Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

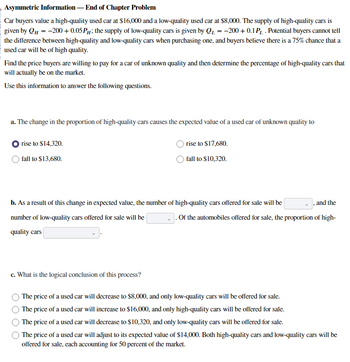

Transcribed Image Text:Asymmetric Information - End of Chapter Problem

Car buyers value a high-quality used car at $16,000 and a low-quality used car at $8,000. The supply of high-quality cars is

given by QH = -200+ 0.05 P; the supply of low-quality cars is given by Q₁ = -200+ 0.1 P₁ . Potential buyers cannot tell

Он

the difference between high-quality and low-quality cars when purchasing one, and buyers believe there is a 75% chance that a

used car will be of high quality.

Find the price buyers are willing to pay for a car of unknown quality and then determine the percentage of high-quality cars that

will actually be on the market.

Use this information to answer the following questions.

a. The change in the proportion of high-quality cars causes the expected value of a used car of unknown quality to

rise to $14,320.

fall to $13,680.

rise to $17,680.

fall to $10,320.

b. As a result of this change in expected value, the number of high-quality cars offered for sale will be

number of low-quality cars offered for sale will be

quality cars

and the

Of the automobiles offered for sale, the proportion of high-

c. What is the logical conclusion of this process?

The price of a used car will decrease to $8,000, and only low-quality cars will be offered for sale.

The price of a used car will increase to $16,000, and only high-quality cars will be offered for sale.

The price of a used car will decrease to $10,320, and only low-quality cars will be offered for sale.

The price of a used car will adjust to its expected value of $14,000. Both high-quality cars and low-quality cars will be

offered for sale, each accounting for 50 percent of the market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A consumer’s demand for a medical service is as follows: Q = 100 – P, where P is theout-of-pocket price she actually faces. Assume this medical service has a market price of $70.This consumer is considering four different insurance options: no insurance, full insurance, a 50% coinsurance plan, and a copayment plan with a $25 co-pay Calculate the deadweight loss under each insurance scheme and show iton each graph. What do you observe?arrow_forward4.arrow_forwardTrue or False: Short-term disability insurance usually requires a short waiting period before it pays benefits. O True O Falsearrow_forward

- Pls help ASAParrow_forwardA website offers a place for people to buy and sell emeralds, but information about emeralds can be quite imperfect. The website then enacts a rule that all sellers in the market must pay for two independent examinations of their emerald, which are available to the customer for inspection. How would you expect this improved information to affect demand for emeralds on this website? How would you expect this improved information to affect the quantity of high-quality emeralds sold on the website?arrow_forwardWhat is the problem of moral hazard?arrow_forward

- Suppose that there are 2 types of plans available to you. Plan A has a deductible of $500, with 10 percent co-insurance rate for many health care services. Plan B has a deductible fo $1000, with 35 percent co-insurance rate. Plan A costs $200 per month in premiums while Plan B costs $80. Discuss characteristics of people who would choose Plan A versus Plan B. Assuming that both plan types exist in the market, who would likely choose Plan B over Plan A? What plan would you choose?arrow_forward/Suppose that an individual's demand curve for doc-tor visits per year is given by the equation P = 100- 25Q, where Q is the number of doctor visits peryear and P is the price per visit. Suppose also thatthe marginal cost of each doctor visit is $50.a. How many visits per year would be efficient?What is the total cost of the efficient numberof visits?b. Suppose that the individual obtains insur-ance. There is no deductible, and the coin-surance rate is 50 percent. How many visitsto the doctor will occur now? What are theindividual's out-of-pocket costs? How muchdoes the insurance company pay for this individual's doctors' visits?c. What is the deadweight loss (if any) causedby this insurance policy?arrow_forwardInsurance buyers have more information about whether they are high-risk or low-risk than the insurance company does. This creates an asymmetric information problem for the insurance company because buyers who are high-risk tend to want to buy more insurance, without letting the insurance company know about their higher risk. How might this problem impact an insurance company? F T O The company will not be impacted. O The insurance buyers, not the company, will be impacted. As high risk buyers submit claims, they will use up the company's funds for that year, and since the company did not adjust for these high risk claims, once that money is used up, remaining claimants won't receive any coverage. The company will be faced with heavy losses. The insurance company may decide not to sell insurance in this market at all or otherwise choose not to sell insurance to those they can identify as high risk. 106 # C 4 $ JUL 21 tv♫♬ % MacBook Pro Search or type URL + W D P N Ⓒarrow_forward

- Pls help ASAParrow_forwardWhat is the key difference between a fee-for-service healthcare system and a system based on health maintenance organizations?arrow_forward2. Suppose the equilibrium price for an average hospital stay in the absence of insurance is S10,000. At that price, 1000 people are hospitalized each year. Now suppose an insurer offers a policy to lower the out of pocket price of a stay to S100, and at that price, 1200 pcople are hospitalized. How much TOTAL premium revenue must be collected to finance this arrangement? HINT: you arc trying to brcak even here to get revenucs to match costs. You are given information that indicates cost. Now you need to consider revenues to balance that out. Keep in mind this is asking about premium revenue. There may be other revenue that you are receiving that you should consider when trying to calculate premium revenue to get to break even. a.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781305971509Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781305971509Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Principles of Economics, 7th Edition (MindTap Cou...

Economics

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:9781305971509

Author:N. Gregory Mankiw

Publisher:Cengage Learning