FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ed

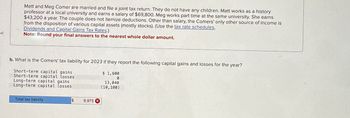

Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history

professor at a local university and earns a salary of $69,800. Meg works part time at the same university. She earns

$43,200 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is

from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules,

Dividends and Capital Gains Tax Rates.)

Note: Round your final answers to the nearest whole dollar amount.

b. What is the Comers' tax liability for 2023 if they report the following capital gains and losses for the year?

Short-term capital gains

Short-term capital losses

Long-term capital gains

Long-term capital losses

$ 1,600

0

13,040

(10,100)

Total tax liability

$

9,975 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 6. What amount should be reported as total income tax expense? ₱ 1,350,000 ₱ 1,950,000 ₱ 2,250,000 ₱ 1,050,000arrow_forward35. LO.2 Sparrow Corporation (a calendar year, accrual basis taxpayer) had the follow- ing transactions in 2020, its second year of operation: $330,000 69,300 5,000 3,000 3,500 Taxable income Federal income tax liability paid Tax-exempt interest income Meals expense (total) Premiums paid on key employee life insurance Increase in cash surrender value attributable to life insurance premiums Proceeds from key employee life insurance policy Cash surrender value of life insurance policy at distribution Excess of capital losses over capital gains 700 130,000 20,000 13,000 MACRS deduction 26,000 16,000 Straight-line depreciation using ADS lives Section 179 expense elected during 2019 Dividends received from domestic corporations (less than 20% owned) 25,000 35,000 Sparrow uses the LIFO inventory method, and its LIFO recapture amount increased by $10,000 during 2020. In addition, Sparrow sold property on installment during 2019. The property was sold for $40,000 and had an adjusted basis at…arrow_forwardProblem 15-58 (LO 15-6) In each of the following independent cases for tax year 2022, determine the amount of business interest expense deduction and disallowed interest expense carryforward, if any. Assume that average annual gross receipts exceed $27 million. Required: a. Company A has ATI of $70,000 and business interest expense of $20,000. b. Company B has ATI of $90,000, business interest expense of $50,000, and business interest income of $2,000. c. Company C has taxable income of $50,000 which includes business interest expense of $90,000 and depreciation of $20,000. Note: For all requirements, leave no cells blank - be certain to enter "0" wherever required. Enter your answers in dollar values not in million of dollars. a. Company A b. Company B c. Company C Interest expense deduction Disallowed interest expense carryforwardarrow_forward

- 41 Using the 2019 marginal tax rates provided in the table below, find the marginal and average tax rates for the incomes shown. Give all answers to two decimals. Part 1 What would be your federal income tax if your taxable income was $108,000.00? $ What is the average tax rate for $108,000.00 in taxable income? % Part 2 How much tax would you owe if your income increased by $25,000 to $133,000.00? $ What would be your average tax rate with $133,000.00 of taxable income? % Skip Start Solving Exit Exit Training Marrow_forwardManagerial Accounting Taxation Problem #1 - Calculating Federal Income Tax & Refund/Payment Due John is a single taxpayer and has the following information for 2023: Income before deductions $120,000 Standard Deduction $ 13,850 Itemized Deduction $ 18,400 Federal Taxes Paid $ 17.100 Tax Credits $ 1,500 Required: 1. What is John's taxable income? 2. What is John's federal income taxes? 3. Does John owe money or get a refund? How much? 4. What is John's marginal tax rate? 5. What is John's average tax rate?arrow_forwardh3arrow_forward

- 42. A province's progressive income tax rates are structured as follows: 16% tax on the first $15,000 of taxable income, 26% on the next $20,000, 35% on the next $40,000, and 45% on nd Applications of Algebra any additional taxable income. What percentage is an individual's total income tax of his (taxable) income if his taxable income for a year is: a. $33,000? b. $66,000? c. $99,000? 126 240 000arrow_forwardCurrent Attempt in Progress For the year ended December 31, 2023, Coronado Ltd. reported income before income taxes of $96,000. In 2023, Coronado Ltd. paid $45,000 for rent; of this amount, $15,000 was expensed in 2023. The remaining $30,000 was treated as a prepaid expense for accounting purposes and would be expensed equally over the 2024-2025 period. The full $45,000 was deductible for tax purposes in 2023. The company paid $72,000 in 2023 for membership in a local golf club (which was not deductible for tax purposes). In 2023 Coronado Ltd. began offering a 1-year warranty on all merchandise sold. Warranty expenses for 2023 were $40,000, of which $29,000 was actual repairs for 2023 and the remaining $11,000 was estimated repairs to be completed in 2024. Meal and entertainment expenses totalled $24,000 in 2023, only half of which were deductible for income tax purposes. Depreciation expense for 2023 was $250,000. Capital Cost Allowance (CCA) claimed for the year was $273,000.…arrow_forwardThe pretax financial income of x company differs from its taxable income throughout each of 4 years as follows Year. Pretax Financial Income. Taxable income. Tax rate 2020. 305,000. 173,000. 35% 2021. 349,000. 216,000. 20% 2022 358,000 277,000 20% 2023 429,000 615,000 20% Pretax fiancial income for each year includes a nondeductible exense of $29,100 (never deductible for tax purposes) The remainder of the difference between pretax fiancial income and taxable income in each period is due to one depreciation temporary difference. No deferred income taxes existed at the beginning of 2020. Prepare journal entries to record income taxes in all 4 years. Assume that the change in the tax rate to 20% was not enacted until the beginning of 2021arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education