Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

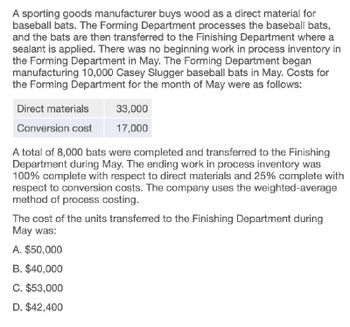

Transcribed Image Text:A sporting goods manufacturer buys wood as a direct material for

baseball bats. The Forming Department processes the baseball bats,

and the bats are then transferred to the Finishing Department where a

sealant is applied. There was no beginning work in process inventory in

the Forming Department in May. The Forming Department began

manufacturing 10,000 Casey Slugger baseball bats in May. Costs for

the Forming Department for the month of May were as follows:

Direct materials

33,000

Conversion cost

17,000

A total of 8,000 bats were completed and transferred to the Finishing

Department during May. The ending work in process inventory was

100% complete with respect to direct materials and 25% complete with

respect to conversion costs. The company uses the weighted-average

method of process costing.

The cost of the units transferred to the Finishing Department during

May was:

A. $50,000

B. $40,000

C. $53,000

D. $42,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Holmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: direct materials, 90,000; conversion costs, 33,750. Manufacturing costs incurred during April: direct materials, 75,000; conversion costs, 220,000. Holmes uses the weighted average method. Required: 1. Compute the unit cost for April. 2. Determine the cost of ending work in process and the cost of goods transferred out.arrow_forwardPrecision Inc. manufactures wristwatches on an assembly line. The work in process inventory as of March 1 consisted of 1,000 watches that were complete as to materials and 75% complete as to labor and overhead. The March 1 work in process costs were as follows: During the month, 10,000 units were started and 9,500 units were completed. The 1,500 units of ending inventory were complete as to materials and 25% complete as to labor and overhead. The costs for March were as follows: Calculate: a. Equivalent units for material, labor, and overhead, using the weighted average cost method b. Unit costs for materials, labor, and overhead c. Cost of the units completed and transferred d. Detailed cost of the ending inventory e. Total of all costs accounted forarrow_forwardDura-Conduit Corporation manufactures plastic conduit that is used in the cable industry. A conduit is a tube that encircles and protects the underground cable. In the process for making the plastic conduit, called extrusion, the melted plastic (resin) is pressed through a die to form a tube. Scrap is produced in this process. Information from the cost of production reports for three months is as follows, assuming that inventory remains constant: Assume that there is one-half pound of resin per foot of the finished product. a. Determine the resin materials cost per foot of finished product for each month. Round to the nearest whole cent. b. Determine the ratio of the number of resin pounds output in conduit by the number of pounds input into the process for each month. Round percentages to one decimal place. c. Interpret the resin materials cost per foot for the three months. Use the information in (a) and (b) to explain what is happening. d. Determine the conversion cost per foot of finished product for each month and interpret the result.arrow_forward

- Kraus Steel Company has two departments, Casting and Rolling. In the Rolling Department, ingots From the Casting Department are rolled into steel sheet. The Rolling Department received 4,000 tons from the Casting Department in October. During October, the Rolling Department completed 3,900 tons, including 200 tons of work in process on October 1. The ending work in process inventory on October 31 was 300 tons. How many tons were started and completed during October?arrow_forwardMimasca Inc. manufactures various holiday masks. Each mask is shaped from a piece of rubber in the molding department. The masks are then transferred to the finishing department, where they are painted and have elastic bands attached. Mimasca uses the weighted average method. In May, the molding department reported the following data: a. BWIP consisted of 15.000 units, 20% complete. Cost in beginning inventor) totaled 1,656. b. Costs added to production during the month were 26,094. c. At the end of the month, 45.000 units were transferred out to finishing. Then, 5,000 units remained in EWIP, 25% complete. Required: 1. Prepare a physical flow schedule. 2. Calculate equivalent units of production. 3. Compute unit cost. 4. Calculate the cost of goods transferred to finishing at the end of the month. Calculate the cost of ending inventor). 5. CONCEPTUAL CONNECTION Assume that the masks are inspected at the end of the molding process. Of the 45,000 units inspected, 2,500 are rejected as faulty and are discarded. Thus, only 42,500 units are transferred to the finishing department. The manager of Mimasca considers all such spoilage as abnormal and does not want to assign any of this cost to the 42.500 good units produced and transferred to finishing. Your task is to determine the cost of this spoilage of 2,500 units and then to discuss how you would account for this spoilage cost. Now suppose that the manager feels that this spoilage cost is just part of the cost of producing the good units transferred out. Therefore, he wants to assign this cost to the good production. Explain how this would be handled. (Hint: Spoiled units are a type of output, and equivalent units of spoilage can be calculated.)arrow_forwardDuring March, the following costs were charged to the manufacturing department: $22,500 for materials; $45,625 for labor; and $50,000 for manufacturing overhead. The records show that 40,000 units were completed and transferred, while 10,000 remained in ending inventory. There were 45,000 equivalent units of material and 42,500 units of conversion costs. Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forward

- Dama Company produces womens blouses and uses the FIFO method to account for its manufacturing costs. The product Dama makes passes through two processes: Cutting and Sewing. During April, Damas controller prepared the following equivalent units schedule for the Cutting Department: Costs in beginning work in process were direct materials, 20,000; conversion costs, 80,000. Manufacturing costs incurred during April were direct materials, 240,000; conversion costs, 320,000. Required: 1. Prepare a physical flow schedule for April. 2. Compute the cost per equivalent unit for April. 3. Determine the cost of ending work in process and the cost of goods transferred out. 4. Prepare the journal entry that transfers the costs from Cutting to Sewing.arrow_forwardPetrini Products Co. has two departments: Mixing and Cooking. At the beginning of the month, Cooking had 4,000 units in process with costs of 8,600 from Mixing, and its own departmental costs of 500 for materials, 1,000 for labor, and 2,500 for factory overhead. During the month, 10,000 units were received from Mixing with a cost of 25,000. Cooking incurred costs of 4,250 for materials, 8,500 for labor, and 21,250 for factory overhead, and finished 12,000 units. At the end of the month, there were 2,000 units in process, one-half completed. Required: 1. Determine the unit cost for the month in Cooking. 2. Determine the adjusted weighted average unit cost for all units received from Mixing. 3. Determine the unit cost of goods finished. 4. Determine the accumulated cost of the goods finished and of the ending work in process. (Round unit costs to three decimal places.)arrow_forwardFordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000. Required: 1. Assuming the use of the weighted average method, prepare a schedule of equivalent units. 2. Compute the unit cost for the month.arrow_forward

- Ardt-Barger has a beginning work in process inventory of 5.500 units and transferred in 25,000 units before ending the month with 3.000 u flits that were 100% complete with regard to materials and 80% complete with regard to conversion costs. The cost per unit of material is $5.45, and the cost per unit for conversion is $6.20 per unit, Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forwardAda Clothes Company produced 40,000 units during April. The Cutting Department used 12,800 direct labor hours at an actual rate of 16.50 per hour. The Sewing Department used 19,600 direct labor hours at an actual rate of 19.25 per hour. Assume there were no work in process inventories in either department at the beginning or end of the month. The standard labor rate is 18.00. The standard labor time for the Cutting and Sewing departments is 0.3 hour and 0.5 hour per unit, respectively. a. Determine the direct labor rate, direct labor time, and total direct labor cost variance for the (1) Cutting Department and (2) Sewing Department. b. Interpret your results.arrow_forwardThe finishing department started the month with 600 units in WIP inventory. Lt received 1,500 units from the molding department and ended the month with 550 units still in process. How many units were transferred out?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning