FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

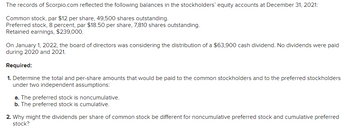

Transcribed Image Text:The records of Scorpio.com reflected the following balances in the stockholders' equity accounts at December 31, 2021:

Common stock, par $12 per share, 49,500 shares outstanding.

Preferred stock, 8 percent, par $18.50 per share, 7,810 shares outstanding.

Retained earnings, $239,000.

On January 1, 2022, the board of directors was considering the distribution of a $63,900 cash dividend. No dividends were paid

during 2020 and 2021.

Required:

1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders

under two independent assumptions:

a. The preferred stock is noncumulative.

b. The preferred stock is cumulative.

2. Why might the dividends per share of common stock be different for noncumulative preferred stock and cumulative preferred

stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- 3M CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (In millions) Accumulated Additional Other Total Common Paid-in Treasury Retained Comprehensive Stockholders' Stock Capital $ 4,295 Stock Equity $ 11,622 Earnings Income Balance, December 31, 2017 $ 9 $ (23,572) $ 38,699 (7,809) Net income 5,363 5,363 Stock issued 485 485 Stock-based compensation 302 302 Stock repurchased (4,870) (4,870) (3,193) (23) Cash dividends (3,193) Currency & pension adjustments (23) Other, net 162 162 Balance, December 31, 2018 $ 9 $ 5,082 $ (28,442) $ 40,869 $ (7,670) $ 9,848 Net income 4,582 4,582 Stock issued 547 547 Stock-based compensation 278 278 Stock repurchased (1,407) (1,407) Cash dividends (3,316) (3,316) Currency & pension adjustments (349) (349) Other, net (57) (57) Balance, December 31, 2019 $ 9 $ 5,907 $ (29,849) $ 42,135 $ (8,076) $ 10,126arrow_forwardCullumber Holding's accounting records show the following balances on December 31, 2020. 12% Preferred stock-$100 par value, outstanding 19,000 shares Common stock-$1 par value, outstanding 45,000 shares Retained earnings Assuming that the directors decide to declare total dividends in the amount of $500,000, determine how much each class of stock should receive under each of the conditions stated below. One year's dividends are in arrears on the preferred stock. Preferred (a) The preferred stock is cumulative and fully participating. (Round the rate of participation to 4 decimal places, e.g.1.4278%. Round answers to O decimal places, e.g. $38,487.) $ Preferred Common $1,900,000 (b) The preferred stock is noncumulative and nonparticipating. (Round answers to O decimal places, e.g. $38,487.) $ 45,000 Common 1,550,000 (c) The preferred stock is noncumulative and is participating in distributions in excess of a 12% dividend rate on the common stock. (Round the rate of participation to 4…arrow_forwardListed below are the transactions that affected the shareholders' equity of Branch - Rickie Corporation during the period 2024-2026. At December 31, 2023, the corporation's accounts included: ($ in thousands) Common stock, 108 million shares at $1 par $ 108,000 Paid - in capital-excess of par 648,000 Retained earnings 870,000 November 1, 2024, the board of directors declared a cash dividend of $0.90 per share on its common shares, payable to shareholders of record November 15, to be paid December 1. On March 1, 2025, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch - Rickie was holding as an investment. The bonds had a fair value of $2.3 million, but were purchased two years previously for $2.0 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record March 13, to be distributed April 5. On July 12, 2025, the…arrow_forward

- At January 1, 2023, Elan Corporation had 300,000 common shares outstanding (no preferred issued). On March 1, the corporation issued 45,000 new shares to raise additional capital. On July 1, the corporation declared and issued a 2 for 1 stock split. On October 1, the corporation purchased on the open market 180,000 of its own shares at $35 each and retired them. Instructions Calculate the weighted average number of common shares outstanding to be used in calculating earnings per share for 2023. Increase (Decrease) Shares Outstanding Stock Split TPOTELTIDAIDAL Portion of Year Outstandingarrow_forwardThe records of Uluru Charters reflected the following balances in the stockholders' equity accounts at December 31, 2024: Common stock, par $12 per share, 43,500 shares outstanding. Preferred stock, 8 percent, par $17.00 per share, 6,610 shares outstanding. Retained earnings, $227,000. On January 1, 2025, the board of directors was considering the distribution of a $62,700 cash dividend. No dividends were paid during 2023 and 2024. Required: 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions: a. The preferred stock is noncumulative. b. The preferred stock is cumulative. 2. Why might the dividends per share of common stock be different for noncumulative preferred stock and cumulative preferred stock?arrow_forwardSubject :- Accountarrow_forward

- Listed below are the transactions that affected the shareholders’ equity of Branch-Rickie Corporation during the period 2024–2026. At December 31, 2023, the corporation’s accounts included: ($ in thousands) Common stock, 113 million shares at $1 par $ 113,000 Paid-in capital—excess of par 678,000 Retained earnings 920,000 November 1, 2024, the board of directors declared a cash dividend of $0.50 per share on its common shares, payable to shareholders of record November 15, to be paid December 1. On March 1, 2025, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch-Rickie was holding as an investment. The bonds had a fair value of $2.9 million, but were purchased two years previously for $2.5 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record March 13, to be distributed April 5. On July 12,…arrow_forwardPlease provide assistance and explanation for scenario provided in the attached image.arrow_forwardThe books of Oriole corporation carried the following account balances as of December 31, 2020. Cash $210,000. preferred stck(cumulative, nonparticipating,$50 par) $310,000. common stock (non-par value, 284,000 shares issued) $1,420,000. Paid-in capital in excess of par -preferred stock $157,000. Treasury stock (common 2,900 shares at cost). Retained earnings $ 106,100. The company decided not to pay any dividend in 2020. The board of directors, at their annual meeting on December 21,2021, declared the following: The current year dividend shall be 6% on the preferred and $0.30% per share on the common. The dividend in arrears shall be paid by issuing 1,550 shares of treasury stock. At the date of deceleration, the preferred is selling at $80 per shares , and the common at $12 per shares . Net income for 2021 is estimated at $81,400. (a) prepare the journal entries required for the dividend declaration and payment assuming that they occur simultaneously. ( credit amount title are…arrow_forward

- Detroit Inc reported the following ($ in thousands) as of December 31, 2021. All accounts have normal balances. Deficit (debit balance in retained earnings) $ 2,500 Common stock 3,400 Paid-in capital—share repurchase 1,900 Treasury stock (at cost) 220 Paid-in capital—excess of par 30,300 During 2022 ($ in thousands), net income was $9,100; 25% of the treasury stock was resold for $510; cash dividends declared were $700; cash dividends paid were $450. What ($ in thousands) was shareholders' equity as of December 31, 2022?arrow_forwardThe records of Seahawks Company reflected the following balances in the stockholders' equity accounts at the end of the current year: Common stock, $11 par value, 49,000 shares outstanding Preferred stock, 8 percent, $9 par value, 9,000 shares outstanding Retained earnings, $231,000 On September 1 of the current year, the board of directors was considering the distribution of a(n) $71,000 cash dividend. No dividends were paid during the previous two years. You have been asked to determine dividend amounts under two independent assumptions: a. The preferred stock is noncumulative. b. The preferred stock is cumulative. Required: 1. Determine the total and per share amounts that would be paid to the common stockholders and the preferred stockholders under the two independent assumptions. Note: Round your "per share" amounts to 2 decimal places. Noncumulative: Total Per share Cumulative: Total Per share $ Preferred stock Common stock 35,280 $ 64,520arrow_forwardDonnie Hilfiger has the following balances in its stockholders' equity accounts on December 31, 2021: Treasury Stock, $375,000; Common Stock, $250,00O; Preferred Stock, $1,300,000; Retained Earnings, $1,650,000; and Additional Paid-in Capital, $3,100,000. Prepare the stockholders' equity section of the balance sheet for Donnie Hilfiger as of December 31, 2021. (Amounts to be deducted should be indicated with a minus sign.) DONNIE HILFIGER Balance Sheet (Stockholders' Equity Section) December 31, 2021 Stockholders' equity: Total paid-in capital Total stockholders' equityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education