Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Financial accounting question

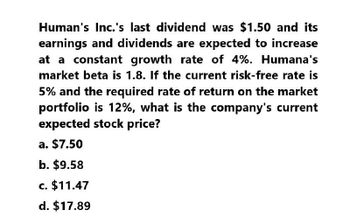

Transcribed Image Text:Human's Inc.'s last dividend was $1.50 and its

earnings and dividends are expected to increase

at a constant growth rate of 4%. Humana's

market beta is 1.8. If the current risk-free rate is

5% and the required rate of return on the market

portfolio is 12%, what is the company's current

expected stock price?

a. $7.50

b. $9.58

c. $11.47

d. $17.89

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that Temp Force is a constant growth company whose last dividend (D0, which was paid yesterday) was 2.00 and whose dividend is expected to grow indefinitely at a 6% rate. (1) What is the firms current estimated intrinsic stock price? (2) What is the stocks expected value 1 year from now? (3) What are the expected dividend yield, the expected capital gains yield, and the expected total return during the first year?arrow_forwardCorenson Corp.'s expected year-end dividend is D1 = $4.00, its required return is rs = 11.00%, its dividend yield is 6.00%, and its growth rate is expected to b onstant in the future. What is Sorenson's expected stock price in 7 years, i.e., what is P-? Do not round intermediate calculations. O a. $87.24 O b. $76.92 O c. $93.81 O d. $90.05 O e. $85.36arrow_forwardConnolly Co.'s expected year-end dividend is D₁ = $2.75, its required return is rs = 11.00%, its dividend yield is 6.00%, and its growth rate is expected to be constant in the future. What is Connolly's expected stock price in 7 years, i.e., what is P7? Select the correct answer. a. $64.97 b. $63.05 O c. $63.53 d. $64.01 O e. $64.49arrow_forward

- Yharnam Co. is expected to pay a dividend of D1 = $1.40 per share at the end of the year, and that dividend is expected to grow at a constant rate of 5.00% per year in the future. The company's beta is 1.2, the Market Risk Premium is 6.25%, and the risk-free rate is 3.90%. What is the company's current stock price? Group of answer choices 24.06 18.59 28.00 22.40 21.88arrow_forwardBirkin Systems is expected to pay a dividend of D1 = $2.00 per share at the end of the year, and that dividend is expected to grow at a constant rate of 5.00% per year in the future. The company's beta is 1.2, the Market Risk Premium is 6.00%, and the risk-free rate is 4.00%. What is the company's current stock price? (Ch. 9) Group of answer choices 40.00 27.42 32.26 35.48 33.33arrow_forwardA Company just paid a dividend of $0.65 per share, and that dividend is expected to grow at a constant rate of 4.75% per year in the future. The company's beta is 1.0, the market risk premium is 5.10%, and the risk-free rate is 2.25%. What is the company's current stock price, P 0? Do not round intermediate calculations.arrow_forward

- The last dividend paid by Wilden Corporation was $1.50. The dividend growth rate is expected to be constant at 1.5% for 2 years, after which dividends are expected to grow at a rate of 8.0% forever. The firm's required return (r) is 12.0%. What is the best estimate of the current stock price? Select the correct answer. Oa. $36.71 b. $34.13 c. $34.99 d. $35.85 e. $33.27arrow_forwardNational Advertising just paid a dividend of D0 = $0.75 per share, and that dividend is expected to grow at a constant rate of 6.50% per year in the future. The company's beta is 1.25, the required return on the market is 10.50%, and the risk-free rate is 4.50%. What is the company's current stock price? a. $14.52 b. $14.89 c. $15.26 d. $15.64 e. $16.03arrow_forwardDyer Furniture is expected to pay a dividend of D1 = $1.25 per share at the end of the year and that dividend is expected to grow at a constant rate of 6.00% per year in the future. The company's beta is 1.15. the market risk premium is 5.50%, and the risk-free rate is 4.00% What is Dyer's current stock price? a. $28.90 b. $29.62 C. $31.12 d. $30.36 e. $31.90arrow_forward

- Dyer Furniture is expected to pay a dividend of D1 = $1.25 per share at the end of the year, and that dividend is expected to grow at a constant rate of 6.00% per year in the future. The company's beta is 1.85, the market risk premium is 5.50%, and the risk-free rate is 4.00%. What is Dyer's current stock price? Select the correct answer. a. $16.23 b. $16.70 c. $17.17 d. $15.29arrow_forwardPlease see attachedarrow_forwardThe Francis Company is expected to pay a dividend of D₁ = $1.25 per share at the end of the year, and that dividend is expected to grow at a constant rate of 6.00% per year in the future. The company's beta is 0.85, the market risk premium is 5.50%, and the risk-free rate is 4.00%. What is the company's current stock price? Do not round intermediate calculations. a. $51.40 b. $47.66 c. $49.53 d. $46.73 e. $54.21arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT