FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

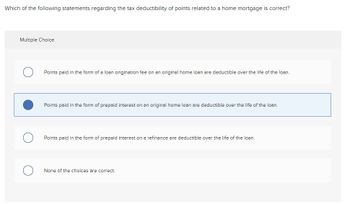

Which of the following statements regarding the tax deductibility of points related to a home mortgage is correct? (See image for answers)

Transcribed Image Text:**Question:**

Which of the following statements regarding the tax deductibility of points related to a home mortgage is correct?

**Multiple Choice:**

1. ○ Points paid in the form of a loan origination fee on an original home loan are deductible over the life of the loan.

2. ● Points paid in the form of prepaid interest on an original home loan are deductible over the life of the loan. (Selected)

3. ○ Points paid in the form of prepaid interest on a refinance are deductible over the life of the loan.

4. ○ None of the choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which is false? a. The estate tax is computed based on the net estate or taxable estate. b. The net estate is determined by subtracting from the gross estate the deductions authorized by law. C. Both a" and D d. Neither a" nor "b"arrow_forwardWhat is the purpose of establishing an allowance for uncollectible property taxes at the time the property tax levy is recorded?arrow_forwardWhich of the following statements is correct? O a. A tax offset can result in a refund if it relates to franking credits. O b. Tax offsets are same as allowable deductions as both reduce assessable income. O c. Any tax offset can increase deductions. O d. Tax offsets are used to reduce your taxable income.arrow_forward

- All of the following are examples of facts that may create temporary book-tax differences except ________. Group of answer choices depreciation contingent liabilities product warranty costs payment of premiums for life insurancearrow_forwardWhich of the following is accurate regarding a real estate foreclosure transaction? A A foreclosure transaction can never involve recourse debt. B A foreclosure transaction can never involve nonrecoursedebt. C A foreclosure transaction has no federal income taxconsequences for the borrower. D A foreclosure transaction can have significant federalincome tax consequences for the borrower.arrow_forwardAmounts that are made available to a taxpayer without substantial restrictions are included in gross income under which of the following legal doctrines? Assignment of Income Doctrine Constructive Receipt Doctrine Cohan Doctrine Recovery of Capital Doctrinearrow_forward

- The tax rate that is applied against a prepayment penalty is the ______. Group of answer choices a. Ordinary income tax rate b. Depreciation recapture tax rate c. Local property tax rate d. Capital gains tax ratearrow_forwardDescribe the procedure to incorporate the tax effects of gains (or losses) whenever an asset is disposed of?arrow_forwardBriefly explain how tax loss carryback and carryforward procedureswork.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education