ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

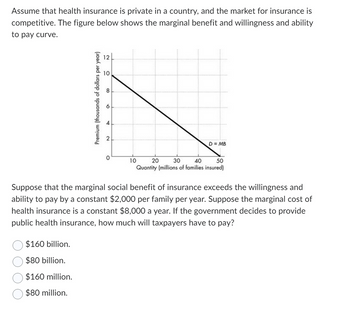

Transcribed Image Text:Assume that health insurance is private in a country, and the market for insurance is

competitive. The figure below shows the marginal benefit and willingness and ability

to pay curve.

Premium (thousands of dollars per year)

$160 billion.

$80 billion.

$160 million.

$80 million.

O

00

6

N

D = MB

10

20 30 40 50

Quantity (millions of families insured)

Suppose that the marginal social benefit of insurance exceeds the willingness and

ability to pay by a constant $2,000 per family per year. Suppose the marginal cost of

health insurance is a constant $8,000 a year. If the government decides to provide

public health insurance, how much will taxpayers have to pay?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Draw a market where consumers demand health insurance and insurance companies supply insurance at a price of insurance called the premium. Explain why, in this model of the insurance market, the individual mandate (the mandate is everyone has to have insurance) will cause health insurance premiums to increase.arrow_forwardCompare the market for baby products and the market for childbirth (via either vaginal delivery or cesarean section procedure), then discuss the concept of ‘Agreement of Trade’ in both markets. Using illustrations, briefly explain how the following economic concepts find significance in understanding the market for health and health care: Scarcity, Choice and Opportunity Cost Efficiency and Equity Benefit-Cost Principlearrow_forwardNew York Times columnist David Brooks wrote about the implementation of the Affordable Care Act (ACA) and described a possible adverse selection cascade: “the young may decide en masse that it is completely irrational for them to get health insurance that subsidizes others.” a. Why might it be irrational for young and healthy people to buy health insurance? b. In what sense do young and healthy people who buy health insurance provide a subsidy to people who are older or who are ill? c. What do you think Brooks meant by an adverse selection cascade? How might the actions of young and healthy people contribute to adverse selection problems in the health insurance system?arrow_forward

- BN7.1 Explain the First Welfare Theorem & why it does not apply to Health Care Markets?arrow_forwardSuppose that Hubert, an economist from an AM talk radio program, and Kate, an economist from a school of industrial relations, are arguing over health insurance. The following dialogue shows an excerpt from their debate: Kate: A popular topic for debate among politicians as well as economists is the idea of providing government assistance for health benefits. Hubert: I think it is oppressive for the government to tax people who take care of themselves in order to pay for health insurance for those who are obese. Kate: I disagree. I think government funding of health insurance is useful to ensure basic fairness. The disagreement between these economists is most likely due to (DIFFERENCE IN SCIENTIFIC JUDGEMENT, DIFFERENCE IN VALUES, DIFFERENCE BETWEEN PERCEPTION VERSUS REALITY) . Despite their differences, with which proposition are two economists chosen at random most likely to agree? A. Employers should not be restricted from outsourcing work to foreign nations.…arrow_forwardDemand for medical services is price inelastic (Absolute value of price elasticity of demand is less than 1 and greater than zero). Medical services are different from most other goods and services in that the person who determines the demand (the patient) is not the person who makes the payment (payment is made by the insurance company). How does this affect the price elasticity of demand for medical services (increase it or decrease it)? You may assume that this question only refers to people who have health insurance. Ignore co-payments and deductibles and any other out-of-pocket expenses. Please give an explanation.arrow_forward

- Ronald Coase in his classic October 1960 article “The Problem of Social Cost” (Journal of Law and Economics 3[1], pp.1-4) discussed collective ownership of resources. Collective ownership often means that no one takes care of resources, or at minimum that resources are not cared for as well as if they were privately owned. What are some of problems with collective ownership in the health care industry? Can you think of some examples in which collective ownership works? In what situations does it not work?arrow_forwardHow would functionalists, conflict theorists and symbolic interactionists suggest that health care delivery might be improved in the USA?arrow_forwardIf the demand curve is steeper for particular health services the moral hazard is less ? True or false Explain briefly.arrow_forward

- Explain how each of these situations will affect the quantity demanded of health insurance: a) A reduction in the tax-exempt fraction of health insurance premiums. b) An increase in buyer income. c) An increase in per capita medical expenses.arrow_forwardSuppose you have an insurance plan in which you pay the market price for medical care until you meet a deductible of $1,000, after which you have a coinsurance rate of .20. Answer parts a and b assuming your inverse demand curve for medical care is P = 400 – 10Q and the market price for medical care is $200 per unit.a) Graph the price line and your demand curve. On the graph, label the values of the x and y intercepts of the demand curve, the quantity where you meet the deductible, the horizontal sections of the price line, and the point(s) where the demand curve intersects the price line.b) Find the number of units of medical care that you will demand. Show all calculations that youperformed in your analysis.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education