadsheet format. See above for location of spreadsheet template. A company invests in stock of other companies for trading purposes. Its accounting year ends December 31. Its investment activity during 2019, 2020, and 2021 is as follows: a. Purchased stock of Acme Company in 2019 for $250,000 for the purpose of taking advantage of short-term volatility in the market place. b. Sold the investment shortly after purchase for $235,000. c. Purchased stock of Beeber Company in 2019 for $300,000. d. The investment had a fair value of $275,000 at the end of 2019. e. It was sold for $310,000 in late 2020. f. Purchased stock of Cromwell Company in 2019 for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education