Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

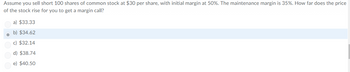

Transcribed Image Text:Assume you sell short 100 shares of common stock at $30 per share, with initial margin at 50%. The maintenance margin is 35%. How far does the price

of the stock rise for you to get a margin call?

a) $33.33

b) $34.62

c) $32.14

d) $38.74

e) $40.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Suppose the call money rate is 4.5 percent, and you pay a spread of 2.5 percent over that. You buy 800 shares of stock at $36 per share. You put up $14, 400. One year later, the stock is selling for $48 per share and you close out your position. What is your return assuming a dividend of $0.65 per share is paid?arrow_forwardYou decided to invest $10,000 of your savings in a stock whose current price is $25 per share. To utilize the benefit of margin investing, you borrowed an additional $10,000 from your broker and invested $20,000 in the stock, If the maintenance margin is 30 pereent, at what price will you receive your first margin call?arrow_forwardYou short sell 1,000 shares of RAJ stock at a price of $70. Your initial margin is 50%. If you cover your RAJ short position at a price of $65, how much is your return? A. 14.29% B. 12.31% C. 17.39% D. 15.65%arrow_forward

- You are bearish on Telecom and decide to sell short 160 shares at the current market price of $65 per share. a. How much in cash or securities must you put into your brokerage account if the broker's initial margin requirement is 50% of the value of the short position? (Round your answer to the nearest whole number.) b. How high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? (Round your answer to 2 decimal places.)arrow_forwardA stock is selling today for $50 per share. At the end of the year, it pays a dividend of $3 per share and sells for $59. Required: a. What is the total rate of return on the stock? b. What are the dividend yield and percentage capital gain? c. Now suppose the year-end stock price after the dividend is paid is $44. What are the dividend yield and percentage capital gain in this case?arrow_forwardsuppose you short sell 100 shares of IBX, now selling at $172 per share. (a) what is your maximum possible loss? (b) what happens if you simultaneously place a stop-buy order at $182?arrow_forward

- Suppose the call money rate is 6.8 percent, and you pay a spread of 1.9 percent over that. You buy 1,300 shares at $93 per share with an initial margin of 55 percent. One year later, the stock is selling for $101 per share and you close out your position. What is your return assuming no dividends are paidarrow_forwardYou short sell 200 shares of stock at $48.23 per share and cover your short position three months later at $44.66 per share. If your broker's initial margin requirement is 65%, and the maintenance margin requirement is 45%, what is your rate of return? 100tnearrow_forwardAssume you buy 100 shares of stock at $40 per share on margin (40 percent). If the price rises to $55 per share, what is your percentage gain on the initial equity? No of shares = 100; Price of stock = $40; Position taken = long Equity required in account (Initial Margin) = 40% x (100 shares x $40) = 40% x $4,000 = $1,600 Gain percentage = {[(Current price -Entry price) no of shares]/Initial Margin} x 100 = {[($55 - $40) 100 shares] / $1,600} x 100 = $1,500 / $1,600 x 100 = 93.75% 2. In problem 1, what would the percentage loss on the initial equity be if the price had decreased to $28? Loss percentage = {[(current price – entry price) no of shares] / Initial Margin} x 100 = {[($28 - $40) 100 shares] / $1,600} x 100 = {[ -$12 x 100 shares] / $1,600} x 100…arrow_forward

- You have a preferred stock with an $80 par value. The stock has a required return of 7% and the dividend is 6% of par value. How much should you pay for this stock?arrow_forwardAn investor short sells 100 shares of a stock for £50 per share. The initial margin is 50%. With a maintenance margin of 30%, what is the stock price at which there will be a margin call? If rather than short selling the shares you buy them on margin, explain how the definition of the margin would change.arrow_forwardYou have gathered the following information for a company: The current price-to-earnings for the firm is The expected Earnings per share for the firm is The current price of the stock is Someone offers you $110 for the stock. What would you do? B Reject the offer as the expected future value is 15 $8.25 Accept the offer as there is a profit of $90.00 $123.75 Accept the offer as the expected future value is less than $110 Reject the offer as you have no idea where future prices will be. $20.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education