On 30 September 2022, Piston Limited had a balance in its ‘Cash in Bank’ general ledger account of $13,034.30 debit. The bank statement from ANZ bank on that date showed a credit balance of $19,495.00. A comparison of the September 2022 bank statement with the ‘Cash in Bank’ general ledger account and the bank reconciliation for August 2022 revealed the following facts (ignore GST):

Ref:

(1) Electronic Funds Transfers (EFTs), totalling $1,770.10, from the August 2022 bank reconciliation has still not been presented to the bank.

(2) Cash sales of $2,945 on 20 September 2022 were deposited in the bank. The general

(3) From the review of the September 2022 cash journals, it was established that outstanding EFTs totalled $3,567.10, and outstanding deposits were $1,190.40.

(4) On 24 September 2022 Piston Limited made a payment (EFT no. 3485) for $540.80 to J. Smith for an accounts payable payment. The EFT no. 3485, which showed up on the bank statement on 25 September 2022, was incorrectly recorded in the ‘Cash in Bank’ general ledger account as $450.80.

(5) A $3,000 note receivable was collected by the bank for Piston Limited on 15 September 2022, plus $80 interest. The bank charged a bank fee of $20 for this transaction. These items were not accounted for in the ‘Cash in Bank’ general ledger account.

(6) The bank statement showed that the bank returned a dishonoured

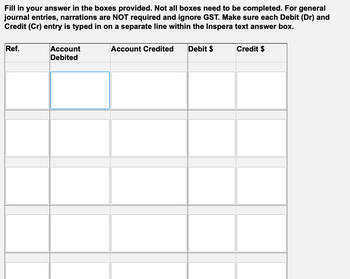

Prepare any

Step by stepSolved in 2 steps

- Submit it in excel formarrow_forwardGiven this book and bank statement information, create an October bank reconciliation for Arrowhead company. And the journal entries required for the book side. BOOK INFO: Cash Date Debit Credit Balance 10/1/2020 Beginning Balance 8,259.86 10/1/2020 Ck 10102 Accounts Payable 1,374.12 6,885.74 10/2/2020 Ck 10103 Rent 3,420.00 3,465.74 10/2/2020 Ck 10104 Utilities 689.00 2,776.74 10/4/2020 Deposit 3,743.10 6,519.84 10/4/2020 Ck 10105 Advertising 344.21 6,175.63 10/4/2020 Ck 10106 Subscription 102.84 6,072.79 10/9/2020 Ck 10107 Internet 74.97 5,997.82 10/9/2020 Deposit 4,859.47 10,857.29 10/9/2020 Ck 10108 Telephone 221.00 10,636.29 10/9/2020 Deposit 11,339.64 21,975.93 10/12/2020 Ck 10109 Accounts Payable 1,680.00 20,295.93 10/13/2020 Ck 10110 Wages…arrow_forwardQUESTION: ON OCTOBER 31, 2015, THE BANK STATEMENT FOR THE CHECKING ACCOUNT OF BLOCKWOOD VIDEO SHOWS A BALANCE OF $12,818, WHILE THE COMPANY S RECORDS SHOW A BALANCE OF $12,326. INFORMATION THAT MIGHT BE USEFUL IN PREPARING A BANK RECONCILIATION IS AS FOLLOWS: A. OUTSTANDING CHECKS ARE $1,225. B. THE OCTOBER 31 CASH RECEIPTS OF $780 ARE NOT DEPOSITED IN THE BANK UNTIL NOVEMBER 2. C. ONE CHECK WRITTEN IN PAYMENT OF UTILITIES FOR $136 IS CORRECTLY RECORDED BY THE BANK BUT IS RECORDED BY BLOCKWOOD AS DISBURSEMENT OF $163. D. IN ACCORDANCE WITH PRIOR AUTHORIZATION, THE BANK WITHDRAWS $449 DIRECTLY FROM THE CHECKING ACCOUNT AS PAYMENT ON A NOTE PAYABLE. THE INTEREST PORTION OF THAT PAYMENT IS $49 AND THE PRINCIPAL PORTION IS $400. BLOCKWOOD HAS NOT RECORDED THE DIRECT WITHDRAWAL. E. BANK SERVICE FEES OF $23 ARE LISTED ON THE BANK STATEMENT. F. A DEPOSIT OF $566 IS RECORDED BY THE BANK ON OCTOBER 13, BUT IT DID NOT BELONG TO BLOCKWOOD. THE DEPOSIT SHOULD HAVE BEEN MADE TO THE CHECKING ACCOUNT…arrow_forward

- Given the following information to reconcile GCompany’s cash book balance with its bank statement balance as of July 31, 2021: a. Cheques #296 for $1,334 and #307 for $12,754 were outstanding on the September 30 bank reconciliation. Cheque #307 was returned with the October cancelled cheques, but cheque #296 was not. It was also found that cheque #315 for $893 and cheque #321 for $2,000, both written in July, were not among the cancelled cheques returned with the statement. b. In comparing the cancelled cheques returned by the bank with the entries in the accounting records, it was found that cheque #320 for the July rent was correctly written for $4,090 but was erroneously entered in the accounting records as $4,900. c. Also enclosed with the statement was a $74 debit memo for bank services. It had not been recorded because no previous notification had been received. d. A credit memo enclosed with the bank statement indicated that there was an electronic fund transfer related to a…arrow_forwardDo not give image formatarrow_forwardPlease review the attached files. Thank youarrow_forward

- Please do not give solution in image format ?.arrow_forwardThe books of Cajardo Service, Inc. disclosed a cash balance of P687,570 on December 31, 2010. The bank statement as of December 31 showed a balance of P547,800. Addifional information that might be useful in reconciling the two balances follows: A. Check No. 748 for P30,000 was originally recorded on the books as P45,000. B. A Customer's note dated September 25 was discounted on October 12. The note was dishonored on December 29, the note's maturity date. The bank charged Cajardo's account for P142,650, including a protest fee of P2,650. C. The deposit of December 24 was recorded on the books as P28,950 but it was actually a deposit of P27.000. D. Outstanding checks totaled P98,850 as of December 31. E. There woas a bank service charge for December of P2,100 not yet recorded on the books. F. Cajardo's account had been charged on December 26 for a customer's NSF check for P12.960. G. Cajardo properly deposited P6.000 on December 3 that was not recorded by the bank. H. Receipts of…arrow_forwardCurrent Attempt in Progress At August 31, 2025, Sage Hill Nail Bar has this bank information: cash balance per bank $10,790; outstanding checks $840; deposits in transit $1,800; and a bank service charge $30. Determine the adjusted cash balance per bank at August 31, 2025. Adjusted cash balance per bank Touthook and Modla $arrow_forward

- I need help with correct solutionarrow_forwardPlease help.me to do part a and b. Thank you for your helparrow_forwardOn february 28th, 2022, Mark, the accountant of the scented candle business Smells LTD, prepared the documents for his february bank reconciliation. He noted a Cash balance of $15,534 in the general ledger. The bank statement on that date showed a balance of $17,675. A comparison of the bank statement with the cash account revealed the following The bank statement included service charges and card processing fees of $50 The bank statement included electronic collections (EFT) from customers, totaling $5,520. Smells LTD had not recorded the EFT yet A deposit of $200 made by another company was incorrectly added to Breathe-ins account by their bank Recent deposits worth $5,400 are not currently showing on the bank statement Cheques outstanding on January 31 totaled $3,754. Of these, $1,883 cleared the bank in February and are no longer outstanding. All new cheques written in February cleared the bank during the month Enter amounts with the final number rounded to the nearest $.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education