FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

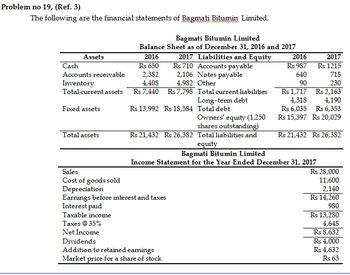

Transcribed Image Text:Problem no 19, (Ref. 3)

The following are the financial statements of Bagmati Bitumin Limited.

Assets

Cash

Accounts receivable

Inventory

Total current assets

Fixed assets

Total assets

Sales

Cost of goods sold

Depreciation

Bagmati Bitumin Limited

Balance Sheet as of December 31, 2016 and 2017

2016

Rs 650

2,382

4,408

Rs 7,440

2017 Liabilities and Equity

Rs 710 Accounts payable

2,106 Notes payable

4,982 Other

Rs 7,798

Rs 13,992 Rs 18,584 Total debt

Total current liabilities

Long-term debt

Owners' equity (1,250

shares outstanding)

Rs 21,432 Rs 26,382 Total liabilities and

equity

Earnings before interest and taxes

Interest paid

Taxable income

Taxes @ 35%

Net Income

Dividends

Addition to retained earnings

Market price for a share of stock

2016

Rs 987

640

90

Rs 1,717

4,318

Rs 6,035

Rs 15,397

Bagmati Bitumin Limited

Income Statement for the Year Ended December 31, 2017

2017

Rs 1215

718

230

Rs 2,163

4,190

Rs 6,353

Rs 20,029

Rs 21,432 Rs 26,382

Rs 28,000

11,600

2,140

Rs 14,260

980

Rs 13,280

4,648

Rs 8,632

Rs 4,000

Rs 4,632

Rs 63

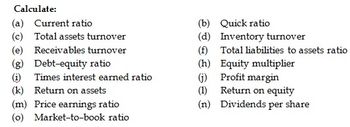

Transcribed Image Text:Calculate:

(a) Current ratio

(c)

Total assets turnover

(e) Receivables turnover

(g) Debt-equity ratio

(1) Times interest earned ratio

Return on assets

(k)

(m) Price earnings ratio

(0) Market-to-book ratio

(b)

(d)

(f)

(h)

(j)

(1)

(n)

Quick ratio

Inventory turnover

Total liabilities to assets ratio

Equity multiplier

Profit margin

Return on equity

Dividends per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Additional information: 2018 current ratio: 1.4:1 debt to total assets: 61.1% Question: find working capital for 2018 Additional information: 2017 current ratio 1.5:1 working capital: 214,500 Question find debt to total assets for 2017arrow_forwardThe asset side of the 2017 balance sheet for the Corporation is below. The company reported total revenues of $37,728 million in 2017 and $37,047 million in 2016. in millions May 31, 2017 May 31, 2016 Current assets: Cash and cash equivalents $ 21,784 $ 20,152 Marketable securities 44,294 35,973 Trade receivables, net of allowances for doubtful accounts of $319 and $327 as of May 31, 2017 and May 31, 2016, respectively 5,300 5,385 Inventories 300 212 Prepaid expenses and other current assets 2,837 2,591 Total current assets 74,515 64,313 Non-current assets: Property, plant and equipment, net 5,315 4,000 Intangible assets, net 7,679 4,943 Goodwill, net 43,045 34,590 Deferred tax assets 1,143 1,291 Other assets 3,294 3,043 Total non-current assets 60,476 47,867 Total assets $134,991 $112,180 How do I figure what the company’s gross amount…arrow_forward7arrow_forward

- Bruno Inc.'s Financial Statement for years 2014-2015. Compute for the Bruno Inc. Year 2015 Debt to Equity Ratio. (Answer Format: 12.23%, if computed answer is 12.343% answer should be 12.34%, if computed answer is 12.347% answer should be 12.35%) INCOME STATEMENTS 2014 2015 BALANCE SHEETS Assets Cash 2014 2015 Net sales $ 4,760 $ 5,000 S 60 50 COGS (excl. depr.) 3,560 3,800 ST Investments 40 . Depreciation 170 200 Accounts receivable 380 500 480 500 Inventories 820 1,000 Other operating expenses EBIT S 550 S 500 Total CA $ 1,300 $ 1,550 Interest expense 100 120 Net PP&E 1,700 2,000 Pre-tax earnings S 450 S 380 $ 3,000 $ 3,550 Taxes (40%) 180 152 NI before pref. div. $ 270 228 Preferred div. 8 8 S 190 $ 200 Net income $ 262 220 280 300 130 280 Other Data $ 600 S 780 Common dividends $48 $50 1,000 1,200 Addition to RE $214 $170 $ 1,600 $ 1,980 Tax rate 40% 40% 100 100 Shares of common stock 50 50 500 500 Earnings per share $5.24 $4.40 800 970 Dividends per share $0.96 $1.00 $ 1,300 S…arrow_forwardWhat is the overall assement of the company's credit risk (explain)? Is there any difference between the two years?arrow_forwardBruno Inc.'s Financial Statement for years 2014-2015. Compute for the Bruno Inc. Year 2015 Debt to Equity Ratio. (Answer Format: 12.23%, if computed answer is 12.343% answer should be 12.34%, if computed answer is 12.347% answer should be 12.35%)arrow_forward

- The current assets and current liabilities sections of the balance sheet of Sunland Co. appear as follows. Sunland Co.Balance Sheet (Partial)As of December 31, 2017 Cash $ 17,900 Accounts payable $ 29,500 Accounts receivable $ 39,600 Notes payable 15,400 Less: Allowance for doubtful accounts 3,200 36,400 Unearned revenue 3,800 Inventory 61,100 Total current liabilities $ 48,700 Prepaid expenses 7,400 Total current assets $ 122,800 The following errors in the corporation’s accounting have been discovered: 1. Keane collected $ 5,200 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company’s controller recorded the amount as revenue. 2. The inventory amount reported included $ 2,300 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $ 1,600 had been received on…arrow_forwardSolar Electric Inc. Balance Sheet 32 Marks ACB As at December 31, 2023 Account Title Debit Credit Assets Current Assets Cash 100,649 Accounts Receivable 35,860 Interest Rceivable 9,113 Prepaid Insurance 7,370 Short-Term Investment- Citi Inc 237,000 Short-Term Investment- Bonds 135,000 Inventory 90,640 Valuation Allowance for Fair Value Adjustment 50,700 Total Current Assets 666,332 Non-current Assets Investment in HSBC Inc. Common Shares 503,840 Long-Term Investment- Bond 145,000 Property, Plant & Equipment 280,000 Accumulated Depreciation 86,000 Total Non-Current Assets 842,840 Total Assets 1,509,172 Liabilities Current Liabilities Accounts Payable 212,400 Interest Payable 31,167 Unearned Revenue 21,000 Total Current Liabilities 264,567 Long-Term Liabilities Bonds Payable 340,000 Discount on Bonds Payable 15,741 Bank Loan 225,000 Total-Long Term Liabilities 549,259 Total Liabilities 813,826 Shareholders Equity Common Shares 362,000 Preferred Shares 80,000 Retained Earnings 348,385…arrow_forwardBelow are Laiho Industries' 2017 and 2018 balance sheet items: Cash Accounts Receivable Long-Term Debt Accounts Payable Common Stock (total value) Notes Payable Net Fixed Assets Accruals Inventories Retained Earnings $ $ $ $ LA $ LA $ LA $ LA LA 2018 102,850.00 103,365.00 76,264.00 30,761.00 100,000.00 $ $ $ $ Sm 16,717.00 $ 67,165.00 $ 30,477.00 $ 38,444.00 $ 57,605.00 2017 89,725.00 85,527.00 63,914.00 23,109.00 90,000.00 14,217.00 42,436.00 22,656.00 34,982.00 38,774.00 Sales for 2018 were $455,150, and EBITDA was 15% of sales. Furthermore, depreciation and amortization were 11% of net fixed assets, interest was $8,575, the corporate tax rate was 40%, and Laiho pays 40% of its net income as dividends. Given this information, construct the firm's 2018 income statement, statement of cash flows, and statement of owner's equity. Then answer the questions below.arrow_forward

- How to calculate Net Operating Asset from this balance sheet for fiscal year-end 2015 .arrow_forwardBalance Sheets as of December 31, 2015 and 2016 2015 2016 2015 2016 Assets Liabilities and Owners' Equity Cash Accounts receivable Inventory Net fixed assets 21,900 24,300 Common stock $ 850 $ 1,210 126 Accounts payable 1,370 Short-term notes payable $ 1,080 $ 970 500 0 4,350 4,610 Long-term debt 11,900 13,500 6,000 6,200 Retained earnings Total assets $28,310 $30,406 Total liabilities and owners' equity 8,830 $28,310 $30,406 9,736 2016 Income Statement Sales Cost of goods sold Depreciation Interest Taxes Net income $30,710 18,470 6,132 744 1,824 $ 3,540 What are the values of the three components of the DuPont identity? Use ending balance sheet values. Multiple Choicearrow_forwardUse the current asset section of the balance sheets of the Waverley Company as of June 30, 2017 and 2016 presented below to answer the questions that follow. 2017 2016Cash and cash equivalents R 75,000 R 58,800Trade accounts receivable, net 157,500 193,200Inventory 208,200 253,400Other current assets 18,400 15,500Total current assets R 459,100 R 520,900Total assets R2,650,000 R3,430,000Required:Complete a horizontal analysis of the current asset section of Waverley Company’s balance sheet for 2017. Your answers for “% Change” should be rounded to one decimal place, e.g.,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education