Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

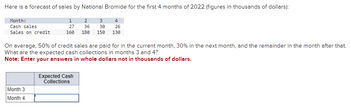

Transcribed Image Text:Here is a forecast of sales by National Bromide for the first 4 months of 2022 (figures in thousands of dollars):

Month:

Cash sales

Sales on credit

1

2

3

4

27

36

30

26

160 180 150 130

On average, 50% of credit sales are paid for in the current month, 30% in the next month, and the remainder in the month after that.

What are the expected cash collections in months 3 and 4?

Note: Enter your answers in whole dollars not in thousands of dollars.

Month 3

Month 4

Expected Cash

Collections

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- For the year ending December 31, 2017, sales for Company Y were $78.51 billion. Beginning January 1, 2018 Company Y plans to invest 7.5% of their sales amount each year and they expect their sales to increase by 4% each year over the next three years. Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream. How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. 84.762 X billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. billion dollars How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer. billion dollars Submit Answerarrow_forwardSuppose a firm has had the following historic sales figures. Year: 2016 2017 2018 2019 2020 Sales $1,500,000 $1,670,000 $1,580,000 $2,160,000 $1,890,000 What would be the forecast for next year's sales using FORECAST.ETS to estimate a trend? Note: Round your answer to the nearest whole dollar. Next year's salesarrow_forwardThe Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year: Q1 Q2 Q3 Q4 Sales $830 $860 $940 $970 a. Accounts receivable at the beginning of the year are $420. The company has a 45- day collection period. Calculate cash collections in each of the four quarters by completing the following (A negative answer should be indicated by a minus sign. Round your answers to 2 decimal places, e.g., 32.16.): Q1 Q2 Beginning receivables $ 420.00 Sales 830.00 Cash collections Ending receivables 860.00 Q3 940.00 Q4 970.00arrow_forward

- Cash flow of accounts receivable. Myers and Associates, a famous law firm in California, bills its clients on the first of each month. Clients pay in the following fashion: 40% pay at the end of the first month, 30% pay at the end of the secondmonth, 20% pay at the end of the third month, 5% pay at the end of the fourth month, and 5% default on their bills. Myers wants to know the anticipated cash flow for the first quarter of 2015 if the past billings and anticipated billings follow this same pattern. The actual and anticipated billings are as follows: Fourth Quarter Actual Billings First Quarter Anticipated Billings Oct. Nov. Dec. Jan. Feb. Mar. $316,000 $253,000 $235,000 $266,000 $288,000 $315,000 What is the anticipated cash flow for January of 2015 if past billings and anticipated billings follow this same pattern? (Round to the nearest dollar.)arrow_forwardYour company forecasts that next year's sales will be $59.00 million, Cost of Goods Sold (COGS) will be 85% of sales, and the Days Payables Outstanding (DPO) ratio will be 22.19. What is the forecasted accounts payable for next year?arrow_forwardcO X HAS cASH BALANCE OF $33 AND SHORT TERM LOAN BALANCE OF $200 AT THE BEGINNING OF QTR 1. THE NET CASH INFLOW FOR THE 1ST QTR IS $89 AND THE FOR THE SECOND QTR THERE IS A NET CAHS OUTFLOW OF $44. aLL CASH SHORTFALLS ARE FUNDED WITH SHORT TERM DEBT. THE FIRM PAYS 2% OF ITS PRIOR QUARTERS ENDING LOAN BALANCE AS INTERST EACH QUARTER. THE MINIMUM CASH BALANCE IS $25. wHAT IS THE SHORT TERM LOAN BALANCE AT THE END OF THE YEAR? available anwsers are 107 111 121 128 133arrow_forward

- Suppose that Freddie's Fries has annual sales of $620,000; cost of goods sold of $495, 000; average inventories of $21,000; average accounts receivable of $37,000, and an average accounts payable balance of $32, 000. Assuming that all of Freddie's sales are on credit, what will be the firm's cash cycle? (Round your answer to 2 decimal places.) a. 37.26. b. 60.86. c. 1.82. d. 13.66.arrow_forwardUsing the future values tables, solve the following: What is the future value on December 31, Year 11, of 20 cash flows of $15,000 with the first cash payment made on December 31, Year 1, and the annual interest rate of 10% being compounded semiannually?arrow_forwardYour company forecasts that next year's sales will be $78.00 million and the Days Sales Outstanding (DSO) ratio will be 24.84. What is the forecasted accounts receivable for next year? Note: your answer should in millions of dollars..arrow_forward

- Provide correct solutionarrow_forwardLewellen Products has projected the following sales for the coming year: 01 02 03 04 Sales $940 $1,020 $980 $1,080 Sales in the year following this one are projected to be 20 percent greater in each quarter a. Calculate payments to suppliers assuming that the company places orders during each quarter equal to 30 percent of projected sales for the next quarter. Assume that the company pays immediately. What is the payables period in this case? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate payments to suppliers assuming a 90-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Calculate payments to suppliers assuming a 60-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. b. Payment of accounts Payment of accounts Payment of accounts 01 02 Q3 Q4arrow_forwardStratosphere Wireless is examining its cash conversion cycle. The company expects its cost of goods sold, which equals 60 percent of sales, to be $144,000 this year. Stratosphere normally turns over inventory 24 times per year, accounts receivable is turned over 12 times per year, and the accounts payable turnover is 45. Assume there are 360 days in a year. Calculate the cash conversion cycle. Round your answer to the nearest whole number. days Calculate the average balances in accounts receivable, accounts payable, and inventory. Round your answers to the nearest dollar. Accounts receivable: $ Accounts payable: $ Inventory: $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education