Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

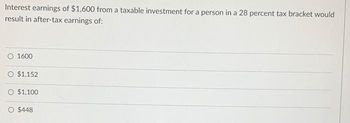

Transcribed Image Text:Interest earnings of $1,600 from a taxable investment for a person in a 28 percent tax bracket would

result in after-tax earnings of:

1600

O $1,152

$1,100

O $448

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What would be the average tax rate for a person who paid taxes of $6,435 on a taxable income of $40,780? (Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardIf we add to our problem that Builtrite also had $20,000 in interest expense and that they were in the 39% income tax bracket, how much would this interest expense cost Builtrite after taxes? $12,200 $7,800 $3,900 $20,000arrow_forwardA single person with taxable income of $36090 will have the first $9525 of that income taxed at 10%. Determine the taxes owed on just the first $9525.arrow_forward

- What is the after-tax cost in the following situations if the taxpayer has additional deductions as stated? Assume the taxpayer is in the 24% marginal tax bracket. (a) Deductible expense paid of $33,000. After-tax cost $arrow_forwardTaxable Income and Total Tax Liability are in thousands. Item Number of returns Taxable income Under $15,000 30,715,203 Total tax liability Average tax rate* $ 5,400,125 $ 529,117 9.80% Ranges of Adjusted Gross Income $15,000 to under $30,000 27,411,021 $ 189,357,926 $ 15,530,244 $30,000 to under $50,000 28,926,896 $ 639,301,718 $ 55,477,985 8.20% 8.68% *The average tax rate is total tax liability divided by taxable income. Required: $50,000 to under $100,000 37,548,054 $ 1,912,937,663 $ 214,989,667 11.24% $100,000 to under $200,000 24,180,826 $ 2,687,830,279 $ 385,058,662 14.33 % $200,000 or more 11,616,732 $ 6,249,277,422 $ 1,591,015,179 25.46% a. If the federal tax system was changed to a proportional tax rate structure with a tax rate of 17.10%, calculate the amount of tax liability for 2021 for all taxpayers. b. What is the amount and nature of difference from actual tax liability specified in the above table? Required A Required B If the federal tax system was changed to a…arrow_forwardGiven the following tax structure: Total tax Salary $ 10,000 $ 20,000 Тахрayer Mae $ 600 Pedro ??? a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? (Round your final answer to nearest whole dollar amount.) Minimum tax b. This would result in what type of tax rate structure? Tax rate structure Progressivearrow_forward

- Suppose you get a raise and your taxable income increases from $2,000 to $8,000, use the information below to calculate the MARGINAL tax rate on income of $8,000. (Do NOT include % sign in your answer) Total Taxable Income Total Taxes Paid $0 $0 $2,000 $4,000 $200 $600 $6,000 $1,200 $8,000 $2,000arrow_forwardIf the tax rates are 15% on the first $50,000 of taxable income, and 20% on the next $25,000, and 25% on the next $25,000, what is the tax liability for an individual with $80,000 of taxable income, what is the marginal tax rate, and what is the average tax rate ? a. $10,250, 15%, and 20% b. $25,122, 22%, and 16% c. $11,345, 15%, and 34% d. $13,750, 25%, and 17.19%arrow_forwardaa.3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education