FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

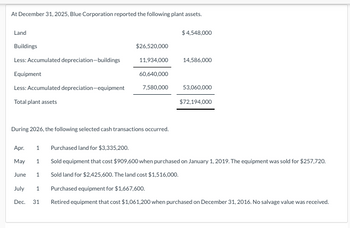

Transcribed Image Text:At December 31, 2025, Blue Corporation reported the following plant assets.

Land

Buildings

Less: Accumulated depreciation-buildings

Equipment

Less: Accumulated depreciation-equipment

Total plant assets

$26,520,000

11,934,000

60,640,000

7,580,000

During 2026, the following selected cash transactions occurred.

1

$4,548,000

14,586,000

53,060,000

$72,194,000

Apr.

1 Purchased land for $3,335,200.

May

Sold equipment that cost $909,600 when purchased on January 1, 2019. The equipment was sold for $257,720.

June 1

Sold land for $2,425,600. The land cost $1,516,000.

July 1

Purchased equipment for $1,667,600.

Dec. 31 Retired equipment that cost $1,061,200 when purchased on December 31, 2016. No salvage value was received.

![Journalize the transactions. (Hint: You may wish to set up T-accounts, post beginning balances, and then post 2026 transactions.)

Blue uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no

salvage value; the equipment is estimated to have a 10-year useful life and no salvage value. Update depreciation on assets

disposed of at the time of sale or retirement. (List all debit entries before credit entries. Record entries in the order displayed in the

problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts.)

Date

April 1

May 1

>

}}]

Account Titles and Explanation

Land

Cash

Cash

Accumulated Depreciation-Equipment

(To record depreciation on equipment sold)

(To record sale of equipment)

(To record depreciation on equipment retired)

(To record disposal of equipment)

Debit

3,335,200

257,720

Credit](https://content.bartleby.com/qna-images/question/9df31b94-8c85-47ac-a6f1-74eb687a61d6/3c60f3a1-dc17-47d5-8e9e-4fad8c373ba2/3dp750d_thumbnail.png)

Transcribed Image Text:Journalize the transactions. (Hint: You may wish to set up T-accounts, post beginning balances, and then post 2026 transactions.)

Blue uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no

salvage value; the equipment is estimated to have a 10-year useful life and no salvage value. Update depreciation on assets

disposed of at the time of sale or retirement. (List all debit entries before credit entries. Record entries in the order displayed in the

problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts.)

Date

April 1

May 1

>

}}]

Account Titles and Explanation

Land

Cash

Cash

Accumulated Depreciation-Equipment

(To record depreciation on equipment sold)

(To record sale of equipment)

(To record depreciation on equipment retired)

(To record disposal of equipment)

Debit

3,335,200

257,720

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mary, Inc. has prepared the following comparative balance sheets for 2020 and 2021: 2021 2020 Cash $ 310,200 $ 168,300 Accounts receivable 152,900 128,700 Inventory 165,000 198,000 Prepaid expenses 19,800 29,700 Plant assets 1,424,500 1,155,000 Accumulated depreciation (495,000) (412,500) Patents 168,300 191,400 $1,745,700 $1,458,600 Accounts payable $ 168,300 $ 184,800 Accrued liabilities 66,000 46,200 Martgage payable ― 495,000 Preferred stock 577,500 ― Additional paid-in capital—preferred 132,000 ― Common stock 660,000 660,000 Retained earnings 141,900 72,600 $1,745,700 $1,458,600 1. The Accumulated Depreciation account has been credited only for the depreciation expense for the period. 2. The Retained Earnings account has been…arrow_forwardSubject: accountingarrow_forwardThe plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2023: Plant Asset Accumulated Depreciation $ 335,000 175,500 1,470,000 1,128,000 147,000 Land Land improvements Building Equipment Automobiles Transactions during 2024 were as follows: a. On January 2, 2024, equipment were purchased at a total invoice cost of $245,000, which included a $5,200 charge for freight. Installation costs of $24,000 were incurred in addition to the invoice cost. b. On March 31, 2024, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $22,000. The fair value of the building on the day of the donation was $15,400. c. On May 1, 2024, expenditures of $47,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those originally anticipated. d. On…arrow_forward

- KAT Productions reports the following amounts on December 31, 2024: retained earnings, $15,000; equipment, $38,000; accounts payable, $9,000; inventory, $15,000; notes payable, $20,000; common stock, $19,000; cash, $10,000. Prepare the balance sheet for KAT Productions. Equipment Intangible assets Inventory Cash Intangible assets Total assets Assets ***** S $ Answer is complete but not entirely correct. KAT Productions Balance Sheet December 31, 2024 38,000 38,000 15,000 10,000✔✔ 25,000 126,000 Accounts payable Notes payable Total liabilities Retained earnings Common stock Liabilities Stockholders' Equity equity Total stockholders' equity Total liabilities and stockholders 9 $ 9,000 20,000 29,000 15,000 19,000 34,000 63,000arrow_forwardThe plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2023: Plant Asset Accumulated Depreciation $ 340,000 177,000 1,480,000 1,138,000 148,000 Land Land improvements Building Equipment Automobiles Transactions during 2024 were as follows: a. On January 2, 2024, equipment were purchased at a total invoice cost of $250,000, which included a $5,300 charge for freight. Installation costs of $25,000 were incurred in addition to the invoice cost. b. On March 31, 2024, a small storage building was donated to the company. The person donating the building originally purchased It three years ago for $23,000. The fair value of the building on the day of the donation was $16,000. c. On May 1, 2024, expenditures of $48,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those originally anticipated. d. On…arrow_forward18 eppertree Company’s financial statements on December 31, 2021, showed the following: Net Sales $ 550,000 Fixed Assets, January 1 $ 146,000 Fixed Assets, December 31 $ 134,000 Total Assets, January 1 $ 194,000 Total Assets, December 31 $ 200,000 What is the fixed asset turnover for 2021? Multiple Choice 3.93 2.60 4.10 2.79arrow_forward

- Suppose during 2022 that Federal Express reported the following information (in millions): net sales of $34,400 and net income of $88. Its balance sheet also showed total assets at the beginning of the year of $24,580 and total assets at the end of the year of $23,300. Calculate the asset turnover and return on assets. (Round asset turnover to 2 decimal places, e.g. 6.25 and return on assets to 1 decimal place, e.g. 17.5%.) Asset turnover Return on assets times %arrow_forwardMarchant Ltd. reported the following abbreviated statement of financial position and statement of income for 2024. MARCHANT LTD. Comparative Statement of Financial Position Dec. 31, 2024 Dec. 31, 2023 Cash $ 60,000 $ 70,000 Accounts receivable 120,000 140,000 Inventory 320,000 280,000 Property, plant, and equipment 700,000 650,000 Less: Accumulated depreciation (260,000) (230,000) Total assets $940,000 $910,000 Accounts payable $ 82,000 $ 85,000 Wages payable 8,000 10,000 Loan payable 350,000 400,000 Common shares 200,000 150,000 Retained earnings 300,000 265,000 Total liabilities and shareholders’ equity $940,000 $910,000 MARCHANT LTD. Statement of Income For the year ended December 31, 2024 Sales revenue $450,000 Cost of goods sold 240,000 Gross profit 210,000 Other expenses: Supplies expense $ 15,000 Depreciation expense 30,000 Wages expense 100,000 Other operating expenses 5,000 Interest expense…arrow_forward27. On December 31, 2022, Marizor Company believed that the assets of a cash generating unit are impaired based on an analysis of economic indicators. The assets and liabilities of the cash generating unit at carrying amount on December 31, 2022 are: Cash 4,000,000 Accounts receivable 6,000,000 Allowance for doubtful accounts 1,000,000 Inventory Property, plant and equipment Accumulated depreciation 7,000,000 22,000,000 4,000,000 Goodwill 3,000,000 2,000,000 Accounts payable Loans payable The entity determined that the value in use of the cash generating unit is P28,000,000. The accounts receivable are considered collectible, except those considered doubtful. The carrying amount of the inventory is lower than fair value less cost of disposal. What is the impairment loss to be allocated to property, plant and equipment? А. 3,600,000 1,000,000 В. 6,000,000 С. 3,000,000 D. 1,800,000arrow_forward

- 18 eppertree Company’s financial statements on December 31, 2021, showed the following: Net Sales $ 550,000 Fixed Assets, January 1 $ 146,000 Fixed Assets, December 31 $ 134,000 Total Assets, January 1 $ 194,000 Total Assets, December 31 $ 200,000 What is the fixed asset turnover for 2021? Multiple Choice 3.93 2.60 4.10 2.79arrow_forward15. Each of the following items must be considered in preparing a statement of cash flows (indirect method) for Turbulent Indigo Inc. for the year ended December 31, 2020. State where each item is to be shown in the statement of cash flows, if at all. Items (a) Plant assets that had cost $20,000 6 years before and were being depreciated on a straight-line basis over 10 years with no estimated scrap value were sold for $5,300. select an option (b) During the year, 10,000 shares of common stock with a stated value of $10 a share were issued for $43 a share. select an option (c) Uncollectible accounts receivable in the amount of $27,000 were written off against Allowance for Doubtful Accounts. select an option (d) The company sustained a net loss for the…arrow_forwardAt December 31, 2022, Swifty Company reported the following as plant assets. Land $ 4,080,000 Buildings $28,360,000 Less: Accumulated depreciation—buildings 12,210,000 16,150,000 Equipment 48,670,000 Less: Accumulated depreciation—equipment 5,160,000 43,510,000 Total plant assets $63,740,000 During 2023, the following selected cash transactions occurred. April 1 Purchased land for $2,000,000. May 1 Sold equipment that cost $780,000 when purchased on January 1, 2019. The equipment was sold for $468,000. June 1 Sold land purchased on June 1, 2013 for $1,410,000. The land cost $392,000. July 1 Purchased equipment for $2,430,000. Dec. 31 Retired equipment that cost $502,000 when purchased on December 31, 2013. Journalize the above transactions. The company uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 50-year life and no salvage value. The equipment is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education