FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

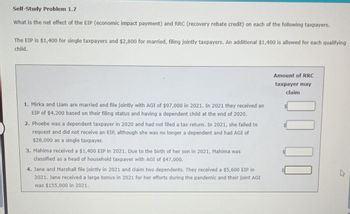

Transcribed Image Text:Self-Study Problem 1.7

What is the net effect of the EIP (economic impact payment) and RRC (recovery rebate credit) on each of the following taxpayers.

The EIP is $1,400 for single taxpayers and $2,800 for married, filing jointly taxpayers. An additional $1,400 is allowed for each qualifying

child.

1. Mirka and Liam are married and file jointly with AGI of $97,000 in 2021. In 2021 they received an

EIP of $4,200 based on their filing status and having a dependent child at the end of 2020.

2. Phoebe was a dependent taxpayer in 2020 and had not filed a tax return. In 2021, she failed to

request and did not receive an EIP, although she was no longer a dependent and had AGI of

$28,000 as a single taxpayer.

3. Mahima received a $1,400 EIP in 2021. Due to the birth of her son in 2021, Mahima was

classified as a head of household taxpayer with AGI of $47,000.

4. Jane and Marshall file jointly in 2021 and claim two dependents. They received a $5,600 EIP in

2021. Jane received a large bonus in 2021 for her efforts during the pandemic and their joint AGI

was $155,000 in 2021.

Amount of RRC

taxpayer may

claim

000

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Q.How can annuity help in having a good benefit proposal for workers?arrow_forward. What is the difference between active income, passive income and portfolio income? Provides examples of the most prevalent types of each of those incomes. How do deductions from these three types of income vary?arrow_forwardwhat are the legal provisions related to Taxable Income, Medicare Levy, and Medicare Levy surcharge?arrow_forward

- What will be the Effect of the After-Tax Interest Cost on Loan Decisions?arrow_forwardDiscuss the various effects of income taxes on the ability to work, save and investarrow_forwardWhich of the following is business income for NOL purposes? Interest earned on savings account. Unemployment compensation. Alimony received. IRA distribution.arrow_forward

- Select the best answer. An example of investment income that would be subject to the net investment income tax is: O A. Rental and royalty income O B. Tax-exempt interest O C. Wages O D. Self-employment income Submit Answersarrow_forwardFor financial institutions, wages and staff benefits are considered part of which type of the following: a. Interest expenses. b. Non-interest income. c. Non-interest expenses. d. Net Interest income.arrow_forward1.How is cost recovery properly assessed that will account for tax benefit? 2.What is Tax Benefit? Give an examplearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education