Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

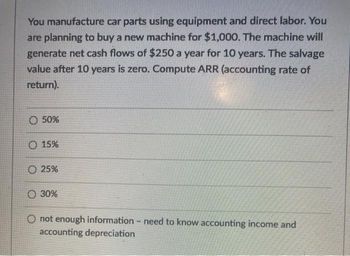

Transcribed Image Text:You manufacture car parts using equipment and direct labor. You

are planning to buy a new machine for $1,000. The machine will

generate net cash flows of $250 a year for 10 years. The salvage

value after 10 years is zero. Compute ARR (accounting rate of

return).

O 50%

O 15%

25%

30%

O not enough information - need to know accounting income and

accounting depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- How do I work out this problem? It is published by Flatworks the course is Financial Management Chapter 7. Thank you in advance. A new delivery truck can be purchased for $30,000. The old one could be sold day for $5,000, and has a book value of $3,000. In three years, the old truck will have a salvage value of $1,000 (and no book value). The new truck would be depreciated on a 5-year MACRS schedule. The firm’s tax rate is 21%. Assume the remaining book value of the old truck will be depreciated in year 1, and that the new truck will have a salvage value of $10,000 in year 3. a. What are the appropriate capital spending items to include in a capital budgeting analysis for the decision to purchase the new truck (assuming the old one would be sold to make room in the garage)? b. What are the appropriate operating cash flows to consider for the first three years? c. If the new truck will also save the firm $1,000 a year in gas expenses, what are the appropriate operating cash flows for…arrow_forwarddon't use excel also can you show me maths solving with equation by hand please....arrow_forwardOne year ago, your company purchased a machine used in manufacturing for $120,000. You have learned that a new machine is available that offers many advantages; you can purchase it for $160,000 today. It will be depreciated on a straight-line basis over 10 years, after which it has no salvage value. You expect that the new machine will contribute EBITDA (earnings before interest, taxes, depreciation, and amortization) of $40,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $25,000 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, after which it will have no salvage value, so depreciation expense for the current machine is $10,909 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 20%, and the opportunity cost of capital for this type of equipment is 10%. Is it profitable to replace the…arrow_forward

- The term depreciation refers to how the value of an asset (such as a car) decreases over time. There are several different approaches for calculating depreciation. Part A: In the straight-line method of calculating depreciation, the value of the item is reduced by the same amount each year. Suppose a company purchases a car for $24000. Using straight-line depreciation, the value of the car may be reduced by $2500 each year. Determine a formula for S(t), the value of the car t years after purchase. Answer: Part B: After five years, the value of the car, using the straight-line method, will be $ Part C: After twelve years, the value of the car, using the straight-line method, will be Part D: In the declining balance method of depreciation, the value of the item is reduced by the same percentage each year. Suppose the $24000 car is depreciated at a rate of 14% each year. Determine a formula for D(t), the value of the car t years after purchase. Answer: Part E: After five years, the value…arrow_forward1 A new backhoe costs Bob the Builder $X. It is expected to have a salvage value of $Y after N years. What rate of depreciation for the declining-balance method should Bob be using? X= Y= N= Depreciation Rate $750,000 $58,000 29 years Try Again What is the Book Value after 25 years? Try Again (Use unrounded rate)arrow_forwardYou purchase a new pizza oven for $9,950 which will have a scrap value of $900. Assuming a 35% depreciation rate, how much depreciation would you recognize in year one when using the Double Declining Balance depreciation method? $2,810 $3167.50 $3482.50 $3.572.75arrow_forward

- ssarrow_forwardPlease see image for question to solve.arrow_forwardA business is planning to purchase new equipment at a cost of £60,000. The equipment is expected to last 4 years and to have no scrap value (residual value). Depreciation is calculated on a straight-line basis. The investment is expected to generate the following profits/(losses): Year 1 2 3 4 Profit/(loss) (10,000) 20,000 40,000 20,000 Required: Convert these profits/(losses) to cash flows.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education