FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

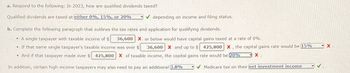

Transcribed Image Text:a. Respond to the following: In 2023, how are qualified dividends taxed?

Qualified dividends are taxed at either 0%, 15%, or 20%

✓depending on income and filing status.

b. Complete the following paragraph that outlines the tax rates and application for qualifying dividends.

• A single taxpayer with taxable income of $

. If that same single taxpayer's taxable income was over $

And if that taxpayer made over $ 425,800 X of taxable income, the capital gains rate would be 20%

In addition, certain high-income taxpayers may also need to pay an additional 3.8%

·

x.

36,600 X and up to $ 425,800 X, the capital gains rate would be 15%

36,600 X or below would have capital gains taxed at a rate of 0%.

Medicare tax on their net investment income

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 2-Based on the following tax information for an individual, salary, $144,000; interest earned, $2,000; qualified retirement plan contribution, $6,000; itemized deductions, $18,000. Filing as a single individual, calculate the taxable income and tax liability.arrow_forward3. Mr. So filed his 2022 income tax return on June 30, 2023. The BIR discovered a deficiency income tax on August 15, 2024. When should the deficiency tax assessment be served? a. On or before August 15, 2027 b. On April 15, 202 c. On or before June 30, 2026 d. On or before April 15, 2026arrow_forwardCompute for the tax due in each of the following cases. Show your computation and highlight your final answer. Please answer items 1 to 5. Thank you!arrow_forward

- Based on 2022 Tax Table, federal tax payable before tax credit of a person whose net income of $221,708 isarrow_forwardRequired information [The following information applies to the questions displayed below.] Henrich is a single taxpayer. In 2023, his taxable income is $533,500. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. d. Henrich has $196,750 of taxable income, which includes $50,700 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $213,500. Income tax Net investment income tax Total tax liability Amount $ 0.00arrow_forward! Required information Problem 7-45 (LO 7-2) (Algo) [The following information applies to the questions displayed below.] Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $69,600. Meg works part time at the same university. She earns $33,800 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) Note: Round your final answers to the nearest whole dollar amount. Problem 7-45 Part-a (Algo) a. What is the Comers' tax liability for 2022 if they report the following capital gains and losses for the year? $ 9,800 (2,400) Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses 15,800 (6,400) Total tax liabilityarrow_forward

- Vishuarrow_forwardA taxpayer employs a qualified PWD for a total salary of P50,000. Assuming taxpayer meets all requirements, how much may he claim as special deduction from gross income? a. 50,000 b. 12,500 c. 10,000 d. 7,500arrow_forward4 Required information [The following information applies to the questions displayed below.] Henrich is a single taxpayer. In 2023, his taxable income is $531,500. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. b. His $531,500 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $570,000. Income tax Net investment income tax Total tax liability Amountarrow_forward

- In 2023, a taxpayer who paid $16,500 of self-employment tax would deduct $ deduction. of the tax as a (for/from) I AGIarrow_forwardDetermine from the tax table the amount of the income tax for each of the following taxpayers for 2020: Taxpayer(s) Filing Status Taxable Income Income Tax Allen Single $ 30,000 $______________________ Boyd MFS 34,545 $______________________ Caldwell MFJ 55,784 $______________________ Dell H of H 67,450 $______________________ Evans Single 75,000 $______________________arrow_forward! Required information [The following information applies to the questions displayed below.] Henrich is a single taxpayer. In 2019, his taxable income is $461,00O. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates, Estates and Trusts for reference. (Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no answer blank. Enter zero if applicable.) a. All of his income is salary from his employer. Income tax Net investment income tax Total tax liabilityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education