FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

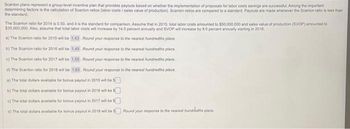

Transcribed Image Text:Scanlon plans represent a group-level incentive plan that provides payouts based on whether the implementation of proposals for labor costs savings are successful. Among the important

determining factors is the calculation of Scanion ratios (labor costs / sales value of production). Scanion ratios are compared to a standard. Payouts are made whenever the Scanion ratio is less than

the standard.

The Scanlon ratio for 2014 is 0.50, and it is the standard for comparison. Assume that in 2015, total labor costs amounted to $50,000,000 and sales value of production (SVOP) amounted to

$35,000,000. Also, assume that total labor costs will increase by 14.0 percent annually and SVOP will increase by 9.0 percent annually starting in 2016

1.43. Round your response to the nearest hundredths place

a) The Scanion ratio for 2015 will be

b) The Scanlon ratio for 2016 will be

1.49. Round your response to the nearest hundredths place

c) The Scanion ratio for 2017 will be

1.55. Round your response to the nearest hundredtha place

d) The Scanion ratio for 2018 will be 1.63. Round your response to the nearest hundredths place.

a) The total dollars available for bonus payout in 2015 will be

b) The total dollars available for bonus payout in 2010 will be

c) The total dollars available for bonus payout in 2017 will be S

d) The total dollars available for bonus payout in 2016 will be Round your response to the nearest hundredths place.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- In order to determine the optimal sales mix for a company, one should evaluate the contribution margin per unit of whatever the scarce resource is True or Faisearrow_forwardWhen evaluating if a company should accept a new contract to produce more product it should: Evaluate all possible fixed cost of accepting the contract. Evaluate the propose contract using a contribution margin approach. Accept the new contract if the sales price for the product is equal to or higher than the current sale price. Accept the new contract if fixed costs will remain the same.arrow_forwardBalanced scorecard, social performance. Comtex Company provides cable and Internet services in the greater Boston area. There are many competitors that provide similar services. Comtex believes that the key to nancial success is to offer a quality service at the lowest cost. Comtex currently spends a signicant amount of hours on installation and postinstallation support. This is one area that the company has targeted for cost reduction. Comtex’s balanced scorecard for 2017 follows.arrow_forward

- 5) Which of the following will cause a movement from one point on an AD curve to another point on the same AD curve? a) a change in government expenditures b) a change in the price level c) a change in net exports d) all of the options provided 6) Here is a consumption function: C = CO + MPC(Yd). If MPC is 0.80, then we know that a) as Co rises by $0.80, Yd rises by $1. b) Yd rises by $0.80. c) as Yd rises by $1. Co rises by $0.80. d) as Yd rises by $1, C rises by $0.80. 7) An aggregate demand (AD) curve shows the a) none of the options provided is correct b) quantity of output that people are willing and can afford to buy at different price levels, ceteris paribus c) quantity of output that people are willing as well as able to produce and sell at different price levels, ceteris paribus. d) value of a particular good that people are willing and able to buy at a particular price, ceteris paribus. d) value of a particular good that people are willing and able to buy at a particular…arrow_forwardWhen comparing the lower of cost to market the appropriate market value is determined before comparing it to the cost the purpose of the ceiling is to ensure that the write-down is sufficient to cover all expected gains O the purpose of the floor is to prevent an excessive gain from being recognized in the future the process is consistent with the principle of conservatism because the goal is to limit excessive swings in gross margin O000arrow_forwardTarget profit is added to what other financial statement line item, or element, to determine the numerator in the overall target contribution margin (CM) calculation in break-even analysis? Variable costs Fixed costs Net income after taxes Operating profitarrow_forward

- Please solve accurately. Thank youarrow_forwardThe following question is based on the demand and cost data for a pure monopolist given in the table below. Output Price Total Cost 0 $500 $250 12345 300 260 250 290 200 350 150 500 100 680 Refer to the above table. If the monopolist were forced to produce the socially optimal output through the imposition of a ceiling price, the ceiling price would have to be set at: O $100 $150 O $200 $250 www.yout House of High Ant SWEPT his OVER HIMarrow_forwardThe SPDR Dow Jones Industrial Average ETF (ticker: DIA) aims to mimic the Dow Jones Industrial Average (DJIA) return. However, the ProShares Short Dow30 (ticker: DOG) aims to short the DJIA and earn ‒1× the DJIA return. The ProShares UltraShort Dow30 (ticker: DXD) and ProShares UltraPro Short Dow30 (ticker: SDOW) aim to earn ‒2× and ‒3× the DJIA return, respectively. Consider that the NAVs of DIA, DOG, DXD, and SDOW all start at $380 and the DJIA earns 12% in the first year and -12% in the second year. If the four ETFs are successful in their objectives, what is the NAV of each ETF at the end of the second year? Year 1 12% Year 2 -12% The NAV ofarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education