ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

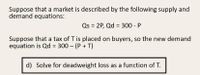

Transcribed Image Text:Suppose that a market is described by the following supply and

demand equations:

Qs = 2P, Qd = 300 - P

Suppose that a tax of T is placed on buyers, so the new demand

equation is Qd = 300 – (P + T)

d) Solve for deadweight loss as a function of T.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (a) Suppose in a competitive market, the market demand curve for salt is infinitelyinelastic. What is the impact of a per-unit tax (i.e. a specific tax) on the priceof salt that consumers pay? Suppose the demand curve for butter is Q = 50 − 3P and the supply curve isQ = 2P. Suppose the government announces a per-unit tax of 1 on the priceof butter. Tax on butter can be seen as a ’fat tax’. What is the overall effectof a fat tax on the consumers? Please do not use chat gpt and answer the best way it can be.arrow_forwardA market for a certain type of golf clubs has the following supply and demand: QD where p denotes the unit price. 25p —D 4,500 - 20р, (a) Find the number of golf clubs produced and the equilibrium price. What is the consumer and producer surplus? (b) Suppose that a unit tax of nine dollars is levied on the producers of golf clubs. Find the number of golf clubs sold. What is the consumer and producer surplus in this case? ce wa се (c) How is the tax burden shared? cro.comarrow_forward2. Suppose the demand for a commodity depends on the price per unit P according to D = a – bP, but that a tax of t per unit is imposed on the consumers. The constants a and b are positive. The supply function is S = g(P), where g'(P) > 0. a. Express the equilibrium condition in the marker for this commodity. b. The equilibrium equation defines P as a differentiable function of t. Find dP/dt and determine its sign. c. What happens to the price P +t paid by the consumers when t increases?arrow_forward

- Suppose demand and supply are given by:Qx d = 14 − 2Px and Qx s = 14Px-2b. Suppose a $12 excise tax is imposed on the good. Determine the new inverse demand function.arrow_forward18. Suppose that corporate income tax in Japan is 30% for large enterprises. And one of them is Nissan Japan. Assume that Nissan Japan places its electric vehicles (EV) factory in California, USA by setting up Nissan America. California charges enterprises with a 10% corporate (flat) income tax rate. Suppose the demand of Nissan EV in Japan is p=220-2Q (p: price in one hundred thousand yen, Q is number of EV per week). Costs of transporting EV cars from California to Japanese customers and taxes and fees related to export-import activities are assumed to be zero. Its production cost in California is constant at 20 per unit. If Nissan American sells EVS produced in California to Nissan Japan at its production cost, what are the combined net profits of all Nissans and total corporate income tax the Nissan Japan has to pay (per week)? (Note: Nissan Japan will use the transfer price as its marginal cost.) ONet profit=5000; Sum of corporate tax=1500 Net profit=3500; Sum of corporate…arrow_forwardSuppose that the demand and supply functions for good x are given as follows: Q = 240-2P, +1-P, and Q - -30+ P-21 +8-25 where P, denotes the price of good x. P, denotes the price of a related product y, I denotes income, t denotes tax firms face, s denotes subsidy and f denotes factor prices What is the equilibrium quantity of x as a function of exogenous variables P, .I. t. s and f eqb Qeqb Qeq = 60 + = 90 + = 1+Py-4t+2s-4f 3 90+ 1-Py-4t+2s-4f 3 eqb Qx = 60 + 1-Py-4t+2s-4f 3 1+Py+4t+2s-4/ 3arrow_forward

- If the pre-tax cost function for John's Shoe Repair is C(q)=100+10q-q^2+1/3q^3, and it faces a specific tax of t=10, what is the profit-maximizing condition if the market price is p? Can you solve for a single, profit maximizing q in terms of p?arrow_forwardConsider an ad-valorem tax on a good X. The Demand for good X is constant elasticity with elasticity -2. The Supply for good Y is constant elasticity with elasticity 3. Consider the same setting as for the previous question. When a tax of 1% of the price is imposed on good X, then equilibrium quantity of X exchanged declines by what percentage?arrow_forwardIf a $6 per unit excise (sales) tax is imposed, who will suffer the greater burden of this tax, the suppliers or demanders? a) Demanders b) Suppliers c) Both share the burden equally d) Can't tell from the available informationarrow_forward

- Suppose that a market is described by the following supply and demand equations: Q³ = 2P QD=300-P A tax of T is place on buyers, so the new demand equation is QD = 300 - (P+T). The deadweight loss of a tax is the area of the triangle between the supply and demand curves. Recalling that the area of a triangle is 1/2"base height, which of the following functions of T is the deadweight loss? T²/3 2T/3 2*(300-T)/3 (300-T)/3arrow_forwardSuppose that a certain product has the following demand and supply functions. Demand: Supply: p = -0.049 + 45 0.049 + 20 p = A $5 tax per item is levied. Determine the supply function when tax is added. p = Find the market equilibrium point after the tax. C (q, p) = =arrow_forwardThe demand function D(p) = 200 - 4p and supply function is S(p)= 6p Find the equilibrium price and quantity If government collect $10 unit tax from each product, find the equilibrium demand and supply prices. How much tax revenue is collected? What is the deadweight loss amount as a result of taxation?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education