ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

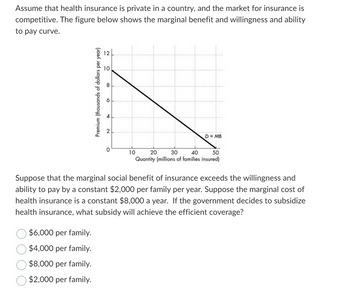

Transcribed Image Text:Assume that health insurance is private in a country, and the market for insurance is

competitive. The figure below shows the marginal benefit and willingness and ability

to pay curve.

Premium (thousands of dollars per year)

$6,000 per family.

$4,000 per family.

$8,000 per family.

$2,000 per family.

12

10

8

6

2

0

D = MB

10

20 30 40 50

Quantity (millions of families insured)

Suppose that the marginal social benefit of insurance exceeds the willingness and

ability to pay by a constant $2,000 per family per year. Suppose the marginal cost of

health insurance is a constant $8,000 a year. If the government decides to subsidize

health insurance, what subsidy will achieve the efficient coverage?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 6. The demand for the doctor's visits, Q, is the following: Q= 5 – 0.04P. The market price of a visit, equals the MC of $100. What is the equilibrium number of visits? What if the consumer purchases full-coverage (no coinsurance) health insurance and the demand stays the same. How many doctor visits would the patient consume? Calculate the deadweight loss or moral hazard cost as a result of the insurance coverage. Remember, DWL is there if units for which MB>MC are not produced, or if units for which MC>MB are produced.arrow_forwardAssume that health insurance is private in a country, and the market for insurance is competitive. The figure below shows the marginal benefit and willingness and ability to pay curve. Premium (thousands of dollars per year) $160 billion. $80 billion. $160 million. $80 million. 12 10 8 606 4 2 0 D = MB 10 20 30 40 50 Quantity (millions of families insured) Suppose that the marginal social benefit of insurance exceeds the willingness and ability to pay by a constant $2,000 per family per year. Suppose the marginal cost of health insurance is a constant $8,000 a year. If the government decides to provide public health insurance, how much will taxpayers have to pay?arrow_forwardBriefly discuss at least one of the outcomes of the 2008 Oregon Experiement? Briefly discuss why Medicaid payments to providers are lower than those paid through private insurers.arrow_forward

- 1. If you are trying to use a RDD setup to evaluate the effect of health insurance on health, and you qualify for a health insurance subsidy if your family income is below $20,000. What's the running variable? What's treatment, and what's the outcome?arrow_forwardOnce HMOs were initiated, Amy and Becky decided to switch to HMOs. The Medicare program will pay the HMO 90% of the "average costs of those who remain the Medicare" for every individual who leaves and enrolls in the HMOs. Below presents the costs to the government. Patient Traditional Medicare Medicare Plus HMOs Amy 1000 1000 Becky 2000 2000 Carols 3000 3000 Donny 4000 4000 1. Calculate the average cost per individual who remains in Medicare. $ 2. How much does the government need to pay to the HMOs for Amy and Becky? $ 3. The total cost to the government with HMO is 4. The total cost to the government BEFORE HMO is $arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Weigh the pros and cons. How would changing Medicaid financing to a block grant or per capita cap be an advantage or disadvantage for millions of low-income children and adult participants?arrow_forwardNew York Times columnist David Brooks wrote about the implementation of the Affordable Care Act (ACA) and described a possible adverse selection cascade: “the young may decide en masse that it is completely irrational for them to get health insurance that subsidizes others.” a. Why might it be irrational for young and healthy people to buy health insurance? b. In what sense do young and healthy people who buy health insurance provide a subsidy to people who are older or who are ill? c. What do you think Brooks meant by an adverse selection cascade? How might the actions of young and healthy people contribute to adverse selection problems in the health insurance system?arrow_forwardwhy skateholder health wants to understand how to approach healthcare provision access for complex community.arrow_forward

- BN7.1 Explain the First Welfare Theorem & why it does not apply to Health Care Markets?arrow_forwardSuppose that Hubert, an economist from an AM talk radio program, and Kate, an economist from a school of industrial relations, are arguing over health insurance. The following dialogue shows an excerpt from their debate: Kate: A popular topic for debate among politicians as well as economists is the idea of providing government assistance for health benefits. Hubert: I think it is oppressive for the government to tax people who take care of themselves in order to pay for health insurance for those who are obese. Kate: I disagree. I think government funding of health insurance is useful to ensure basic fairness. The disagreement between these economists is most likely due to (DIFFERENCE IN SCIENTIFIC JUDGEMENT, DIFFERENCE IN VALUES, DIFFERENCE BETWEEN PERCEPTION VERSUS REALITY) . Despite their differences, with which proposition are two economists chosen at random most likely to agree? A. Employers should not be restricted from outsourcing work to foreign nations.…arrow_forwardIf the demand curve is steeper for particular health services the moral hazard is less ? True or false Explain briefly.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education