CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:AUD-1115

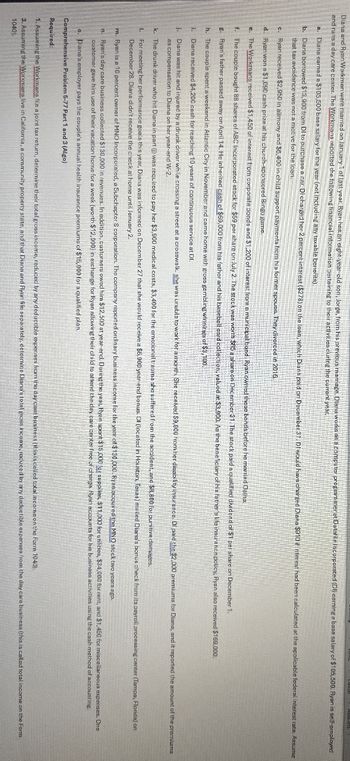

Diana and Ryan Workman were married on January 1 of last year. Ryan has an eight-year-old son, Jorge, from his previous marriage. Diana works as a computer programmer at Datafile Incorporated (DI) earning a base salary of $105,500. Ryan is self-employed

and runs a day care center. The Workmans reported the following financial information pertaining to their activities during the current year.

a. Diana earned a $105,500 base salary for the year (not including any taxable benefits).

b. Diana borrowed $13,900 from DI to purchase a car. Di charged her 2 percent interest ($278) on the loan, which Diana paid on December 31. DI would have charged Diana $910 if interest had been calculated at the applicable federal interest rate. Assume

that tax avoidance was not a motive for the loan.

c. Ryan received $2,950 in alimony and $6,400 in child support payments from his former spouse. They divorced in 2016.

d. Ryan won a $1,090 cash prize at his church-sponsored Bingo game.

e. The Workmans received $1,450 of interest from corporate bonds and $1,200 of interest from a municipal bond. Ryan owned these bonds before he married Daiha

f. The couple bought 88 shares of ABC Incorporated stock for $59 per share on July 2. The stock was worth $85 a share on December 31. The stock paid a qualified dividend of $1 per share on December 1.

Ryan's father passed away on April 14. He inherited cash of $69,000 from his father and his baseball card collection, valued at $3.900. As the beneficiary of his father's life insurance policy, Ryan also received $169,000.

h. The couple spent a weekend in Atlantic City in November and came home with gross gambling winnings of $3,100.

i. Diana received $4,200 cash for reaching 10 years of continuous service at DI.

j. Diana was hit and injured by a drunk driver while crossing a street at a crosswalk, she was unable to work for a month. She received $9,800 from her disability insurance. Di paid the $2,000 premiums for Diana, and it reported the amount of the premiums

as compensation to Diana on her year-end W-2.

k. The drunk driver who hit Diana in part () was required to pay her $3,900 medical costs, $3,400 for the emotional trauma she suffered from the accident, and $8,800 for punitive damages.

L

For meeting her performance goals this year, Diana was informed on December 27 that she would receive a $6,900 year-end bonus. DI (located in Houston, Texas) mailed Diana's bonus check from its payroll processing center (Tampa, Florida) on

December 28. Diana didn't receive the check at home until January 2.

m. Ryan is a 10 percent owner of MNO Incorporated, a Subchapter S corporation. The company reported ordinary business income for the year of $130,000. Ryan acquired the MNO stock two years ago.

n. Ryan's day care business collected $130,000 in revenues. In addition, custorners owed him $12,500 at year-end. During the year, Hyen spent $15,000 for supplies, $11,000 for utilities, $34,000 for rent, and $1,450 for miscellaneous expenses. One

customer gave him use of their vacation home for a week (worth $12,000) in exchange for Ryan allowing their child to attend the day care center free of charge Ryan accounts for his business activities using the cash method of accounting.

9. Diana's employer pays the couple's annual health insurance premiums of $15,000 for a qualified plan..

Comprehensive Problem 5-77 Part 1 and 3 (Algo)

Required:

1. Assuming the Workmans file a joint tax return, determine their total gross income, reduced by any deductible expenses from the day care business (this is called total income on the Form 1040).

3. Assuming the Workmans live in California, a community property state, and that Diana and Ryan file separately, determine Diana's total gross income, reduced by any deductible expenses from the day care business (this is called total income on the Form

1040).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- John Benson, age 40, is single. His Social Security number is 111-11-1111, and he resides at 150 Highway 51, Tangipahoa, LA 70465. John has a 5-year-old child, Kendra, who lives with her mother, Katy. As a result of his divorce in 2016, John pays alimony of 6,000 per year to Katy and child support of 12,000. The 12,000 of child support covers 65% of Katys costs of rearing Kendra. Kendras Social Security number is 123-45-6789, and Katys is 123-45-6788. Johns mother, Sally, lived with him until her death in early September 2019. He incurred and paid medical expenses for her of 15,588 and other support payments of 11,000. Sallys only sources of income were 5,500 of interest income on certificates of deposit and 5,600 of Social Security benefits, which she spent on her medical expenses and on maintenance of Johns household. Sallys Social Security number was 123-45-6787. John is employed by the Highway Department of the State of Louisiana in an executive position. His salary is 95,000. The appropriate amounts of Social Security tax and Medicare tax were withheld. In addition, 9,500 was withheld for Federal income taxes and 4,000 was withheld for state income taxes. In addition to his salary, Johns employer provides him with the following fringe benefits. Group term life insurance with a maturity value of 95,000; the cost of the premiums for the employer was 295. Group health insurance plan; Johns employer paid premiums of 5,800 for his coverage. The plan paid 2,600 for Johns medical expenses during the year. Upon the death of his aunt Josie in December 2018, John, her only recognized heir, inherited the following assets. Three months prior to her death, Josie gave John a mountain cabin. Her adjusted basis for the mountain cabin was 120,000, and the fair market value was 195,000. No gift taxes were paid. During the year, John reported the following transactions. On February 1, 2019, he sold for 45,000 Microsoft stock that he inherited from his father four years ago. His fathers adjusted basis was 49,000, and the fair market value at the date of the fathers death was 41,000. The car John inherited from Josie was destroyed in a wreck on October 1, 2019. He had loaned the car to Katy to use for a two-week period while the engine in her car was being replaced. Fortunately, neither Katy nor Kendra was injured. John received insurance proceeds of 16,000, the fair market value of the car on October 1, 2019. On December 28, 2019, John sold the 300 acres of land to his brother, James, for its fair market value of 160,000. James planned on using the land for his dairy farm. Other sources of income for John are: Potential itemized deductions for John, in addition to items already mentioned, are: Part 1Tax Computation Compute Johns net tax payable or refund due for 2019. Part 2Tax Planning Assume that rather than selling the land to James, John is considering leasing it to him for 12,000 annually with the lease beginning on October 1, 2019. James would prepay the lease payments through December 31, 2019. Thereafter, he would make monthly lease payments at the beginning of each month. What effect would this have on Johns 2019 tax liability? What potential problem might John encounter? Write a letter to John in which you advise him of the tax consequences of leasing versus selling. Also prepare a memo addressing these issues for the tax files.arrow_forwardAshley Panda lives at 1310 Meadow Lane, Wayne, OH 43466, and her Social Security number is 123-45-6777. Ashley is single and has a 20-year-old son, Bill. His Social Security number is 111-11-1112. Bill lives with Ashley, and she fully supports him. Bill spent 2018 traveling in Europe and was not a college student. He had gross income of 4,655 in 2018. Bill paid 4,000 of lodging expenses that Ashley reimbursed after they were fully documented. Ashley paid the 4,000 to Bill using a check from her sole proprietorship. That amount is not included in the items listed below. Ashley had substantial health problems during 2018, and many of her expenses were not reimbursed by her health insurance. Ashley owns Panda Enterprises, LLC (98-7654321), a data processing service that she operates as a sole proprietorship. Her business is located at 456 Hill Street, Wayne, OH 43466. The business activity code is 514210. Her 2018 Form 1040, Schedule C for Panda Enterprises shows revenues of 315,000, office expenses of 66,759, employee salary of 63,000, employee payroll taxes of 4,820, business meal expenses (before the 50% reduction) of 22,000, and rent expense of 34,000. The rent expense includes payments related to renting an office (30,000) and payments related to renting various equipment (4,000). There is no depreciation because all depreciable equipment owned has been fully depreciated in previous years. No fringe benefits are provided to the employee. Ashley personally purchases health insurance on herself and Bill. The premiums are 23,000 per year. Ashley has an extensive stock portfolio and has prepared the following analysis: Note: Ashley received a Form 1099B from her stockbroker that included the adjusted basis and sales proceeds for each of her stock transactions. The per-share cost includes commissions, and the per-share selling price is net of commissions. Also, the dividends are the actual dividends received in 2018, and these are both ordinary dividends and qualified dividends. Ashley had 800 of interest income from State of Ohio bonds and 600 of interest income on her Wayne Savings Bank account. She paid 25,000 of alimony to her former husband. His Social Security number is 123-45-6788. Ashley itemizes her deductions and provides the following information, which may be relevant to her return: Ashley made a 26,000 estimated Federal income tax payment, does not want any of her taxes to finance presidential elections, has no foreign bank accounts or trusts, and wants any refund to be applied against her 2019 taxes. Compute Ashleys net tax payable or refund due for 2018. If you use tax forms for your computations, you will need Form 1040 and its Schedules 1, 4, 5, A, C, D, and SE and Form 8949. Ashley qualifies for the 199A deduction for qualified business income. Be sure to include that in your calculations. Suggested software: ProConnect Tax Online.arrow_forwardDarrell is an employee of Whitneys. During the current year, Darrells salary is 136,000. Whitneys net self-employment income is also 136,000. Calculate the Social Security and self-employment taxes paid by Darrell and Whitney. Write a letter to Whitney in which you state how much she will have to pay in Social Security and self-employment taxes and why she owes those amounts.arrow_forward

- Diana and Ryan Workman were married on January 1 of last year. Ryan has an eight-year-old son, Jorge, from his previous marriage. Diana works as a computer programmer at Datafile Incorporated (DI) earning a salary of $96,000. Ryan is self- employed and runs a day care center. The Workmans reported the following financial information pertaining to their activities during the current year. a. Diana earned a $96,000 salary for the year. b. Diana borrowed $12,000 from Dl to purchase a car. DI charged her 2 percent interest ($240) on the loan, which Diana paid on December 31. DI would have charged Diana $720 if interest had been calculated at the applicable federal interest rate Assume that tax avoidance was not a motive for the loan. c. Ryan received $2,000 in alimony and $4,500 in child support payments from his former spouse. They divorced in 2016. d. Ryan won a $900 cash prize at his church-sponsored Bingo game. e. The Workmans received $500 of interest from corporate bonds and $250 of…arrow_forwardDiana and Ryan Workman were married on January 1 of last year. Ryan has an eight-year-old son, Jorge, from his previous marriage. Diana works as a computer programmer at Datafile Incorporated (DI) earning a base salary of $98,000. Ryan is self-employed and runs a day care center. The Workmans reported the following financial information pertaining to their activities during the current year. a. Diana earned a $98,000 base salary for the year (not including any taxable benefits). b. Diana borrowed $12,400 from DI to purchase a car. DI charged her 2 percent interest ($248) on the loan, which Diana paid on December 31. DI would have charged Diana $760 if interest had been calculated at the applicable federal interest rate. Assume that tax avoidance was not a motive for the loan. c. Ryan received $2,200 in alimony and $4,900 in child support payments from his former spouse. They divorced in 2016. d. Ryan won a $940 cash prize at his church-sponsored Bingo game. e. The Workmans received…arrow_forwardDiana and Ryan Workman were married on January 1 of last year. Diana has an eight-year-old son, Jorge, from her previous marriage. Ryan works as a computer programmer at Datafile Incorporated (DI) earning a salary of $100,000. Diana is self-employed and runs a day care center. The Workmans reported the following financial information pertaining to their activities during the current year. Ryan earned a $100,000 salary for the year. Ryan borrowed $12,800 from DI to purchase a car. DI charged him 2 percent interest ($256) on the loan, which Ryan paid on December 31. DI would have charged Ryan $800 if interest had been calculated at the applicable federal interest rate. Assume that tax avoidance was not a motive for the loan. Diana received $2,400 in alimony and $5,300 in child support payments from her former husband. They divorced in 2016. Diana won a $980 cash prize at her church-sponsored Bingo game. The Workmans received $900 of interest from corporate bonds and $650 of interest…arrow_forward

- Can some expert give answer for this account question?arrow_forwardSandy and John Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2022, Sandy worked as a computer technician at a local university earning a salary of $152,100, and John worked part time as a receptionist for a law firm earning a salary of $29,100. Sandy also does some Web design work on the side and reported revenues of $4,100 and associated expenses of $800. The Fergusons received $820 in qualified dividends and a $205 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2022 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,425. Federal tax withholding of $21,000. Alimony payments to Sandy's former spouse of $10,050 (divorced 12/31/2014). Child support payments for Sandy's child with…arrow_forwardSandy and John Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2022, Sandy worked as a computer technician at a local university earning a salary of $152,100, and John worked part time as a receptionist for a law firm earning a salary of $29,100. Sandy also does some Web design work on the side and reported revenues of $4,100 and associated expenses of $800. The Fergusons received $820 in qualified dividends and a $205 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2022 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,425. Federal tax withholding of $21,000. Alimony payments to Sandy's former spouse of $10,050 (divorced 12/31/2014). Child support payments for Sandy's child with…arrow_forward

- Sandy and John Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2022, Sandy worked as a computer technician at a local university earning a salary of $154,100, and John worked part time as a receptionist for a law firm earning a salary of $31,100. Sandy also does some Web design work on the side and reported revenues of $6,100 and associated expenses of $1,800. The Fergusons received $1,220 in qualified dividends and a $305 refund of their state income taxes. The Fergusons always itemize their deductions, get the full benefit of deducting the entire amount of state income taxes paid, and their itemized deductions were well over the standard deduction amount last year. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2022 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,925. Federal tax withholding of $21,000. Alimony payments to Sandy's former…arrow_forwardSandy and John Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2022, Sandy worked as a computer technician at a local university earning a salary of $153,700, and John worked part time as a receptionist for a law firm earning a salary of $30,700. Sandy also does some Web design work on the side and reported revenues of $5,700 and associated expenses of $1,600. The Fergusons received $1,140 in qualified dividends and a $285 refund of their state income taxes. The Fergusons always itemize their deductions, get the full benefit of deducting the entire amount of state income taxes paid, and their itemized deductions were well over the standard deduction amount last year. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2022 AMT exemption for reference. The Fergusons reported making the following payments during the year: • State income taxes of $4,825. Federal tax withholding of $21,000. • Alimony payments to Sandy's former…arrow_forwardSandy and John Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2022, Sandy worked as a computer technician at a local university earning a salary of $152,600, and John worked part time as a receptionist for a law firm earning a salary of $29,600. Sandy also does some Web design work on the side and reported revenues of $4,600 and associated expenses of $1,050. The Fergusons received $920 in qualified dividends and a $230 refund of their state income taxes. The Fergusons always itemize their deductions, get the full benefit of deducting the entire amount of state income taxes paid, and their itemized deductions were well over the standard deduction amount last year. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2022 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,550. Federal tax withholding of $21,000. Alimony payments to Sandy's former spouse…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT