Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

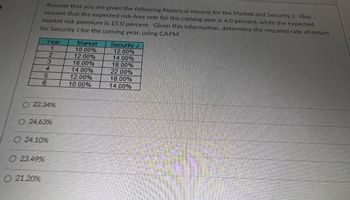

Transcribed Image Text:Assume that you are given the following historical returns for the Market and Security J. Also

assume that the expected risk-free rate for the coming year is 4.0 percent, while the expected

market risk premium is 15.0 percent. Given this information, determine the required rate of return

for Security J for the coming year, using CAPM.

Year

1

2

O21.20%

3

4

5

6

O22.34%

O 23.49%

O24.63%

O24.10%

Market

10.00%

12.00%

16.00%

14.00%

12.00%

10.00%

Security J

12.00%

14.00%

18.00%

22.00%

18.00%

14.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are given the following partial covariance and correlation tables from historical data: Securities J K Market Securities J K Market 1.24 1.11 1.17 1.03 Covariance Matrix K 0.90 J 0.0020480 0.0021600 Also, you have estimated that the market's standard deviation is 4.3 percent. For the coming year, the expected return on the market is 14.0 percent and the risk-free rate is expected to be 4.0 percent. Given this information, determine the beta for Security K for the coming year, assuming CAPM is the correct model for required returns. Correlation Matrix K 0.60 1.00 0.90 1.00 0.60 0.80 Market 0.0020480 0.0021600 Market 0.80 0.90 1.00 Ston sharing Hidel lines Wearrow_forwarduppose the average return on Asset A is 7.1 percent and the standard deviation is 8.3 percent, and the average return and standard deviation on Asset B are 4.2 percent and 3.6 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.38 percent. How likely is it that such a low return will recur at some point in the future? (Do not round…arrow_forwardFind expected return with beta if -0.8, if risk free rate is 3.4% and expected return on market is 12.3%arrow_forward

- Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill presented below. What is the Fama diversification measure for the Globex Fund? Assume the T-bill rate as the risk- free rate and the S&P return as the market average return. Use at least four decimal places in your calculations, but report your answer in percentage terms rounded to two decimal places. (Ex..12345 should be entered as "12.35") Investment Vehicle Globex Fund World Fund S&P500 90-day T-bill Answer: Average Rate of Return% 25.2 13.92 15.52 7.10 Standard Deviation 21.33 14 12.8 0.3 Beta 1.05 0.95 R² 0.756 0.741arrow_forwardYear End Index Realized Return 2000 23.6% 2001 24.7% 2002 30.5% 2003 9.0% 2004 -2.0% 2005 -17.3% 2006 -24.3% 2007 32.2% 2008 4.4% 2009 7.4%arrow_forwardRequired Return If the risk-free rate is 11.8 percent and the market risk premium is 7.6 percent, what is the required return for the market?arrow_forward

- If the risk-free rate is 3.80 percent and the risk premium is 2.8 percent, what is the required return? (Round your answer to 1 decimal place.) Required returnarrow_forwardThe expected return for the investment is ??? The standard deviation is ??? While the expected return for the risk-free assets, Treasury Bills, is ??? The standard deviation is ???arrow_forwardThis section asks you to calculate prices for various options. In all cases, consider a rate r = 7.97% per year. Estimate the volatility of returns using the estimator: 1 n-1 σ²≈ T-t i=0 Si+1 log. Sti 2 The term of each option will be T = 182/360 (half a year). Determine a reasonable strike K, which is at similar levels to the price series you have downloaded. An option is a derivative instrument that gives its holder the right to buy or sell an underlying asset at a pre-agreed price K at a future date T. If this right can only be exercised in time T, we say that the option is of the European type. If it can be exercised at T or at any time prior to T, then we say that the option is American. Likewise, if the option grants the right to buy, we say that the option is Call type, if it grants the right to sell then the option is Puttype. These types of options are the simplest and are known as European vanilla options. In this case, if T is the expiration date of the contract, and St is…arrow_forward

- The following represents the probability distribution for the rates of return for next month: Probability 1/6 2/6 2/6 1/6 Portfolio Market M P (%) (%) -20 -5 -5 +5 +10 0 +50 +10 What is the market beta of P?arrow_forwardAsset Y has a beta of 1.2. The risk-free rate of return is 6 percent, while the return on the market portfolio of assets is 12 percent. The asset's market risk premium isarrow_forwardplease help with this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education