FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

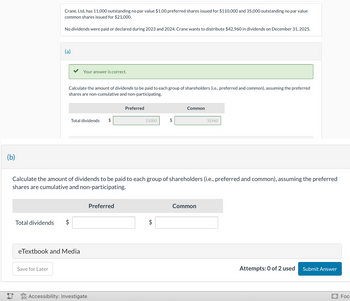

Transcribed Image Text:(b)

i

Total dividends

Crane, Ltd. has 11,000 outstanding no par value $1.00 preferred shares issued for $110,000 and 35,000 outstanding no par value

common shares issued for $21,000.

No dividends were paid or declared during 2023 and 2024. Crane wants to distribute $42,960 in dividends on December 31, 2025.

(a)

Save for Later

Your answer is correct.

Calculate the amount of dividends to be paid to each group of shareholders (i.e., preferred and common), assuming the preferred

shares are non-cumulative and non-participating.

Total dividends $

eTextbook and Media

Accessibility: Investigate

Preferred

Calculate the amount of dividends to be paid to each group of shareholders (i.e., preferred and common), assuming the preferred

shares are cumulative and non-participating.

Preferred

11000

tA

$

Common

31960

Common

Attempts: 0 of 2 used

Submit Answer

Foc

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- psh// Carla Vista, Inc. has $500,000, $0.95, no par value preferred shares (50,000 shares) and $1,000,000 of no par value common shares outstanding (80,000 shares). No dividends were paid or declared during 2021 and 2022. The company wants to distribute $591,500 in dividends on December 31, 2023. Calculate the amount of dividends to be paid to each group of shareholders (i.e., preferred and common), assuming the preferred shares are cumulative and fully participating. (Round intermediate percentage calculations to 3 decimal places, e.g. 15.251% and final answers to 0 decimal places, e.g. 1,225.)arrow_forwardI need help with part carrow_forwardFor part 2 of this question, how would I be able to solve for the amount ending balance in retained earnings? I believe I would need this number in calculating total shareholder's equity. If you could share the way you found the number, that would be great as well! Thank you!arrow_forward

- Vishalarrow_forwardCan you help me with this problem with step by step explanation, please? Thank you :) On January 1, 2021, Gerlach Inc. had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 247,000 shares issued $ 247,000 Paid-in capital—excess of par, common 494,000 Paid-in capital—excess of par, preferred 165,000 Preferred stock, $100 par, 16,500 shares outstanding 1,650,000 Retained earnings 3,300,000 Treasury stock, at cost, 4,700 shares 23,500 During 2021, Gerlach Inc. had several transactions relating to common stock. January 15: Declared a property dividend of 100,000 shares of Slowdown Company (book value $11.3 per share, fair value $9.65 per share). February 17: Distributed the property dividend. April 10: A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Fascom chose to reduce Paid-in capital—excess of par.) The fair…arrow_forwardAnthony's Athletic Apparel has 1,800 shares of 6%, $100 par value preferred stock the company issued at the beginning of 2023. All remaining shares are common stock. The company was not able to pay dividends in 2023, but plans to pay dividends of $23,000 in 2024. Required: 1. & 2. How much of the $23,000 dividend will be paid to preferred stockholders and how much will be paid to common stockholders in 2024, assuming the preferred stock is cumulative? What if the preferred stock were noncumulative? Preferred dividends in arrears for 2023 Preferred dividends for 2024 Remaining dividends to common stockholders Total dividends Cumulative $ Non Cumulative 0 $ 0arrow_forward

- Rahularrow_forwardI'm having trouble compiling the Shareholder's Equity Section of the balance sheet. Please help! The balance sheet of Consolidated Paper, Inc., included the following shareholders’ equity accounts at December 31, 2020: Paid-in capital: Preferred stock, 7.5%, 98,000 shares at $1 par $ 98,000 Common stock, 484,800 shares at $1 par 484,800 Paid-in capital—excess of par, preferred 1,595,000 Paid-in capital—excess of par, common 2,645,000 Retained earnings 9,745,000 Treasury stock, at cost; 4,800 common shares (52,800 ) Total shareholders' equity $ 14,515,000 During 2021, several events and transactions affected the retained earnings of Consolidated Paper. Required: 1. Prepare the appropriate entries for these events. On March 3, the board of directors declared a property dividend of 290,000 shares of Leasco International common stock that Consolidated Paper had purchased in January as an investment (book value: $552,000). The investment shares had a fair value of $2 per share and were…arrow_forwardMarutzky Corporation had a net income of $2,200,000 for the year 2018. On January 1, 2018, the corporation had 300,000 shares of common stock outstanding and issued an additional 250,000 shares of common stock on October 1, 2018. Calculate the earnings per shares using the weighted-average number of common shares outstanding.arrow_forward

- Lenore, Inc. declared a cash dividend of $90,000 in 2021 when the following stocks were outstanding: Common stock 30,000 shares, $5 par value $150,000 Preferred stock, 6%, 6,000 shares, $50 par value $300,000 No dividends were declared or paid during the prior two years. Required: Compute the amount of dividends that would be paid to each stockholder group if the preferred stock is noncumulative. Compute the amount of dividends that would be paid to each stockholder group if the preferred stock is cumulative.arrow_forwardRitz Company had the following stock outstanding and Retained Earnings at December 31, 2021: $ 570,000 Common stock (par $1; issued and outstanding, 570,000 shares) Preferred stock, 9% (par $10; issued and outstanding, 21,700 shares) Retained Earnings 217,000 907,000 On December 31, 2021, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were declared during 2019 or 2020. Three independent cases are assumed: Case A: The preferred stock is noncumulative; the total amount of 2021 dividends would be $37,000. Case B: The preferred stock is cumulative; the total amount of 2021 dividends would be $37,000. Dividends were not in arrears prior to 2019. Case C: Same as Case B, except the amount is $82,000. Required: 1-a. Compute the amount of dividends in total payable to each class of stockholders if dividends were declared as described in each case. 1-b. Compute the amount of dividends per share payable to each…arrow_forwardOn January 1st, 2023, Jackson Corporation had 15,000, $2.60 cumulative preferred shares and 20,000 common shares. Jackson did not pay any cash dividends during the previous fiscal year-ended December 31st, 2022. The company pays $45,000 of cash dividends during 2023. Which of the following amounts represents the cash dividends that the preferred shareholders would receive in 2023? $39,000 $45,000 $15,000 $6,000 None of the above. please answer do not image.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education