Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

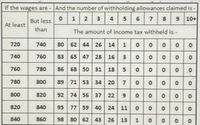

Use the following federal tax table for biweekly earnings of a single person to help answer the question below.

Emeril has gross biweekly earnings of $784.21. By claiming 1 more withholding

allowance, Emeril would have $13 more in his take home pay. How many

withholding allowances does Emeril currently claim?

a. 3

b. 4

c. 5

d. 6

Transcribed Image Text:If the wages are-

And the number of withholding allowances claimed is-

12 3 4

5 6

9 10+

7

But less

At least

than

The amount of income tax withheld is -

720

740

0 0 0 0

83 65 47 28 16 3 00000

86 68 50 31 18 5 00000

89 71 53 34 20 70000 o

92 74 56 37 22 900000

95 77 59 40 24 11 o0000

98 80 62 43 26 13 1 0 o

740

760

760

780

780

800

800

820

820

840

840

860

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How do I calculate self-employment taxes with self-employment earnings. For example Bob Marks has self-employment earnings of 149,200, what would be his total self-employment taxes for 2021.arrow_forwardSuppose you made $85,776 of income from wages and $830 of taxable interest. You also made contributions of $3700 to a tax deferred retirement account. You have 2 dependents and file as single. The standard deduction is 11900 and the exemption amount is 3100 per exemption. What is your Adjusted Gross Income? Answer to the nearest dollar.arrow_forwardCalculating Social Security and Medicare taxes assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128,400 and a Medicare tax rate of 1.45% is applied to all earnings. What is the Medicare tax paid if Anthony's gross income is $114,550.00 for the year. *arrow_forward

- hr.4arrow_forwardIn 2020, Shelly had net earnings from her business of $160,000. What is the amount of Shelly’s self-employed tax? Round answer to nearest dollar.arrow_forwardUse the following information Molly has collect to help her determine her taxable income for the year: Salary from her job 115,100 Interest earn from 1,280 savings Interest paid on student loans Your Answer: Answer 905 Standard deduction 12,950 Itemized deductions 842 Child tax credit 2000arrow_forward

- Determine the self-employment tax for an individual who has $111,700 in wages, $4,000 in interest income, and $20,000 in self-employment income. The self employment tax is________?arrow_forwardDarius' net income from self-employment reported on Schedule C is $25,000. Calculate his self-employment tax. Group of answer choices $1,766 $23,088 $3,825 $3,532arrow_forwardA surviving spouse with one dependent child has a gross income of 68,170 per year. If 3,000 is withheld from the taxpayers wages for federal income taxes, what is the amount of the taxpayers refund or tax due?arrow_forward

- PROBLEM: Jose Diaz has a federal tax levy of $4,119.90 against him. If Diaz is single with three personal exemptions and had a take home pay of $1020.00 this week, how much would his employer take from his pay to satisfy part of the tax levy? Federal tax levy amount _________arrow_forwardUse the following information to calculate the federal average tax rate (ignore tax credits) for a taxpayer who earned $115,000 from employment, and where bonds were sold for $20,000 during the year that originally cost $10,000: Taxable income Up to $47,630 On the next $47,629 On the next $52,408 On the next $62,704 Over $210,371 Select one: Tax Rate 15% 20.5% Based on the above, the average tax rate (ATR) is closest to: a. 19.15% b. 19,45% c. 20.5% d. 26.0% 26% 29% 33%arrow_forwardMary Matthews made $1,150 during a biweekly pay period. Only social security (fully taxable) and federal income taxes attach to her pay. Matthews contributes $100 from each biweekly pay to her company's 401k. Determine Matthews' take home pay if she is married filing jointly. (Use wage bracket method) Round your answer to two decimal places. please use 2022 tax rate tablesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education