FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

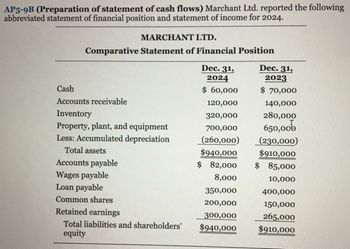

Marchant Ltd. reported the following abbreviated statement of financial position and statement of income for 2024.

MARCHANT LTD.

Comparative Statement of Financial Position

Dec. 31, 2024

Dec. 31, 2023

Cash

$ 60,000

$ 70,000

Accounts receivable

120,000

140,000

Inventory

320,000

280,000

Property, plant, and equipment

700,000

650,000

Less: Accumulated depreciation

(260,000)

(230,000)

Total assets

$940,000

$910,000

Accounts payable

$ 82,000

$ 85,000

Wages payable

8,000

10,000

Loan payable

350,000

400,000

Common shares

200,000

150,000

Retained earnings

300,000

265,000

Total liabilities and shareholders’ equity

$940,000

$910,000

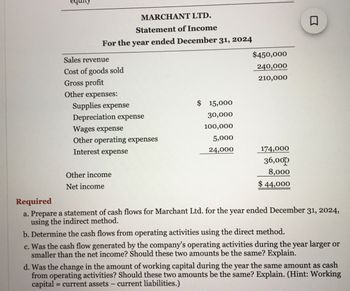

MARCHANT LTD.

Statement of Income

For the year ended December 31, 2024

Sales revenue

$450,000

Cost of goods sold

240,000

Gross profit

210,000

Other expenses:

Supplies expense

$ 15,000

Depreciation expense

30,000

Wages expense

100,000

Other operating expenses

5,000

Interest expense

24,000

174,000

36,000

Other income

8,000

Net income

$ 44,000

Required

Prepare a statement of cash flows for Marchant Ltd. for the year ended December 31, 2024, using the indirect method.

Determine the cash flows from operating activities using the direct method.

Was the cash flow generated by the company’s operating activities during the year larger or smaller than the net income? Should these two amounts be the same? Explain.

Was the change in the amount of working capital during the year the same amount as cash from operating activities? Should these two amounts be the same? Explain. (Hint: Working capital = current assets − current liabilities.)

Transcribed Image Text:AP5-9B (Preparation of statement of cash flows) Marchant Ltd. reported the following

abbreviated statement of financial position and statement of income for 2024.

MARCHANT LTD.

Comparative Statement of Financial Position

Cash

Accounts receivable

Inventory

Property, plant, and equipment

Less: Accumulated depreciation

Total assets

Accounts payable

Wages payable

Loan payable

Common shares

Retained earnings

Total liabilities and shareholders'

equity

Dec. 31,

2024

$ 60,000

120,000

320,000

700,000

(260,000)

$940,000

$ 82,000

8,000

350,000

200,000

300,000

$940,000

Dec. 31,

2023

$70,000

140,000

280,000

650,005

(230,000)

$910,000

$ 85,000

10,000

400,000

150,000

265,000

$910,000

Transcribed Image Text:MARCHANT LTD.

Statement of Income

For the year ended December 31, 2024

Sales revenue

Cost of goods sold

Gross profit

Other expenses:

Supplies expense

Depreciation expense

Wages expense

Other operating expenses

Interest expense

Other income

Net income

$ 15,000

30,000

100,000

5,000

24,000

$450,000

240,000

210,000

174,000

36,000

8,000

$44,000

Required

a. Prepare a statement of cash flows for Marchant Ltd. for the year ended December 31, 2024,

using the indirect method.

b. Determine the cash flows from operating activities using the direct method.

c. Was the cash flow generated by the company's operating activities during the year larger or

smaller than the net income? Should these two amounts be the same? Explain.

d. Was the change in the amount of working capital during the year the same amount as cash

from operating activities? Should these two amounts be the same? Explain. (Hint: Working

capital = current assets - current liabilities.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mary, Inc. has prepared the following comparative balance sheets for 2020 and 2021: 2021 2020 Cash $ 310,200 $ 168,300 Accounts receivable 152,900 128,700 Inventory 165,000 198,000 Prepaid expenses 19,800 29,700 Plant assets 1,424,500 1,155,000 Accumulated depreciation (495,000) (412,500) Patents 168,300 191,400 $1,745,700 $1,458,600 Accounts payable $ 168,300 $ 184,800 Accrued liabilities 66,000 46,200 Martgage payable ― 495,000 Preferred stock 577,500 ― Additional paid-in capital—preferred 132,000 ― Common stock 660,000 660,000 Retained earnings 141,900 72,600 $1,745,700 $1,458,600 1. The Accumulated Depreciation account has been credited only for the depreciation expense for the period. 2. The Retained Earnings account has been…arrow_forwardhe current sections of Skysong, Inc.’s balance sheets at December 31, 2021 and 2022, are presented here.Skysong’s net income for 2022 was $152,700. Depreciation expense was $27,600. 2022 2021 Current assets Cash $107,600 $95,900 Accounts receivable 78,400 89,400 Inventory 167,800 172,100 Prepaid expenses 26,800 22,000 Total current assets $380,600 $379,400 Current liabilities Accrued expenses payable $15,800 $8,600 Accounts payable 84,900 95,500 Total current liabilities $100,700 $104,100 Prepare the net cash provided by operating activities section of the company’s statement of cash flows for the year ended December 31, 2022, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)arrow_forwardAt December 31, 2022, Concord Corporation reported the following plant assets. Land $ 3,640,000 Buildings $ 28,180,000 Less: Accumulated depreciation-buildings 12,681,000 15,499,000 Equipment 48,740,000 Less: Accumulated depreciation-equipment 6,092,500 42,647,500 Total plant assets $61,786,500 During 2023, the following selected cash transactions occurred. Apr. 1 Purchased land for $ 2,170,000. May 1 Sold equipment that cost $ 750,000 when purchased on January 1, 2016. The equipment was sold for $ 225,000. June 1 Sold land for $ 1,510,000. The land cost $ 993,000. July 1 Purchased equipment for $ 1,093,000. Dec. 31 Retired equipment that cost $ 698,000 when purchased on December 31, 2013. No salvage value was received.arrow_forward

- KAT Productions reports the following amounts on December 31, 2024: retained earnings, $15,000; equipment, $38,000; accounts payable, $9,000; inventory, $15,000; notes payable, $20,000; common stock, $19,000; cash, $10,000. Prepare the balance sheet for KAT Productions. Equipment Intangible assets Inventory Cash Intangible assets Total assets Assets ***** S $ Answer is complete but not entirely correct. KAT Productions Balance Sheet December 31, 2024 38,000 38,000 15,000 10,000✔✔ 25,000 126,000 Accounts payable Notes payable Total liabilities Retained earnings Common stock Liabilities Stockholders' Equity equity Total stockholders' equity Total liabilities and stockholders 9 $ 9,000 20,000 29,000 15,000 19,000 34,000 63,000arrow_forwardFlint Corp. Statement of Financial Position For the Year Ended December 31, 2023 Current assets Cash (net of bank overdraft of $40,000 ) $450,000 Accounts receivable (net) Inventory at the lower of cost and net realizable value FV-NI investments (at cost-fair value $320,000 ) Property, plant, and equipment Buildings (net) 590,000 Equipment (net) 190,000 Land held for future use ,265,000 Intangible assets Goodwill Investment in bonds to collect cash flows, at amortized cost 100,000 Prepaid expenses Current liabilities Accounts payable 365,000 Notes payable (due next year) Pension obligation Rent payable 505,000 511,000 340,000 265,000 Long-term liabilities Bonds payable 681,000 Shareholders' equity Common shares, unlimited authorized, 380,000 issued 380,000 Contributed surplus 210,000 Retained earningsarrow_forwardBonita Industries's balance sheet accounts as of December 31, 2021 and 2020 and information relating to 2018 activities are presented below. December 31, 2021 2020 Assets Cash $ 439000 $ 199000 Short-term investments 600000 — Accounts receivable (net) 1000000 1000000 Inventory 1360000 1190000 Long-term investments 398000 600000 Plant assets 3400000 2010000 Accumulated depreciation (900000) (900000) Patent 182000 201000 Total assets $6479000 $4300000 Liabilities and Stockholders' Equity Accounts payable and accrued liabilities $1660000 $1460000 Notes payable (nontrade) 582000 — Common stock, $10 par 1587000 1410000 Additional paid-in capital 802000 500000 Retained earnings 1848000 930000 Total liabilities and stockholders' equity $6479000 $4300000 Information relating to 2021 activities:• Net income…arrow_forward

- The comparative balance sheet of Gus Company at December 31, 2021 and 2020 appears below: Assets: 12/31/2021 12/31/2020 Cash $ 53,000 $ 120,000 Accounts receivable (net) 37,000 48,000 Inventories 108,500 100,000 Equipment 573,200 450,000 Accumulated depreciation-equipment (142,000) (176,000) $629,700 $542,000 Liabilities & Stockholders Equity: Accounts payable $ 62,500 $ 43,800 Bonds payable, due June 2021 0 100,000 Common stock, $10 par 335,000 285,000 Paid-in capital in excess of par - Common stock 74,000 55,000 Retained earnings 158,200 58,200 $629,700 $542,000 The income statement for the year ended December 31, 2021 appears below: Sales $625,700 Cost of merchandise sold 340,000 Gross profit 285,700 Operating expenses (includes $26,000 depreciation expense) 94,000…arrow_forwardthe balance sheets for Plasma Screens Corporation and additional information are provided below. PLASMA SCREENS CORPORATIONBalance SheetsDecember 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 242,000 $ 130,000 Accounts receivable 98,000 102,000 Inventory 105,000 90,000 Investments 5,000 3,000 Long-term assets: Land 580,000 580,000 Equipment 890,000 770,000 Less: Accumulated depreciation (528,000 ) (368,000 ) Total assets $ 1,392,000 $ 1,307,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 109,000 $ 95,000 Interest payable 7,000 13,000 Income tax payable 9,000 6,000 Long-term liabilities: Notes payable 110,000 220,000 Stockholders' equity: Common stock…arrow_forwardThe following information related to TRT Company for the years 2019 and 2020. 1. Income Statement Information 2019 2020 Net Sales $310,000 $250,000 Cost of Goods Sold 00,000 n6,000 Operating Expense 46,000 41,000 Interest Expernse 9,000 10,200 Income Tax Expense 10,200 9,600 Net Income 154,000 103 200 2. Other Infomation: 2019 2020 Total Assets $250,000 $190,000 Construction in Progress 15,000 14,200 intangible Assets 7,000 7,000 Long-term debts 70,000 70,000 Current liabilities 40,000 50,000 Preferred Stocks, 5% 10,000 10,000 Common Stocks. 210,000 150,000 Dividend For Common shares 84,000 60,000 Market Price of Common Shares 16 10 3. Common Stock outstanding information: *No change in outstanding common shares during 2019. in 2020 the following changes occurred: January 1.2020 (Beginning) 40,000 April 1. 2020 Shares issued 20,000 July 1. 2020 Purchased Treasury shares 6,000 Sept 30. 2020 Shares issued 8,000 November 1.2020 Stock Dividend 10% issued Dec 31.2020 Shares issued 1,950…arrow_forward

- Presented below are data taken from the records of Wildhorse Company. December 31,2020 December 31,2019 Cash $15,200 $8,100 Current assets other than cash 84,700 60,600 Long-term investments 10,000 52,900 Plant assets 332,400 215,200 $442,300 $336,800 Accumulated depreciation $20,100 $40,100 Current liabilities 39,600 22,100 Bonds payable 74,800 –0– Common stock 254,500 254,500 Retained earnings 53,300 20,100 $442,300 $336,800 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $50,500 and were 80% depreciated were sold during 2020 for $8,000. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the…arrow_forwardSelected financial info for Strand Corp is below: Cash Accounts receivable (net) Inventory Land Equipment Accumulated depreciation TOTAL Accounts payable Notes payable- current Notes payable- non-current Common stock Retained earnings TOTAL 2022 2021 $63,000 $42,000 $151,200 $84,000 $201,600 $168,000 $21,000 $58,800 $789,600 $504,000 ($115,600) ($84,000) $1,110,800 $772,800 $86,000 $50,400 $29,400 $67,200 $302,400 $168,000 $487,200 $420,000 $205,800 $67,200 $1,110,800 $772,800 Additional info for 2022: 1) Net Income was $235,200 2) Depreciation expense was recorded 3) Land was sold at its original cost. No other assets were sold 4) Cash dividends were paid 5) Equipment was purchased for cash REQUIRED: A) Prepare a formal Statement of Cash Flows for 2022 B) Prepare a calculation for Free Cash Flowarrow_forwardIllies Corporation's comparative balance sheet appears below: Comparative Balance Sheet Ending Balance Beginning Balance Assets: Current assets: Cash and cash equivalents $ 56,000 $ 49,000 Accounts receivable 35,000 38,600 Inventory 83,000 86,600 Total current assets 174,000 174,200 Property, plant, and equipment 406,000 371,000 Less accumulated depreciation 188,000 148,000 Net property, plant, and equipment 218,000 223,000 Total assets $ 392,000 $ 397,200 Liabilities and stockholders' equity: Current liabilities: Accounts payable $ 34,000 $ 36,600 Accrued liabilities 70,000 76,600 Income taxes payable 67,200 58,000 Total current liabilities 171,200 171,200 Bonds payable 98,000 110,000 Total liabilities 269,200 281,200 Stockholders’ equity: Common stock 47,000 38,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education