Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the division s assets turnover ratio? General accounting question

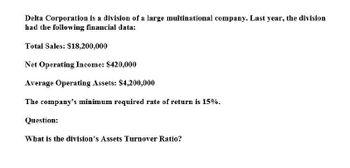

Transcribed Image Text:Delta Corporation is a division of a large multinational company. Last year, the division

had the following financial data:

Total Sales: $18,200,000

Net Operating Income: $420,000

Average Operating Assets: $4,200,000

The company's minimum required rate of return is 15%.

Question:

What is the division's Assets Turnover Ratio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000,000. A. Based on this information, calculate asset turnover. B. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forwardMargin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: At the beginning of last year, Elway had 28,300,000 in operating assets. At the end of the year, Elway had 23,700,000 in operating assets. Required: 1. Compute average operating assets. 2. Compute the margin and turnover ratios for last year. (Note: Round the answer for margin ratio to two decimal places.) 3. Compute ROI. (Note: Round answer to two decimal places.) 4. CONCEPTUAL CONNECTION Briefly explain the meaning of ROI. 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a typical manufacturing company).arrow_forwardGabbe Industries is a division of a major corporation. Last year the division had total sales of $33,667,200, net operating income of $4,679,741, and average operating assets of $7,014,000. The company's minimum required rate of return is 22%. Required: a. What is the division's margin? Note: Round your percentage answer to 2 decimal places. b. What is the division's turnover? Note: Round your answer to 2 decimal places. c. What is the division's return on investment (ROI)? Note: Round percentage your answer to 2 decimal places. a. Margin b. Turnover c. Return on investmentarrow_forward

- Eacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales Net operating income Average operating assets The company's minimum required rate of return $14,720,000 $1,000,960 $4,000,000 14% Required: a. What is the division's margin? b. What is the division's turnover? c. What is the division's return on investment (ROI)? d. What is the division's residual income?arrow_forwardEacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales $14,720,000 Net operating income $1,000,960 Average operating assets $4,000,000 The company’s minimum required rate of return 14% a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forwardGabbe Industries is a division of a major corporation. Last year the division had total sales of $24,048,000, net operating income of $2,765,520, and average operating assets of $6,012,000. The company's minimum required rate of return is 17% Required: a. What is the division's margin? (Round your percentage answer to 2 decimal places.) b. What is the division's turnover? (Round your answer to 2 decimal places.) c. What is the division's return on investment (ROI)? (Round percentage your answer to 2 decimal places.) a. Margin b. Turnover c. Return on investment 96arrow_forward

- Eacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales 24,480,000 Net operating assets 1,000,960 average operatign assets 4,000,000 the company minimum required rate of return 14% Required: a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forwardGabbe Industries is a division of a major corporation. Last year the division had total sales of $27,311,900, net operating income of $2,840,438, and average operating assets of $7,094,000. The company's minimum required rate of return is 15%. Required: a. What is the division's margin? (Round your percentage answer to 2 decimal places.) b. What is the division's turnover? (Round your answer to 2 decimal places.) c. What is the division's return on investment (ROI)? (Round percentage your answer to 2 decimal places.)arrow_forwardWhat are division x's sales?arrow_forward

- Far Sight is a division of a major corporation. The following data are for the latest year of operations: Sales $24,480,000 Net operating Income $1,738,080 Average operating assets $6,000,000 The company’s minimum required rate of return 16% Required: a. What is the division's return on investment (ROI)?b. What is the division's residual income?arrow_forwardCeder Products is a division of a major corporation. Last year the division had total sales of $21.520,000, net operating income of $538,000, and average operating assets of $8,000,000. The company's minimum required rate of return is 18%. The division's turnover is closest to: A. 2.52 B. 0.07 C. 40.00 D. 2.69arrow_forwardWhat is the division's margin on these financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning