International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Choose the correct answer

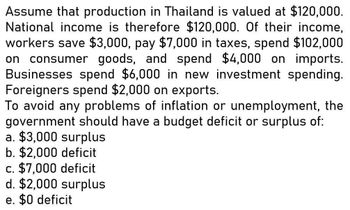

Transcribed Image Text:Assume that production in Thailand is valued at $120,000.

National income is therefore $120,000. Of their income,

workers save $3,000, pay $7,000 in taxes, spend $102,000

on consumer goods, and spend $4,000 on imports.

Businesses spend $6,000 in new investment spending.

Foreigners spend $2,000 on exports.

To avoid any problems of inflation or unemployment, the

government should have a budget deficit or surplus of:

a. $3,000 surplus

b. $2,000 deficit

c. $7,000 deficit

d. $2,000 surplus

e. $0 deficit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of S$20,000,000 (Singapore dollars). Kittle Co. managers provide you key information regarding the project. 1. The government in Singapore will tax any remitted earnings at a rate of 10.00%. 2. The subsidiary will remit all of it’s after-tax earnings back to the parent. 3. The forecasted exchange rate of the Singapore dollar over the four-year period is $0.50. 4. The salvage value is S$12,000,000, which will be paid by the Singapore government in exchange for ownership of the subsidiary after four years. 5. The required rate of return is 15.00%. Furthermore, no funds can be remitted from the subsidiary to the parent until the subsidiary is sold for the salvage value at the…arrow_forwardSuppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and sell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project is four years, with an initial investment of S$20,000,000 (Singapore dollars). Kittle Co. managers provide you key information regarding the project. 1. The government in Singapore will tax any remitted earnings at a rate of 10.00%. 2. The subsidiary will remit all of it’s after-tax earnings back to the parent. 3. The forecasted exchange rate of the Singapore dollar over the four-year period is $0.50. 4. The salvage value is S$12,000,000, which will be paid by the Singapore government in exchange for ownership of the subsidiary after four years. 5. The required rate of return is 15.00%. Furthermore, no funds can be remitted from the subsidiary to the parent until the subsidiary is sold for the salvage value at…arrow_forwardA bank is considering two alternatives for handling its service calls in the next decade ( treat this as one period). The projected number of service calls is 10,000,000. If the bank sets up its own service call center in the U.S., the fixed cost is estimated to be $2,700,000, and the variable cost is calculated to be 32 cents per call. If the call service is outsourced to a foreign company, the fixed cost would be $240,000, and the unit charge would be 57 cents per call. (a)What is the break-even number of service calls? (b)Would the bank set up its own service call center or outsource call handlings? (Enter 1 for Produce or enter O for Outsource) (C)What would be the dollar amount that the bank can save by choosing the better option? (Cost difference between the two options)arrow_forward

- Assume the same situation as described in (2) above, except that the company expects to sell 50,000 Rets through regular channels next year. Thus, accepting the U.S. Army’s order would require giving up regular sales of 7,000 Rets. Given this new information, what is the financial advantage (disadvantage) of accepting the U.S. Army's special order?arrow_forwardGovernment tax revenue is $500,000,000. It's spending is $575,000,000. Is the government running a surplus, a balanced budget, or a deficit? If it is not running a balanced budget, how large is the imbalance?arrow_forwardScenario: You have just been hired by the country of "Shorelinia" to create a tax system. Your tax system must collect at least $1,000 billion in revenue. You have three taxes to choose from; income tax, sales tax, and payroll tax. c) You must decide the SalesTax. For reference, state and local sales taxes around Seattle add up to approximately 10%, some of the highest in America. In the USA, there is no national sales tax, although a number of countries have them, also known as VATs (value added taxes) or GSTs (general sales taxes.) Sales tax revenue (in billions of $) at various tax rates 0% 2% 4% 6% 8% 10% 12% revenue $0 $60 $120 $180 $240 $300 $360 The sales tax rate in Shorelinia will be _______%. (fill in space below) d) Sales tax revenue Look up the tax revenue generated by your chosen tax rate in the table above. The sales tax revenue will be $_______billion. (fill in space below) e) Payroll Tax rate In the country of Shorelinia, the payroll tax is…arrow_forward

- The following table contains data for a hypothetical closed economy that uses the dollar as its currency. Suppose GDP in this country is $1,110 million. Enter the amount for consumption. National Income Account Government Purchases (G) Taxes minus Transfer Payments (T) Consumption (C) Investment (I) Complete the following table by using national income accounting identities to calculate national saving. In your calculations, use data from the preceding table. National Saving (S) = Public Saving Y-T-G S Value (Millions of dollars) 300 240 Y-C-T $ Complete the following table by using national income accounting identities to calculate private and public saving. In your calculations, use data from the initial table. Private Saving million million 210 million Based on your calculations, the government is running a budgetarrow_forwardSuppose you have been hired by President Emmanuel Macron of France as an economic policy consultant. In order to finance an increase in unemployment benefits, the French government needs to raise €10 billion in additional tax revenue. President Macron is considering two policies to achieve this goal: a new tax on gasoline or a new tax on bequests (money left to your children or other heirs). Which of these two policies would be the most economically efficient? Why? Explain why the policy you recommended in a.) might be politically unpopular. Dismayed by your assessment, President Macron proposes a third alternative: a broad decrease in current taxes. Explain why this could increase tax revenue for the French government, but it is unlikely to work in practice.arrow_forwardAssume the United States is an importer of televisions and there are no trade restrictions.US consumers buy 1 million televisions per year, of which 400,000 are produceddomestically and 600,000 are imported,a. Suppose that a technological advance among Japanese television manufacturers causes the world price of televisions to fall by $100. Draw a graph to show how this change affects the welfare of U.S. consumers and U.S. producers and how it affects total surplus in the United States.b. After the fall in price, consumers buy 1.2 million televisions, of which 200,000 are produced domestically and 1 million are imported. Calculate the change in consumer surplus, producer surplus, and total surplus from the price reduction. c. If the government responded by putting a $100 tariff on imported televisions, what would this do? Calculate the revenue that would be raised and the deadweight loss. Would it be a good policy from the standpoint of U.S. welfare? Who might support the policy?d.…arrow_forward

- Give me answerarrow_forwardThink back to the International Collections case in Assignment 5. Assume that the 60-day payment terms that you gave your buyer are typical, and that you will be required to carry up to $2,500,000.00 per month in accounts receivable for export sales. To be able to produce inventory for additional sales while while you carry 60 days of accounts receivable, you are going to need to find an outside source of additional export working capital. Discuss in detail two different options for financing export working capital to keep production going while you wait for payment from the last 60 days of sales.arrow_forward1. In order to reduce its current-account deficit, the United States would NOT do which of the following? a . raise national product relative to national spending b. decrease savings relative to domestic investment c . increase savings relative to domestic investment d . reduce the federal budget deficitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you