FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

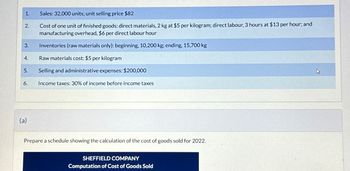

Transcribed Image Text:1.

Sales: 32,000 units; unit selling price $82

2.

Cost of one unit of finished goods: direct materials, 2 kg at $5 per kilogram; direct labour, 3 hours at $13 per hour; and

manufacturing overhead, $6 per direct labour hour

3.

Inventories (raw materials only): beginning, 10,200 kg; ending, 15,700 kg

4.

Raw materials cost: $5 per kilogram

5.

Selling and administrative expenses: $200,000

6.

Income taxes: 30% of income before income taxes

(a)

Prepare a schedule showing the calculation of the cost of goods sold for 2022.

SHEFFIELD COMPANY

Computation of Cost of Goods Sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need helparrow_forwardSales volume (units) Revenue Variable costs Direct materials Direct labor Contribution margin Fixed costs Profit $30,000 $2.00 $45,000 Use direct labor dollars as the cost driver. Compute allocated fixed costs for Product X: O $20,000 Product X 400 $60,000 $50,000 $25,000 $15,000 $20,000 Product Y 600 $60,000 $15,000 $10,000 $35,000 Total 1,000 $120,000 $40,000 $25,000 $55,000 $50,000 $5,000arrow_forwardHaresharrow_forward

- Cost per Equivalent Unit The cost of direct materials transferred into the Rolling Department of Oak Ridge Steel Company is $462,800. The conversion cost for the period in the Rolling Department is $286,700. The total equivalent units for direct materials and conversion are 2,600 tons and 4,700 tons, respectively. Determine the direct materials and conversion costs per equivalent unit. Direct materials cost per equivalent unit: $fill in the blank 1 per ton Conversion cost per equivalent unit: $fill in the blank 2 per tonarrow_forwardRaw materials consumed =15,000 Direct labour charges =9,000 Machine hours worked =900 hrs Machine hour rate=5 per hr Administrative overheads -20% on works cost Selling overheads=0.50 per unit Units produced=17,100 Units sold= 16,000, Selling price= 4 per unit. Prepare (a) the cost per unit b) profit per unit sold and profit for the period.arrow_forwardCost standards for one unit of product no. C77: Direct material 3 pounds at $2.50 per pound S7.50 Direct labor 5 hours at $7.50 per hour 37.50 Actual results: Units produced 8,100 units Direct material purchased 26,600 pounds at $71,820 $2.70 Direct material used 24,000 pounds at $2.70 64,800 Direct labor 41,100o hours at $7.30 300,030 46.Assume that the company computes variances at the earliest point in time. The direct-material quantity variance is: None of these. $5,750F. $5,750U. $750U. $750F.arrow_forward

- Cost per Equivalent Unit The cost of direct materials transferred into the Filling Department of Ivy Cosmetics Company is $187,380. The conversion cost for the period in the Filling Department is $50,400. The total equivalent units for direct materials and conversion are 69,400 ounces and 72,000 ounces, respectively. Determine the direct materials and conversion costs per equivalent unit. If required, round to the nearest cent. Direct materials cost per equivalent unit: $fill in the blank 1 per ounce Conversion costs per equivalent unit: $fill in the blank 2 per ouncearrow_forwardware Company reported the following: Manufacturing costs $2,000,000 Units manufactured 50,000 Units sold 47,000 units sold for $75 per unit Beginning inventory 0 units What is the average manufacturing cost per unit? Select one: a. $75.00 b. $0.025 C. $42.55 d. $40.00arrow_forward1. Information for the month of January concerning Department A, the first stage of Angeles Company's production cycle, is as follows: Materials P 8,000 40,000 P 48,000 100,000 P0.48 Conversion BWIP Current Costs Total Costs P 6,000 32,000 P 38,000 95,000 P 0.40 EUP using weighted average method Average unit costs Goods completed -90,000 units 10,000 units --- EWIP ---- Materials are added at the beginning of the process. The ending WIP is 50% complete as to conversion costs. a. How would the total costs accounted for be distributed to GOODS COMPLETED, using the weighted average method? b. How woluld the total costs accounted for be distributed to ENDING WIP, using the weighted average method?arrow_forward

- Jay Please give me correct answer with explanationarrow_forwardManiarrow_forwardCost per Equivalent Unit The cost of direct materials transferred into the Filling Department of Ivy Cosmetics Company is $314,430. The conversion cost for the period in the Filling Department is $186,300. The total equivalent units for direct materials and conversion are 66,900 ounces and 69,000 ounces, respectively. Determine the direct materials and conversion costs per equivalent unit. If required, round to the nearest cent. Direct materials cost per equivalent unit: $fill in the blank 1 per ounce Conversion costs per equivalent unit: $fill in the blank 2 per ouncearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education