Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

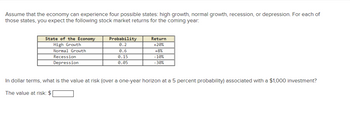

Transcribed Image Text:Assume that the economy can experience four possible states: high growth, normal growth, recession, or depression. For each of

those states, you expect the following stock market returns for the coming year:

State of the Economy

High Growth

Normal Growth

Recession

Depression

Probability

0.2

0.6

0.15

0.05

Return

+20%

+8%

-10%

-30%

In dollar terms, what is the value at risk (over a one-year horizon at a 5 percent probability) associated with a $1,000 investment?

The value at risk: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- can you help me with question b pleasearrow_forwardCompute the expected return given these three economic states, their likelihoods, and the potential returns: Economic State Probability Return Fast Growth 0.2 23% Slow Growth 0.6 14% Recession 0.2 −30% Multiple Choice 12.5 percent 7.5 percent 3.5 percent 7.0 percentarrow_forwardEf 43.arrow_forward

- Assume the following states of the world could exist in the economy tomorrow. Find the expected return for this stock. Reminder that the states of the world have to add to 100%. Probability Return 30% -1 50% 5 xx% 11arrow_forwardFelix is estimating the return for Togo Sledding and has determined the following probabilities and expected returns. Togo's expected return is closest to: Expected Probability Return Roaring expansion Steady high growth Steady moderate growth Slowing Recession 9% 17% 11% 14% 15% 8% 42% 3% 23% -5%arrow_forwardNikularrow_forward

- Nikularrow_forwardSuppose you invest 70% of your fund in stock A and the other 30% in stock B. If stock A and B are expected to have the following returns next year, then what are the standard deviations for Stock A, Stock B and the portfolio returns respectively? Probability State of Economy Recession Boom 9.60%; 11.6% 12.60%; 14.2% 2.60%; 14.05% 9.60%; 7.80% .2 .8 Stock A -9% 18% Stock B 1% 3%arrow_forwardConsider the following scenario analysis: Scenario Recession Normal economy Boom Required A Probability 0.3 0.4 0.3 Assume a portfolio with weights of 0.60 in stocks and 0.40 in bonds. a. What is the rate of return on the portfolio in each scenario? b. What are the expected rate of return and standard deviation of the portfolio? Rate of Return Stocks Bonds 12% 7 3 Complete this question by entering your answers in the tabs below. Required B Expected return Standard deviation -4% 13 22 What are the expected rate of return and standard deviation of the portfolio? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places % %arrow_forward

- es Consider the following information: State of Economy Recession Boom Probability of State of Expected return Economy .28 72 Portfolio Return if State Occurs Calculate the expected return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) -.13 .23 %arrow_forwardIf the probability of a recession is 0.3, normal growth is 0.4 and a boom is 0.3, and the payoff in the event of a recession is $100, normal growth is $300 and boom is $500, what is the expected payoff? a. $300 b. $400 c. $200 d. $500arrow_forward4.StockA sells for $40 a share. Its likely dividend payout and end-of-year price depend on the state of the economy by the end of the year as follows: Probability Stock Price Boom $50 Normal economy 42 Recession 30 50% 30% 20% Dividend $2.00 1.00 0.50 a.Calculate the expected holding-period return and standard deviation of the holding period return. b.Calculate the expected return and standard deviation of a portfolio invested half in this stock and half in Treasury bills. The return on bills is 4%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education