FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

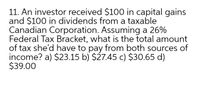

Transcribed Image Text:11. An investor received $100 in capital gains

and $100 in dividends from a taxable

Canadian Corporation. Assuming a 26%

Federal Tax Bracket, what is the total amount

of tax she'd have to pay from both sources of

income? a) $23.15 b) $27.45 c) $30.65 d)

$39.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alexis had a gross income of $92,234 in 2010. What was her net income in 2010? Use the income tax table below to answer the question. 2010 Federal Income Tax Brackets and Tax Rates (Canada) Tax Brackets Tax Rates 15% of taxable income less than or equal to $40,970; plus 22% of taxable income greater $40,970 to $81,941 than $40,970 and less than or equal to $81,941; plus $40,970 or less 26% of taxable income greater $81,941 to $127,021 than $81,941 and less than or equal to $127,021; plus More than $127,021 A 29% of taxable income greater than $127,021arrow_forwardPlease help me !! Note: Tax for Canada !! Question:- Individual J received non-eligible dividends totaling $12,000 in the current year. What is the amount of the federal dividend tax credit?arrow_forwardCc.50.arrow_forward

- Subject :- Accountingarrow_forward6. A married couple are calculating their federal income tax using the tax rate tables: Then Estimated Taxes Are If Taxpayer's Income Is Between So $16,700 $67,900 $137,050 $208,850 $372,950 But Not Over $16,700 $67,900 $137,050 $208,850 $372,950 Base TaxRate $0 10% $1,670.00 15% $9,350.00 25% $26,637.50 28% $46,741.50 33% $100,894.50 35% S0 $16,700 $67,900 $137,050 $208,850 $372,950 How much tax will they have to pay on their taxable income of $202,000? (4arrow_forwardGiven the following tax structure: Taxpayer Mae Pedro Venita Salary $ 22,500 $ 45,000 $ 22,500 What tax would need to be assessed on Venita to make the tax horizontally equitable? Total Tax $ 1,980 $ 4,635 ???arrow_forward

- I need the answer as soon as possiblearrow_forwardam. 35.arrow_forwardChuck, a single taxpayer, earns $75,600 in taxable income and $10,700 in interest from an investment in City of Heflin bonds. A.how much federal tax will he owe. B. What is his average tax rate? C. What is his effective tax rate? D. What is his current marginal tax rate?arrow_forward

- hrd.3arrow_forwardaa.6 Scot and Vidia, married taxpayers, earn $184,000 in taxable income and $5,000 in interest from an investment in City of Tampa bonds. (Use the U.S. tax rate schedule). a If Scot and Vidia earn an additional $81,250 of taxable income, what is their marginal tax rate on this income? b. How would your answer differ if they, instead, had $81,250 of additional deductions?arrow_forwardGiven the following information, determine the total average tax rate for a BC resident earning $100,000 in employment income. Tax Rates Tax Brackets Federal 15.00% Up to $43,953 22.00 43,954−87,907 26.00 87,908−136,270 29.00 136,271 and over British Columbia 5.05% Up to $ 40,120 9.15 40,121−80,242 11.16 80,243−150,000 12.16 150,001−220,000 13.16 220,001 and over Multiple Choice 15% 37.16% 20.05% 42.16% 27.31% Show the steps pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education