Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

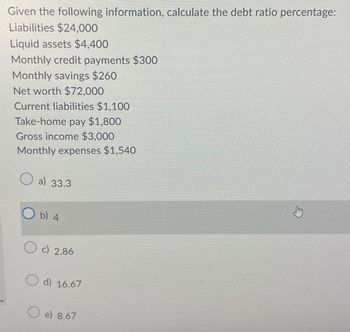

Transcribed Image Text:Given the following information, calculate the debt ratio percentage:

Liabilities $24,000

Liquid assets $4,400

Monthly credit payments $300

Monthly savings $260

Net worth $72,000

Current liabilities $1,100

Take-home pay $1,800

Gross income $3,000

Monthly expenses $1,540

a) 33.3

b) 4

c) 2.86

O d) 16.67

O e) 8.67

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Related to Checkpoint 4.2) (Capital structure analysis) The liabilities and owners' equity for Campbell Industries is found here: E a. What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.1 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? a. What percentage of the firm's assets does the firm finance using debt (liabilities)? The fraction of the firm's assets that the firm finances using debt is %. (Round to one decimal place.)arrow_forwardTotal debt to total assets% ratio: ?? Round your answer to the nearest hundredth percent Return on equity% ratio: ?? Round your answer to the nearest hundredth percent Asset turnover ratio: ?? Round your answer to the nearest centarrow_forward25. Coronado Inc., a greeting card company, had the following statements prepared as of December 31, 2020. CORONADO INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $5,900 $7,000 Accounts receivable 61,400 51,500 Short-term debt investments (available-for-sale) 35,000 18,200 Inventory 40,000 60,500 Prepaid rent 5,000 4,100 Equipment 152,900 131,100 Accumulated depreciation—equipment (35,200 ) (25,100 ) Copyrights 45,800 50,000 Total assets $310,800 $297,300 Accounts payable $46,100 $40,100 Income taxes payable 3,900 5,900 Salaries and wages payable 8,000 4,000 Short-term loans payable 8,100 10,000 Long-term loans payable 60,400 69,300 Common stock, $10 par 100,000 100,000…arrow_forward

- PreviousBalance AnnualPercentageRate (APR)(as a %) MonthlyPeriodicRate FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $2,490.00 % 1 1 4 % $ $1,374.98 $300.00 $arrow_forwardCalculate debt to equity, long-term debt to equity and specify as a percent to 2 decimal placesarrow_forwardThe account balances for KinderMorgan Account Title Balance Accounts Payable $8,990 Accounts Receivable, 1/1/22 4,455 Accumulated Depreciation 21,500 Building 65,000 Cash 10,300 45,000 Common Stock Delivery Truck Depreciation Expense Dividends 9,700 4.210 2,100 Marketable Equity Securities 3,400 Accounts Receivable, 12/31/22 5.250 Determine the Debt to Equity Ratio: 0.1114 0.1694 0.2101 0.1482 O 0.1783 are listed below. All balances are as of December 31, 2022, except where noted: Account Title Balance Inventory, 1/1/22 $2,040 Supplies 7,500 Salaries Expense 11,250 54,005 7,850 Retained Earnings, 1/1/22 23,480 Equipment 15,700 Prepaid Expenses 2,600 Cost of Goods Sold 16,350 Notes Payable (due 2024) 5.400 Inventory, 12/31/22 3,660 Net Revenue Rent Expensearrow_forward

- The following data apply to the next six problems. Consider Fisher & Company's financial data as follows (unit: millions of dollars except ratio figures):Cash and marketable securities $100Fixed assets $280Sales $1,200Net income $358Inventory $180Current ratio 3.2Average collection period 45 daysAverage common equity $500 Calculate the amount of the long-term debt.(a) $134 (b) $500(c) $74 (d) $208arrow_forwardConsider the following balance sheet for Northern Highland Credit Union (NHCU) before answering parts (i) through (v). Assets ($ million) $ Liabilities ($ million) $ Cash 30 Overnight interbank borrowing (7.00%) 160 T-notes 2 month (7.05%) 60 2-year CD (5%) 20 T-notes 3 months (7.25%) 80 7 year fixed rate Subordinated debt (8.55%) 150 T-notes two-year (7.50%) 60 Equity 25 T-notes 10-year (8.96%) 100 Corporate bonds (>5 years to maturity) 25 Total assets 355 Total liabilities and Equity 355 What is the repricing (funding) gap over the 0-to-6 months maturity bucket?arrow_forward1. The following accounts appeared on the partial Balance Sheet of Brandy Inc.: Accounts Payable Accounts Receivable $ 5,500 2,300 2,820 3,000 8,140 18,560 18,760 100 Bank Loan Cash Common Stock Inventory Long-term debt Machinery What is the total amount of all assets (rounded to the nearest dollar)?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education