FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

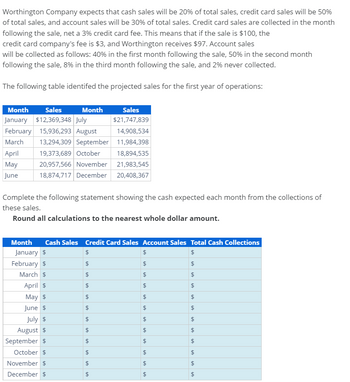

Transcribed Image Text:Worthington Company expects that cash sales will be 20% of total sales, credit card sales will be 50%

of total sales, and account sales will be 30% of total sales. Credit card sales are collected in the month

following the sale, net a 3% credit card fee. This means that if the sale is $100, the

credit card company's fee is $3, and Worthington receives $97. Account sales

will be collected as follows: 40% in the first month following the sale, 50% in the second month

following the sale, 8% in the third month following the sale, and 2% never collected.

The following table identifed the projected sales for the first year of operations:

Month

Sales

Month

January $12,369,348 July

Sales

$21,747,839

February 15,936,293 August

14,908,534

March

13,294,309 September

11,984,398

April

19,373,689 October

18,894,535

May

20,957,566 November 21,983,545

June

18,874,717 December 20,408,367

Complete the following statement showing the cash expected each month from the collections of

these sales.

Round all calculations to the nearest whole dollar amount.

Month

January $

February $

March $

April $

May $

June $

July $

August $

September $

October $

November $

December $

Cash Sales Credit Card Sales Account Sales Total Cash Collections

$

$

"A

$

IA

$

$

LA

$

$

$

$

6A

$

$

$

+A

$

+A

LA

LA

$

+A

$

LA

$

+A

$

$

$

A

LA

A

LA

A

LA

LA

$

$

+A

$

LA

$

LA

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vertical Ladder Company (VLC) forecasts its sales for January through April will be $40,000, $60,000, $100,000, and $90,000, respectively. All sales are made on credit, and it is expected that 40 percent of sales will be collected in the month of the sale and the remainder will be collected the month following the sale. Customers who pay in the month of the sale will take the 2 percent cash discount VLC offers for paying early. VLC normally purchases and pays for raw materials, which cost 45 percent of sales, one month prior to selling the finished products. Employees' wages represent 20 percent of sales and rent is $6,000 per month. At the beginning of February, VLC expects to have $4,000 in cash, which is $1,000 greater than its target cash balance. Using the information provided, construct VLC's cash budget for February and March. Round your answers to the nearest dollar. Use a minus sign to enter a negative value, if any. If your answer is zero, enter "0". February March…arrow_forwardShalom Company expects credit sales for April, May, and June to be P200,000, P260,000, and P300,000, respectively. It is expected that 75% of the sales will be collected in the month of sale, and 25% will be collected in the following month. Amounts must be in whole numbers. Example: 88,000 or (88,000) Calculate cash collections from customers for each month. MAYarrow_forwardCraig has projected sales to be $90,400 in April; $96,400 in May; $104,500 in June and $93,600 in July. The history of Craig’s sales indicates 20% cash and the remaining 80% on credit. The company’s collection history indicates that credit sales are collected as follows: 30% collected in the month of the sale 60% collected in the month after the sale 8% collected two months after the sale 2% of credit sales are never collectedarrow_forward

- Neha Wholesalers supplied you with the following projected information:1. Expected sales are as follows:August R350 000September R280 000October R300 0002. Cash sales are expected to be 50% of total sales. The balance is on credit.3. Debtors are expected to settle their accounts as follows:40% in the month of the sale60% one month after the sale4. Expected purchases are as follows:August R100 000September R 40 000October R 50 0005. All purchases are on credit. Creditors are paid one month after the purchases less 10%discount.6. Rent expenses amount to R7 000 per month, Rent will increase by 15% from 1 October.7. Selling expenses are expected at 1% of total sales and are paid during the month of sales.8. Insurance amounts to R360 000 per annum, payable monthly.9. The owner intends making a cash drawings of R5 000 each month.10. Interest on fixed deposit of R2 000 is due on 1 September.11. The bank balance on 31 July is expected to be R25 000 favourable.Required:1.1 The Debtors…arrow_forwardNew-Markups Department Store has annual credit sales of $ 300 million. John Harris, the collection manager, has estimated that it takes 10 days for a mailed payment to be credited to Newman’s account and that this time can be cut to 5 days if Newman opens up a lockbox account with a local bank. The account in which the checks are placed earns 8.4% annually. The lockbox agreement calls for a monthly payment of $1,350 and, in addition, a monthly charge of $0.06 per check. Newman’s currently processes 120,000 checks monthly. (Treat these expenses as if they occur at the beginning of the year.) a) What are Newman’s daily sales (assuming a 360-day year) b) By how much will Newman’s average bank balance increase if it adopts the lockbox? c) Should Mr Harris adopt the lockbox ? d) Suppose Newman’s has found a regular 20% of its customers account for 80% of credit sales. Should Mr Harris open up the lockbox and use it only for this 20% of the customers?arrow_forwardNeon Inc.’s forecast sales for July is $72,000. It has $15,000 in accounts receivable at the end of June. 30% of its total sales are expected to be cash sales. Of the remaining 70%, 80% are expected to be collected in the month of the sale and the remaining 20% in the month following the sale. Determine the amount of accounts receivable at the end of July. Group of answer choices $79,200 $61,920 $10,080 $40,320arrow_forward

- Star Company was organized on August 1 of the current year. Projected sales for the next three months are as follows: August $250,000 September 200,000 October 275,000 The company expects to sell 50% of its merchandise for cash. Of the sales on credit, 30% are expected to be collected in the month of the sale and the remainder in the following month. What is Star Company expected cash collection for September?arrow_forwardJoAnn Manufacturing has projected the following sales for the coming year: Sales $25,847.50 C$25,182.50 $22,604.17 Q1 $23,560.83 Q2 $ 54,750 $ 61,850 Q3 The company places orders each quarter that are 35 percent of the following quarter's sales and has a 30-day payables period. What is the payment of accounts for the third quarter? $70,050 Q4 $75,750arrow_forwardFinancial information for Strawberry’s Place is as follows: Cash at 1/1/20X1 is $10,000. The firm desires to maintain a minimum balance of $10,000 at the end of each month. Total monthly sales are as follows: DecemberJanuaryFebruary 20X020X120X1 $120,000150,000 (est.)160,000 (est.) The sales are 40 percent cash and 60 percent credit card. Visa is the only acceptable credit card at Strawberry’s, and assume the charges are converted to cash the day of the sale. The brokerage charge is 2 percent of the sale. Expected other income is $2,000 from interest to be received in February. In addition, in January, a range with a net book value of $300 is expected to be sold for cash, resulting in a $1,000 gain on the sale. Food and beverages are paid for the month following the sale and average 40 percent and 25 percent, respectively. Food sales are four times beverage sales. Total sales consist of only food and beverage sales. Labor is paid for the last day of the month and…arrow_forward

- Earthie's Shoes has 55% of its sales in cash and the remaining 45% are credit sales. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forwardHalifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August? NOTE: Enter amounts rounded to the nearest whole dollar. Cash sales Cash for collections the month of sale Cash for collections the month after sale Cash for collections two months after sale TOTAL cash receipts S S LAarrow_forwardMonthly sales for the Garden Centre are shown in the table below. Garden CentreSales Forecast Month Sales January $20,000 February $22,000 March $26,000 April $30,000 May $35,000 June $40,000 The Garden Centre purchases inventory two months in advance. They pay for 50% of the merchandise the month after the purchase, and the other 50% two months after the purchase. The Garden Centre’s gross margin is 40%. What are the Garden Centre’s payments to suppliers in March? Please avoid image based solutions thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education