FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

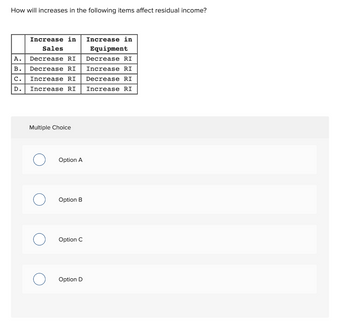

Transcribed Image Text:How will increases in the following items affect residual income?

A.

B.

Increase in Increase in

Sales

Equipment

Decrease RI

Increase RI

Decrease RI

Decrease RI

C.

Increase RI

D. Increase RI

Multiple Choice

Option A

Option B

Option C

Option D

Decrease RI

Increase RI

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Degree of operating leverage (DOL) measures the sensitivity of OCF in response to changes of The higher the DOL, the the volatility of a firm's operating income. Select one: a. sales quantity; lower O b. sales quantity; higher O c. fixed costs; lower O d. fixed costs; higher O e. variable costs; higherarrow_forwardHelparrow_forwardIn a market with a binding price ceiling, an increase in the ceiling will ______ the quantity supplied, ________ the quantity demanded, and reduce the ____ Question 6 options: Increase, decrease, surplus decrease, increase, shortage decrease, increase, surplus increase, decrease, shortagearrow_forward

- When sales price increases and all other variables are held constant, the break-even point will ________.A. remain unchangedB. increaseC. decreaseD. produce a lower contribution marginarrow_forwardWhen comparing the lower of cost to market the appropriate market value is determined before comparing it to the cost the purpose of the ceiling is to ensure that the write-down is sufficient to cover all expected gains O the purpose of the floor is to prevent an excessive gain from being recognized in the future the process is consistent with the principle of conservatism because the goal is to limit excessive swings in gross margin O000arrow_forwardTarget profit is added to what other financial statement line item, or element, to determine the numerator in the overall target contribution margin (CM) calculation in break-even analysis? Variable costs Fixed costs Net income after taxes Operating profitarrow_forward

- Your answer is incorrect. Divide the estimated average annual income by the average investment. Investment cost plus residual value, divided by two, equals average investment. Can you please redo it? Thanksarrow_forwardGenerally, as income rises, the average propensity to consume Group of answer choices stabilizes decreases increases becomes erratic drops to zeroarrow_forwardMultiple Linear Regression Considering a person wants to buy a vehicle with an automatic transmission, how much extra money can the person expect to make by selling it in the future? Transmission type will not have any effect on the selling price X Incorrect Feedback: The coefficient of the variable can be analysed to identify its impact on the dependent variable. 1,28,768 1, 30, 941 ₹1,00,582arrow_forward

- Question 4 Explain how does a decrease in the current income y affect the consumer's consumption-saving decision. In particular, explain: 1) How will current consumption c, future consumption c', and savings s change; 2) Are there any substitution effect or income effect. Make sure you draw two figures, one for the borrowers and one for the lenders.arrow_forwardSales Variable costs Cost of goods sold Operating expenses Total variable Contribution margin Fixed costs Cost of goods sold Operating expenses Total fixed Net income (loss) Continue LA $ Eliminate LA Net Income Increase (Decrease)arrow_forwardHelp4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education