EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

General Accounting Question provide solution

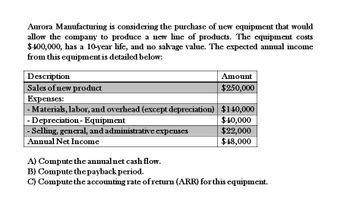

Transcribed Image Text:Aurora Manufacturing is considering the purchase of new equipment that would

allow the company to produce a new line of products. The equipment costs

$400,000, has a 10-year life, and no salvage value. The expected annual income

from this equipment is detailed below:

Description

Sales of new product

Expenses:

Amount

$250,000

Materials, labor, and overhead (except depreciation) $140,000

| - Depreciation - Equipment

- Selling, general, and administrative expenses

Annual Net Income

A) Compute the annual net cash flow.

B) Compute the payback period.

$40,000

$22,000

$48,000

C) Compute the accounting rate of return (ARR) for this equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given here. The company’s cost of capital is 10%. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life? Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?arrow_forwardFilkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins’ cost of capital is 14%. Should the firm replace its old knitting machine? If so, which new machine should it use? By how much would the value of the company increase if it accepted the better machine? What is the equivalent annual annuity for each machine?arrow_forwardDauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?arrow_forward

- Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?arrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $240,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product $ 150,000 Expenses Materials, labor, and overhead (except depreciation) 80,000 Depreciation—Equipment 20,000 Selling, general, and administrative expenses 15,000 Income $ 35,000 (a) Compute the annual net cash flow.(b) Compute the payback period.(c) Compute the accounting rate of return for this equipment.arrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $432,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product $ 270,000 Expenses Materials, labor, and overhead (except depreciation) 144,000 Depreciation—Equipment 36,000 Selling, general, and administrative expenses 27,000 Income $ 63,000 (a) Compute the annual net cash flow.arrow_forward

- B2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $408,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product $ 255,000 Expenses Materials, labor, and overhead (except depreciation) 136,000 Depreciation—Equipment 34,000 Selling, general, and administrative expenses 25,500 Income $ 59,500 (a) Compute the annual net cash flow.(b) Compute the payback period.(c) Compute the accounting rate of return for this equipmentarrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $144,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product $ 90,000 Expenses Materials, labor, and overhead (except depreciation) 48,000 Depreciation—Equipment 12,000 Selling, general, and administrative expenses 9,000 Income $ 21,000 (a) Compute the annual net cash flow.(b) Compute the payback period.(c) Compute the accounting rate of return for this equipment. I could not include an image for "C" please answer seperatelyarrow_forwardFactor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $491,000 cost with an expected four-year life and a $20,000 salvage value Additional annual information for this new product line follows PV of $. EX of St. PVA of Stand EVA of $ (Use appropriate factors) from the tables provided) Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation Machinery 1. Determine income and net cash flow for each year of this machine's life. 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year 3. Compute net present value for this machine using a discount rate of 7% Complete this question by entering your answers in the tabs below. Required 1 Required 2 year 4 Required 3 Compute net present value for this machine using a discount rate of 7%. (Do not round intermediate calculations. Negative amounts should be entered with a minus sign.…arrow_forward

- ssarrow_forwardA company is considering purchasing factory equipment that costs $400000 and is estimated to have no salvage value at the end of its 5-year useful life. If the equipment is purchased, annual revenues are expected to be $162000, and annual operating expenses exclusive of depreciation expenses are expected to be $27000. The straight-line depreciation method would be used.if the equipment is purchased the annual rate of return expected on this equipment is 1)6.75 % 2)33.75% 3)27.50 % 4)40.50%arrow_forwardFactor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $480,000 cost with an expected four-year life and a $20,000 salvage value. All sales are for cash, and all costs are out-of-pocket, except for depreciation on the new machine. Additional information includes the following.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning