College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Need help with this accounting question not use chatgpt

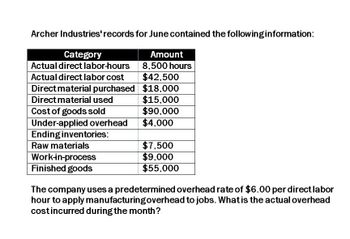

Transcribed Image Text:Archer Industries' records for June contained the following information:

Category

Actual direct labor-hours

Amount

8,500 hours

Actual direct labor cost

$42,500

Direct material purchased

$18,000

Direct material used

$15,000

Cost of goods sold

$90,000

Under-applied overhead

$4,000

Ending inventories:

Raw materials

$7,500

Work-in-process

$9,000

$55,000

Finished goods

The company uses a predetermined overhead rate of $6.00 per direct labor

hour to apply manufacturing overhead to jobs. What is the actual overhead

cost incurred during the month?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Sanchez Welding and Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended December 31, 20--. Assume that all materials inventory items are direct materials. Work in process, January 1 20,500 Materials inventory, January 1 11,000 Materials purchases 12,000 Materials inventory, December 31 13,000 Direct labor 9,500 Overhead 5,500 Work in process, December 31 10,500arrow_forwardDuring the year, a company purchased raw materials of $77,321, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardIn October, the cost of materials transferred into the Rolling Department from the Casting Department of Kraus Steel Company is 3,000,000. The conversion cost for the period in the Rolling Department is 462,600 (275,000 factory overhead applied and 187,600 direct labor). The total cost transferred to Finished Goods for the period was 3,392,400. The Rolling Department had a beginning inventory of 163,800. a. Journalize for the Rolling Department (1) the cost of transferred-in materials, (2) the conversion costs, and (3) the costs transferred out to Finished Goods. b. Determine the balance of Work in ProcessRolling at the end of the period.arrow_forward

- The records of Burris Inc. reflect the following data: Work in process, beginning of month2,000 units one-half completed at a cost of 1,250 for materials, 675 for labor, and 950 for overhead. Production costs for the monthmaterials, 99,150; labor, 54,925; factory overhead, 75,050. Units completed and transferred to stock38,500. Work in process, end of month3,000 units, one-half completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost.arrow_forwardThe records of Stone Inc. reflect the following data: Work in process, beginning of month4,000 units one-fourth completed at a cost of 2,500 for materials, 1,400 for labor, and 1,800 for overhead. Production costs for the monthmaterials, 130,000; labor, 70,000; and factory overhead, 82,000. Units completed and transferred to stock45,000. Work in process, end of month5,000 units, one-half completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost. (Round unit costs to three decimal places.)arrow_forwardBaxter Company has two processing departments: Assembly and Finishing. A predetermined overhead rate of 10 per DLH is used to assign overhead to production. The company experienced the following operating activity for April: a. Materials issued to Assembly, 24,000 b. Direct labor cost: Assembly, 500 hours at 9.20 per hour; Finishing, 400 hours at 8 per hour c. Overhead applied to production d. Goods transferred to Finishing, 32,500 e. Goods transferred to finished goods warehouse, 20,500 f. Actual overhead incurred, 10,000 Required: 1. Prepare the required journal entries for the preceding transactions. 2. Assuming Assembly and Finishing have no beginning work-in-process inventories, determine the cost of each departments ending work-in-process inventories.arrow_forward

- Baldwin Printing Company uses a job order cost system and applies overhead based on machine hours. A total of 150,000 machine hours have been budgeted for the year. During the year, an order for 1,000 units was completed and incurred the following: The accountant computed the inventory cost of this order to be 4.30 per unit. The annual budgeted overhead in dollars was: a. 577,500. b. 600,000. c. 645,000. d. 660,000.arrow_forwardOn December 1, Carmel Valley Production Inc. had a work in process inventory of 1,200 units that were complete as to materials and 50% complete as to labor and overhead. December 1 costs follow: During December the following transactions occurred: a. Purchased materials costing 50,000 on account. b. Placed direct materials costing 49,000 into production. c. Incurred production wages totaling 50,500. d. Incurred overhead costs for December: e. Applied overhead to work in process at a predetermined rate of 125% of direct labor cost. f. Completed and transferred 10,000 units to finished goods. (Hint: You should first compute equivalent units and unit costs. The unit cost should include applied, not actual, factory overhead.) Carmel Valley uses the weighted average cost method. The ending inventory of work in process consisted of 1,000 units that were completed as to materials and 25% complete as to labor and overhead. Required: Prepare the journal entries to record the above December transactions.arrow_forwardA company calculated the predetermined overhead based on an estimated overhead of $70.000, and the activity for the cost driver was estimated as 2,500 hours. If product A utilized 1,350 hours and product 8 utilized 1,100 hours, what was the total amount of overhead assigned to the products? A. $35000 B. $30.800 C. $37,800 D. $68,600arrow_forward

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardSteeler Towel Company estimates its overhead to be $250,000. It expects to have 100,000 direct labor hours costing $2,500,000 in labor and utilizing 12,500 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardOReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,