ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

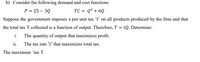

Transcribed Image Text:b) Consider the following demand and cost functions

P = 25 – 3Q

TC = Q² + 6Q

Suppose the government imposes a per unit tax 't' on all products produced by the firm and that

the total tax T collected is a function of output. Therefore, T = tQ. Determine:

i. The quantity of output that maximizes profit.

ii. The tax rate 't' that maximizes total tax.

The maximum 'tax T.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose a firm has demand and supply are given by: Qd = 17− 2Px and Q s = 4Px − 1 c. How much tax revenue does the government earn with the $12 tax when the new equilibrium quantity is 2 units after tax .arrow_forwardIf the tax is imposed on the sellers, shouldn't the 'T' be used alongside the supply 'q' not the demand 'q'? So would it not be q=b(p-T)-a?arrow_forwardSuppose that a market is described by the following supply and demand equations: Qs = 2P, Qd = 300 - P Suppose that a tax of T is placed on buyers, so the new demand equation is Qd = 300 – (P + T) d) Solve for deadweight loss as a function of T.arrow_forward

- (a) Suppose in a competitive market, the market demand curve for salt is infinitelyinelastic. What is the impact of a per-unit tax (i.e. a specific tax) on the priceof salt that consumers pay? Suppose the demand curve for butter is Q = 50 − 3P and the supply curve isQ = 2P. Suppose the government announces a per-unit tax of 1 on the priceof butter. Tax on butter can be seen as a ’fat tax’. What is the overall effectof a fat tax on the consumers? Please do not use chat gpt and answer the best way it can be.arrow_forwardGiven a demand curve of P = 92 - 2Q and a supply curve of P = 2 + Q, with a tax of 60, solve for the resulting quantity.arrow_forwardA market for a certain type of golf clubs has the following supply and demand: QD where p denotes the unit price. 25p —D 4,500 - 20р, (a) Find the number of golf clubs produced and the equilibrium price. What is the consumer and producer surplus? (b) Suppose that a unit tax of nine dollars is levied on the producers of golf clubs. Find the number of golf clubs sold. What is the consumer and producer surplus in this case? ce wa се (c) How is the tax burden shared? cro.comarrow_forward

- Note: use of chat gpt or Google bard is strictly prohibited.arrow_forward18. Suppose that corporate income tax in Japan is 30% for large enterprises. And one of them is Nissan Japan. Assume that Nissan Japan places its electric vehicles (EV) factory in California, USA by setting up Nissan America. California charges enterprises with a 10% corporate (flat) income tax rate. Suppose the demand of Nissan EV in Japan is p=220-2Q (p: price in one hundred thousand yen, Q is number of EV per week). Costs of transporting EV cars from California to Japanese customers and taxes and fees related to export-import activities are assumed to be zero. Its production cost in California is constant at 20 per unit. If Nissan American sells EVS produced in California to Nissan Japan at its production cost, what are the combined net profits of all Nissans and total corporate income tax the Nissan Japan has to pay (per week)? (Note: Nissan Japan will use the transfer price as its marginal cost.) ONet profit=5000; Sum of corporate tax=1500 Net profit=3500; Sum of corporate…arrow_forwardIf the pre-tax cost function for John's Shoe Repair is C(q)=100+10q-q^2+1/3q^3, and it faces a specific tax of t=10, what is the profit-maximizing condition if the market price is p? Can you solve for a single, profit maximizing q in terms of p?arrow_forward

- Consider an ad-valorem tax on a good X. The Demand for good X is constant elasticity with elasticity -2. The Supply for good Y is constant elasticity with elasticity 3. Consider the same setting as for the previous question. When a tax of 1% of the price is imposed on good X, then equilibrium quantity of X exchanged declines by what percentage?arrow_forwardIf a $6 per unit excise (sales) tax is imposed, who will suffer the greater burden of this tax, the suppliers or demanders? a) Demanders b) Suppliers c) Both share the burden equally d) Can't tell from the available informationarrow_forwardThe market for N-95 masks is perfectly competitive. Market Demand is given by Q=486-2P and Market Supply is given by Q-2P. The government imposes a per-unit tax of $5, what is the market quantity with the tax? Note: you don't need to know who pays the tax to answer this question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education