EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Can you help me with accounting questions

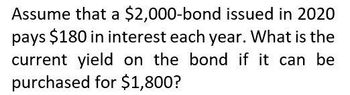

Transcribed Image Text:Assume that a $2,000-bond issued in 2020

pays $180 in interest each year. What is the

current yield on the bond if it can be

purchased for $1,800?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the current yield on the bond if it can be purchased for $800 on these general accounting question?arrow_forwardConsider a 12%, 15 year bond that pays interest semiannually, and its current price is $675. What is the promise yield to maturity?arrow_forwardNeed help with this questionarrow_forward

- If a If a bond pays $90 interest annually, matures after ten years and costs $1,100. What is the current Yield.arrow_forwardYou pay $25.00 for a bond which can be redeemed in 20 years for $50.00. What annual ratedoes this bond pay?arrow_forwardUse the following tables to calculate the present value of a $789,000 @ 6%, 6-year bond that pays $47,340 interest annually, if the market rate of interest is 7%. Round to the nearest dollar.arrow_forward

- You buy a bond that pays annual interest payments of 7% of the bond’s face value of $1000. You initially pay $950 for the bond. You receive an annual interest payment after one year, then sell the bond for $880. What is your total rate of return on the investment, expressed as a percentage of the purchase price?arrow_forwarda. Assuming you purchased the bond for $350 what rate of return would you earn if you held the bond for 25 years until it matured with a value $1000? a. Rate of return____% b. Suppose under the terms of thebond you could redeem the bond in 2024. DMF agreed to pay an annual interest rate of 1.4 percent until the date. How much would the bond be worth at that time? b. Bond value_____ c. In 2024 instead of cashing in the bond for its then current value you decide to hold the bond until it mature in 2043. What annual rate of return will you earn over the last 19 years? c. Rate of return___%arrow_forwardWhat is the yield to maturity on a $1,000-face-value discount bond maturing in one year that sells for $800?arrow_forward

- A one-year premium bond with a face value of $10,000 has been purchased for $11,150. What is the yield to maturity? What is the yield on a discount basis?arrow_forwardSuppose a bond with no expiration date has a face value of $10,000 and annually pays a fixed amount of interest of $750, calculate the interest rate that the bond would yield to a bond buyer. Show all work.arrow_forwardA bond: pay $75 each year in interest, and a $1,000 payment at maturity. The $1,000 is called? A) couponB) face valueC) discountD) yieldarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning