Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

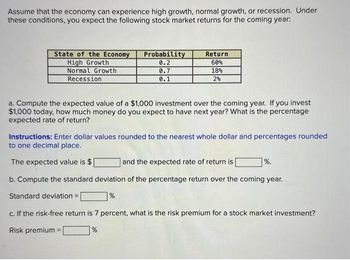

Transcribed Image Text:Assume that the economy can experience high growth, normal growth, or recession. Under

these conditions, you expect the following stock market returns for the coming year:

State of the Economy

High Growth

Normal Growth

Recession

Probability

0.2

0.7

0.1

Return

60%

18%

2%

a. Compute the expected value of a $1,000 investment over the coming year. If you invest

$1,000 today, how much money do you expect to have next year? What is the percentage

expected rate of return?

Instructions: Enter dollar values rounded to the nearest whole dollar and percentages rounded

to one decimal place.

The expected value is $

and the expected rate of return is

b. Compute the standard deviation of the percentage return over the coming year.

Standard deviation =

%

=

%.

c. If the risk-free return is 7 percent, what is the risk premium for a stock market investment?

Risk premium

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Compute the expected return given these three economic states, their likelihoods, and the potential returns: (Round your answer to 2 decimal places.) Economic State Fast growth Slow growth Recession Probability 0.32 Return 38% 0.34 12 0.34 -31 Answer is complete but not entirely correct. Expected return 3.84%arrow_forwardPlease solve using excel and explain formulas.arrow_forwardAssume the following states of the world could exist in the economy tomorrow. Find the expected return for this stock. Reminder that the states of the world have to add to 100%. Probability Return 30% -1 50% 3 xx% 8arrow_forward

- Scenarios: You work in the macroeconomic research department of an investment bank. Based on your modelling of the economy, you think that in the next few months US GDP will evolve according to three basic scenarios: Scenario A: GDP will rise 3%. This will send the S&P ETF to 414. Scenario B: GDP will stagnate. S&P ETF will stay at 407. Scenario C: GDP will fall 2%. This will send the S&P ETF to 400. Question 1: Compute the payoff and net payoff of a bear spread strategy built with put options in the three scenarios above. The put options should have strikes 405 and 409 and mature in February. Draw the profile of the bear spread strategy. Use the data in Table 2. Please show your calculations. Discuss your result.arrow_forwardScenarios: You work in the macroeconomic research department of an investment bank. Based on your modelling of the economy, you think that in the next few months US GDP will evolve according to three basic scenarios: Scenario A: GDP will rise 3%. This will send the S&P ETF to 414. Scenario B: GDP will stagnate. S&P ETF will stay at 407. Scenario C: GDP will fall 2%. This will send the S&P ETF to 400. Question 3 You build an “Iron Condor” strategy with February maturity combining the following positions: a long put at 405 a short put at 406 a short call at 408 a long call at 409 Draw the payoff and net payoff of the Iron Condor strategy. Compute the payoff and net payoff of this strategy in the three scenarios. Use the data in Table 2. Please show your calculations. Discuss your result.arrow_forwardYou have a fixed income portfolio worth $1,000,000. The yield curve is flat at 4.5% per year. Suddenly, interest rates increase, with the yield curve shifting up by 0.5% (i.e., from 4.5% to 5.0%). Your portfolio’s value drops by $20,000 as a result. What must have been the duration of your fixed income portfolio before this change in interest rates?arrow_forward

- Nikularrow_forwardIf the value of sustainable investing is $158.7 and the discount rate is 5.8% while the value of non-sustainable investing is $22.81 and the expected value of the company is $27.14. What is the assumed probability of being sustainable given a 5 year horizon? (Answer in percent to 2 decimals)arrow_forwardYou are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecasts (in millions of dollars) for the project are as follows: Years Cash Flow 0 – 100 1-10 + 17 On the basis of the behavior of the firm’s stock, you believe that the beta of the firm is 1.44. Assuming that the rate of return available on risk-free investments is 5% and that the expected rate of return on the market portfolio is 11%, what is the net present value of the project?arrow_forward

- You know that the stated rate of return is not what you really earned. If the inflation rate last year was 4.5%, and your investment had a stated rate of 18%, what was your real return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Real return %arrow_forwardTable solution providearrow_forwardFelix is estimating the return for Togo Sledding and has determined the following probabilities and expected returns. Togo's expected return is closest to: Expected Probability Return Roaring expansion Steady high growth Steady moderate growth Slowing Recession 9% 17% 11% 14% 15% 8% 42% 3% 23% -5%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education