Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

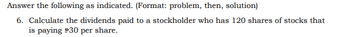

Transcribed Image Text:Answer the following as indicated. (Format: problem, then, solution)

6. Calculate the dividends paid to a stockholder who has 120 shares of stocks that

is paying P30 per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume you own shares in Walmart and that the company currently earns $6.80 per share and pays annual dividend payments that total $5.55 a share each year. Calculate the dividend payout for Walmart. Note: Enter your answer as a percent rounded to 2 decimal places. Dividend payout %arrow_forwardSuppose a firm is operating in 2 periods. The shareholders are expecting to receive $100,000 economic profits (per share of stock) in period 1 and $120,000 (per share of stock) in period 2. Given the required rate of return is the same in both period, which 0.05 and the real option value is $50,000. What is the current value of a share of stock? (Report your answer with 2 decimal points)arrow_forwardhello, I need help pleasearrow_forward

- Suppose you own 2,000 common shares of Laurence Incorporated. The EPSis $10.00, the DPS is $3.00, and the stock sells for $80 per share. Laurenceannounces a 2-for-1 split. Immediately after the split, how many shareswill you have, what will the adjusted EPS and DPS be, and what would youexpect the stock price to be?arrow_forwardThe Beautiful Flower Company. has earnings of $1.44 per sharee. a. If the benchmark PE for the company is 13, how much will you pay for the stock? b. If the benchmark PE for the company is 16, how much will you pay for the stock?arrow_forwardCalculate the value of a preferred stock that pays a dividend of $6 per share required rate of return is 12 percent. if yourarrow_forward

- Your corporation has declared a cash dividend of $5.00 per share. Before the cash dividend the stock was selling for $60.00 per share. When the stock goes ex-dividend what will the price per share be? Please show your calculations in the space provided.What would the ex-dividend price per share be?arrow_forwardA company has just paid an ordinary share dividend of 32 cents and expected to pay a dividend of 33.6 cents in one year’s time. The company has a cost of equity of 13%. What is the market price of the company’s shares to the nearest cent on an ex dividend basis? $3.20 $4.41 $2.59 $4.20 Use the following information to answer questions 18 and 19 Bill plans to open a service centre. The equipment will cost $50,000. Bill expects the after-tax cash inflows to be $15,000 annually for 8 years, after which he plans to scrap the equipment and retire. What is the project’s regular payback period? 2.67 years 3.33 years 3.67 years 4.33 years Assume the required return is 10%. What is the project’s discounted payback period? 4.25 years 5.25 years 6 years the project does not payback on discounted basis.arrow_forwardHi, for number 1, where did you get 300,000 for shares outstanding?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education