Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Accounting

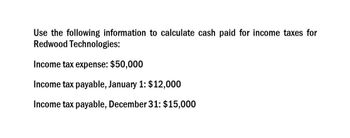

Transcribed Image Text:Use the following information to calculate cash paid for income taxes for

Redwood Technologies:

Income tax expense: $50,000

Income tax payable, January 1: $12,000

Income tax payable, December 31: $15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider the following data extracted from an after-tax cash flow calculation. Before-Tax-and-Loan = $22,500 Loan Principal Payment = $5,926 Loan Interest Payment = $2,400 MACRS Depreciation Deduction = $16,665 Which of the following is closest to the Taxable Income? a. −$2,491. b. −$91. c. $3,435. d. $14,174arrow_forwardQuestions of accountarrow_forwardUse the following information for Taco Swell, Incorporated, (assume the tax rate is 22 percent): Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2020 $ 23,549 2,516 6,390 1,441 1,180 8,746 11,628 1,814 29,480 73,091 6,353 20,662 2,679 Cash flow from assets Cash flow to creditors Cash flow to stockholders 2021 $ 19,188 2,624 6,871 1,248 1,395 9,667 13,902 1,781 35,579 78,030 7,060 22,002 2,454 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

- Use the following information for Ingersoll, Incorporated. Assume the tax rate is 21 percent. 2020 2021 Sales $ 21,049 $ 19,038 Depreciation 2,466 2,574 Cost of goods sold 6,140 6,821 Other expenses 1,406 1,223 Interest 1,155 1,370 Cash 8,721 9,517 Accounts receivable 11,578 13,752 Short-term notes payable 1,764 1,731 Long-term debt 29,330 35,454 Net fixed assets 72,976 77,880 Accounts payable 6,323 6,910 Inventory 20,577 21,952 Dividends 2,429 2,404 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardPlease help mearrow_forwardCalculate net income after corporate income tax is paid for quarter 2 from the following income statement.arrow_forward

- net income? Find net incomearrow_forwardA.M.I. Corporation reported income taxes of $362,884,000 on its 2022 income statement. Its balance sheet reported income taxes payable of $279,289,000 at December 31, 2021, and $518,663,000 at December 31, 2022. What amount of cash payments were made for income taxes during 2022? Cash payment for income taxes = ? I tried 2022 Income Statement + 2021 Balance Sheet - 2022 Balance sheet. What is the correct formula to calculate?arrow_forwardUse the following information for Taco Swell, Incorporated, (assume the tax rate is 23 percent): 2020 2021 Sales $ 18,049 $ 18,858 Depreciation 2,406 2,514 Cost of goods sold 5,840 6,761 Other expenses 1,364 1,193 Interest 1,125 1,340 Cash 8,691 9,337 Accounts receivable 11,518 13,572 Short-term notes payable 1,704 1,671 Long-term debt 29,150 35,304 Net fixed assets 72,838 77,700 Accounts payable 6,287 6,730 Inventory 20,475 21,892 Dividends 2,129 2,344 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

- Sneed Corporation reported balances in the following accounts for the current year: Income taxes payable $ 50 $ 30 Deferred tax liability 80 140 Income tax expense was $230 for the year. What was the amount paid for taxes? $220. $280. $190. $210.arrow_forwardHi expert please give me answer general accountingarrow_forwardDetermine the amount of cash paid for income taxes in each of the nine independent situations below. All dollars are in millions. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Situation Income Tax Expense Income Tax Payable Increase (Decrease) Deferred Tax Liability Increase (Decrease) Cash Paid for Taxes 1 20 0 0 2 20 1.9 0 3 20 (1.9) 0 4 20 0 3.0 5 20 0 (3.0) 6 20 1.9 3.0 7 20 1.9 (3.0) 8 20 (1.9) (3.0) 9 20 (1.9) 3.0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning