FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

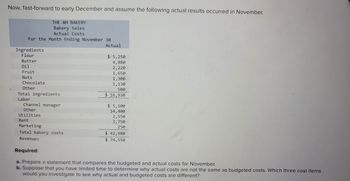

Transcribed Image Text:Now, fast-forward to early December and assume the following actual results occurred in November.

For the Month Ending November 30

Ingredients

Flour

Butter

Oil

Fruit

Nuts

THE AM BAKERY

Bakery Sales

Actual Costs

Chocolate

Other

Total ingredients

Labor

Channel manager

Other

Utilities

Rent

Marketing

Total bakery costs

Revenues

Required:

Actual

$5,250

4,880

2,220

1,650

1,300

1,130

500

$ 16,930

$ 5,100

14,400

2,550

3,750

250

$ 42,980

$ 74,550

a. Prepare a statement that compares the budgeted and actual costs for November.

b. Suppose that you have limited time to determine why actual costs are not the same as budgeted costs. Which three cost items

would you investigate to see why actual and budgeted costs are different?

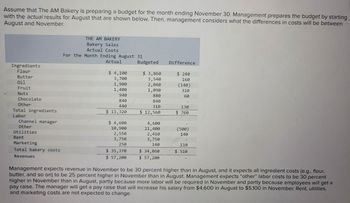

Transcribed Image Text:Assume that The AM Bakery is preparing a budget for the month ending November 30. Management prepares the budget by starting

with the actual results for August that are shown below. Then, management considers what the differences in costs will be between

August and November.

Ingredients

Flour

Butter

Oil

Fruit

Nuts

Chocolate

Other

Total ingredients

Labor

Channel manager

Other

Utilities

Rent

Marketing

Total bakery costs

Revenues

THE AM BAKERY

Bakery Sales

Actual Costs

For the Month Ending August 31

Actual

$ 4,100

3,700

1,900

1,400

940

840

440

$ 13,320

$4,600

10,900

2,550

3,750

250

$ 35,370

$ 57,200

Budgeted

$ 3,860

3,540

2,040

1,090

880

840

310

$ 12,560

4,600

11,400

2,410

3,750

140

$ 34,860

$57,200

Difference

$240

160

(140)

310

60

130

$ 760

(500)

140

110

$510

Management expects revenue in November to be 30 percent higher than in August, and it expects all ingredient costs (e.g., flour,

butter, and so on) to be 25 percent higher in November than in August. Management expects "other" labor costs to be 30 percent

higher in November than in August, partly because more labor will be required in November and partly because employees will get a

pay raise. The manager will get a pay raise that will increase his salary from $4,600 in August to $5,100 in November. Rent, utilities,

and marketing costs are not expected to change.

Expert Solution

arrow_forward

Step 1

Variance:

When the actual cost incurred does not match the budgeted cost. The difference calculated is referred to as variance and it helps in cost control and analysis which is a part of cost accounting.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Print Item Sales, Production, Direct Materials Purchases, and Direct Labor Cost Budgets The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for July is summarized as follows: a. Estimated sales for July by sales territory: Maine: Backyard Chef 310 units at $700 per unit Master Chef 150 units at $1,200 per unit Vermont: Backyard Chef 240 units at $750 per unit Master Chef 110 units at $1,300 per unit New Hampshire: Backyard Chef 360 units at $750 per unit Master Chef 180 units at $1,400 per unit b. Estimated inventories at July 1: Direct materials: Grates 290 units Stainless steel 1,500 lbs. Burner subassemblies 170 units Shelves 340 units Finished products: Backyard Chef 30 units Master Chef 32 units c. Desired inventories at July 31: Direct materials: Grates 340 units…arrow_forwardQ.prepare Budgeted income statement (ignore income taxes) for april.arrow_forwardanswer in text form please (without image),,,,,,,,,,,,,Answer all the rrquirementsarrow_forward

- Vikrambahiarrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Cost Formulas $16.30q $4,300 +$1.50g $5,300 +$0.40g $1.400+ $0.30q $18,200+ $2.70g $8,400 $13,800+ $0.60g $2,600 The Production Department planned to work 4,200 labor-hours in March; however, it actually worked 4,000 labor-hours during the month. Its actual costs incurred in March are listed below: Direct labor Actual Cost Incurred in March $ 66,780 Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Required: $ 9,780 $ 7,370 $ 2,870 $ 29,000 $ 8.800 $ 2,600 $ 15,550 1. Prepare the Production…arrow_forwardUse the data in the following table to prepare the Budget Performance Report for Sole Purpose Shoe Company for September. Budget Performance Report Sarah has learned a lot from you over the past two months, and has compiled the following data for Sole Purpose Shoe Company for September using the techniques you taught her. She would like your help in preparing a Budget Performance Report for September. The company produced 2,500 pairs of shoes that required 8,750 units of material purchased at $8.20 per unit and 6,750 hours of labor at an hourly rate of $8.90 per hour during the month. Actual factory overhead during September was $20,250. When entering variances, use a negative number for a favorable cost variance, and a positive number for an unfavorable cost variance.arrow_forward

- Please give answer the questionarrow_forwardThe production budget should be integrated with the sales budget to ensure that production and sales are kept in balance during the year. The production budget estimates the number of units to be manufactured to meet budgeted sales and desired inventory levels. You note that LearnCo has omitted six numbers from the following production budget and fill in the missing amounts. You may need to use numbers from the sales budget you prepared. LearnCo Production Budget For the Year Ending December 31, 20Y2 Units Basic Units Deluxe Expected units to be sold (from Sales Budget) 36000 36000 Desired ending inventory, December 31, 20Y2 1,000 3,000 Total units available 37000 39000 Estimated beginning inventory, January 1, 20Y2 (1,050) (2,100) Total units to be produced 35950 36900 Direct labor needs from the direct labor cost budget should be coordinated between the production and personnel departments so that there will be enough labor available…arrow_forwardBudget performance report for a cost center GHT Tech Inc. sells electronics over the Internet. The Consumer Products Division is organized as a cost center. The budget for the Consumer Products Division for the month ended July 31 is as follows: Line Item Description Customer service salaries Insurance and property taxes Distribution salaries Marketing salaries Engineer salaries 836,850 586,110 185,120 Total $4,167,050 During July, the costs incurred in the Consumer Products Division were as follows: Warehouse wages Equipment depreciation Line Item Description Customer service salaries Insurance and property taxes Distribution salaries Marketing salaries Engineer salaries Warehouse wages Equipment depreciation Total Required: Question Content Area Line Item Description Customer service salaries Insurance and property taxes Distribution salaries Amount $546,840 114,660 872,340 1,025,130 1. Prepare a budget performance report for the director of the Consumer Products Division for the…arrow_forward

- The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for March is summarized as follows: a. Estimated sales for March by sales territory: Maine: Backyard Chef 350 units at $800 per unit Master Chef 200 units at $1,400 per unit Vermont: Backyard Chef 400 units at $825 per unit Master Chef 240 units at $1,500 per unit New Hampshire: Backyard Chef 320 units at $850 per unit Master Chef 200 units at $1,600 per unit b. Estimated inventories at March 1: Direct materials: Grates 320 units Stainless steel 1,700 lb. Burner subassemblies 190 units Shelves 350 units Finished products: Backyard Chef 30 units Master Chef 36 units c. Desired inventories at March 31: Direct materials: Grates 300 units Stainless steel 1,500 lb. Burner subassemblies 210 units…arrow_forwardKerekes Manufacturing Corporation has prepared the following overhead budget for next month. Activity level 2,200 machine-hours Variable overhead costs: Supplies Indirect labor Fixed overhead costs: Supervision Utilities Depreciation Total overhead cost Multiple Choice The company's variable overhead costs are driven by machine-hours. What would be the total budgeted overhead cost for next month if the activity level is 2,100 machine-hours rather than 2,200 machine-hours? (Round your intermediate calculations to 2 decimal places.) O $54,560 $53,330 $52,770 $ 9,240 17,820 $52,080 15,300 5,600 6,600 $ 54,560arrow_forwardPrepare a 12-month Master Budget for a company of your choosing. It can be a company that you are closely connect too or one randomly selected. COMPLETED IN EXCEL. As you are preparing the Master Budget, some information is NOT provided. You are required to decide or predict or forecast this information. Provide an introduction for the company you have chosen. The introduction should include the following: Name of company Location of company Name of owner Nature of the business. Type of product Fiscal period For the company that you have selected - Prepare a 12-month Master Budget. Your submission must show each month’s activities. Here are some considerations to include in preparing the budget: You must forecast your sales, purchases, direct labour and manufacturing overhead for each month and any other information as required All sales are on accounts Expected collections are to be 50% in the month of the sale, 30 % in the first month following the sale, and 20% in the second…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education