FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

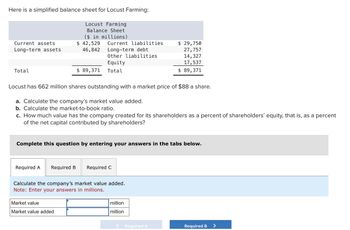

Transcribed Image Text:Here is a simplified balance sheet for Locust Farming:

Locust Farming

Balance Sheet

($ in millions)

Current assets

Long-term assets

$ 42,529

46,842

Current liabilities

Long-term debt

Other liabilities

Equity

$ 29,750

27,757

14,327

17,537

$ 89,371

Total

$ 89,371 Total

Locust has 662 million shares outstanding with a market price of $88 a share.

a. Calculate the company's market value added.

b. Calculate the market-to-book ratio.

c. How much value has the company created for its shareholders as a percent of shareholders' equity, that is, as a percent

of the net capital contributed by shareholders?

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

Calculate the company's market value added.

Note: Enter your answers in millions.

Market value

Market value added

million

million

< Required A

Required B

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mcq .. helparrow_forwardThe following information pertains to Windsor Company. Assume that all balance sheet amounts represent average balance figures. Total assets $330000 Stockholders' equity-common 210,000 Total stockholders' equity 298,000 Sales revenue 110,000 Net income 20,600 Number of shares of common stock 7,500 Common dividends 4,700 Preferred dividends 8,300 What is Windsor's payout ratio? a. 8%. b. 22.82%. c. 16%. d. 36%.arrow_forwardFrom the following balance sheet of Sohel & Co Ltd as at 31st March 2013 and also comment on the ratios. You may use online sources to write about the ratios. Liabilities Amount (RO) Assets Amount (RO) Equity shares capital 6%Preference share capital 7%Debentures 8% Public Debt Bank over draft Creditors Outstanding expenses Proposed dividend Reserves Provision for taxation Net Profit 100,000 100,000 40,000 20,000 40,000 60,000 7,000 10,000 150,000 20,000 20,000 567,000 Cash in hands Cash at bank Bills Receivable Short term investment Debtors Stocks Furniture Machinery Land and Building Good will Preliminary Expenses 3,000 9,000 30,000 20,000 70,000 40,000 30,000 100,000 220,000 35,000 10,000 567,000 Net Sales - 200000 d) Return on Equityarrow_forward

- A company has the following balance sheet (market values): Liabilities + Equity Debt Equity Assets Cash Operating Assets 600 1000 400 1200 If the firm has 110. find the # of outstanding shares remaining after it repurchases 120 worth of shares: (round your answer to the nearest 0.01)arrow_forwardBrenda Limited has an enterprise value of $10 million, total debt of $4 million and 2 million shares outstanding. The latest balance sheet of the firm reports assets worth $8 million. The per-share market value of the equity is: Select one: a. $2.00 b. $3.00 c. $4.00 d. $5.00arrow_forward(Market value analysis) Lei Materials' balance sheet lists total assets of $1.35 billion, $196 million in current liabilities, $421 million in long-term debt, $733 million in common equity, and 52 million shares of common stock. If Lei's current stock price is $50.89, what is the firm's market-to-book ratio? The market-to-book ratio is (Round to two decimal places.)arrow_forward

- he financial statements of Friendly Fashions include the following selected data (in millions): ($ in millions except share data) 2021 2020 Sales $ 9,343 $ 10,434 Net income $ 230 $ 748 Stockholders' equity $ 1,760 $ 2,240 Average Shares outstanding (in millions) 640 - Dividends per share $ 0.33 - Stock price $ 8.10 - Required:Calculate the following ratios for Friendly Fashions in 2021. (Enter your Dividend yield and Price-earning ratio values to 2 decimal places. Enter your answers in millions (i.e. 5,500,000 should be entered as 5.5).)arrow_forwardGold River Corporation has the following data: Current Assets $206,000 Total Assets $20,000 Net Income $345,000 Current Liabilities $125,000 Total Liabilities $250,000 Stockholders' equity $270,000 Average common shares outstanding 10,000 What is Gold River's current ratio? a. 2.08 b. 1.64 c. 1.56 d. 0.82arrow_forward(Market value analysis) Lei Materials' balance sheet lists total assets of $1.17 billion, $197 million in current liabilities, $435 million in long-term debt, $538 million in common equity, and 50 million shares of common stock. If Lei's current stock price is $54.48, what is the firm's market-to-book ratio? The market-to-book ratio is (Round to two decimal places.)arrow_forward

- You have the following balance sheet and information about FedEx: Balance Sheet: Assets Liabilities & Shareholders’ Equity Current Assets $31,000,000 Current Liabilities $28,000,000 PP&E $197,000,000 Long-term Debt (Corporate Bonds) $105,000,000 Equity $95,000,000 Total $228,000,000 Total $228,000,000 FedEx has 16 million shares outstanding. FedEx’s shares have a beta of 1.6 and are currently trading for $15 per share. The expected market risk premium is 7%. The risk-free rate is 1%. The debt is trading at 101% of book value. The coupon rate on existing debt is 5% The yield to maturity on existing debt is 3%. The corporate tax rate is 21%. Compute FedEx’s weighted-average cost of capital (WACC).arrow_forwardNeed help with this questionarrow_forwardHere is a simplified balance sheet for Locust Farming: Locust Farming Balance Sheet (S in millions) Current assets S 42, 526 Current liabilities $ 29,753 Long term assets 46,836 Long-term debt 27,754 Other liabilities 14,321 Equity 17,534 Total S 89, 362 Total S 89, 362 Locust has 659 million shares outstanding with a market price of $85 a share. Calculate the company's market value added. Calculate the market-to-book ratio. How much value has the company created for its shareholders as a percent of shareholders' equity, that is, as a percent of the net capital contributed by shareholders?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education