FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

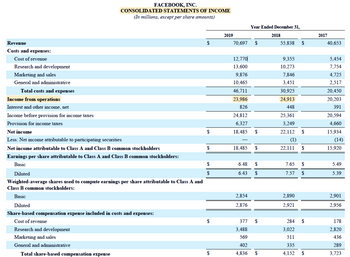

- Assuming that "Cost of Revenue" is the only variable cost and using the previously calculated information, what is Facebook's Margin of Safety in 2019 (round 2 decimal places)?

- Assuming that "Cost of Revenue" is the only variable cost, what is Facebook's Magnitude of Operating Leverage for 2019 (round 2 decimal places)?

Transcribed Image Text:Revenue

Costs and expenses:

Cost of revenue

Research and development

Marketing and sales

General and administrative

Total costs and expenses

Income from operations

Interest and other income, net

Income before provision for income taxes

Provision for income taxes

FACEBOOK, INC.

CONSOLIDATED STATEMENTS OF INCOME

(In millions, except per share amounts)

Net income

Less: Net income attributable to participating securities

Net income attributable to Class A and Class B common stockholders

Earnings per share attributable to Class A and Class B common stockholders:

Basic

Diluted

Weighted-average shares used to compute earnings per share attributable to Class A and

Class B common stockholders:

Basic

Diluted

Share-based compensation expense included in costs and expenses:

Cost of revenue

Research and development

Marketing and sales

General and administrative

Total share-based compensation expense

$

$

$

$

$

$

2019

70,697

12,770

13,600

9,876

10,465

46,711

23,986

826

24,812

6.327

18,485 $

6.48

6.43

Year Ended December 31,

18,485 $

2,854

2,876

$

377

3,488

569

402

4,836

$

$

$

$

2018

55,838

9,355

10,273

7,846

3,451

30,925

24,913

448

25,361

3,249

22,112

(1)

22,111

7.65

7.57

2,890

2,921

284

3,022

511

335

4,152

$

$

$

$

$

$

$

2017

40,653

5,454

7,754

4,725

2,517

20.450

20,203

391

20,594

4,660

15,934

(14)

15,920

5.49

5.39

2,901

2,956

178

2,820

436

289

3,723

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Your answer is incorrect. Divide the estimated average annual income by the average investment. Investment cost plus residual value, divided by two, equals average investment. Can you please redo it? Thanksarrow_forwardMarketingarrow_forwardRequired information [The following information applies to the questions displayed below.] Pacific Company sells electronic test equipment that it acquires from a foreign source. During the year, the inventory records reflected the following: Beginning inventory Purchases Units 22 42 Unit Cost $11,540 10,040 Total Cost $ 253,880 421,680 Sales (47 units at $24, 670 each) Inventory is valued at cost using the LIFO inventory method.arrow_forward

- Please help me. Thankyou.arrow_forwardCalculate the amount and percentage of change in working capital in 2025.arrow_forwardThe SPDR Dow Jones Industrial Average ETF (ticker: DIA) aims to mimic the Dow Jones Industrial Average (DJIA) return. However, the ProShares Short Dow30 (ticker: DOG) aims to short the DJIA and earn ‒1× the DJIA return. The ProShares UltraShort Dow30 (ticker: DXD) and ProShares UltraPro Short Dow30 (ticker: SDOW) aim to earn ‒2× and ‒3× the DJIA return, respectively. Consider that the NAVs of DIA, DOG, DXD, and SDOW all start at $380 and the DJIA earns 12% in the first year and -12% in the second year. If the four ETFs are successful in their objectives, what is the NAV of each ETF at the end of the second year? Year 1 12% Year 2 -12% The NAV ofarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education