FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

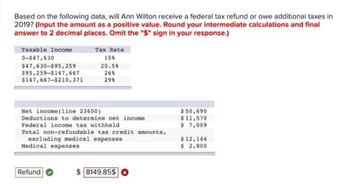

Transcribed Image Text:Based on the following data, will Ann Wilton receive a federal tax refund or owe additional taxes in

2019? (Input the amount as a positive value. Round your intermediate calculations and final

answer to 2 decimal places. Omit the "$" sign in your response.)

Taxable Income

0-$47,630

$47,630-$95,259

$95,259-$147,667

$147,667-$210,371

Tax Rate

158

20.58

268

298

Net income (line 23600)

Deductions to determine net income

Federal income tax withheld

Total non-refundable tax credit amounts,

excluding medical expenses

Medical expenses

Refund

$8149.85$

$50,690

$11,570

$ 7,009

$12,144

$ 2,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- George is preparing tax filings for 2022. Assume the following personal tax rate table is applicable: Taxable Income Up to $9,950 $9,950-$45,000 $45,000-$86,000 $86,000-$165,000 $165,000-$209,000 $209,000-$523,600 Over $523,600 Tax Rate 10% 12 22 24 32 35 37 George has a taxable income of $157,500 in 2022. What is his average tax rate? O a. 17.8% O b. 21.6% O c. 18.3% O d. 19.9%arrow_forwardThe 2020 Arizona graduated tax rate is given in the table below for those filing status is single or married filing separate. To use this table you will calculate the amount of money to be taxed at each level and then sum up the amount for each given tax rate. Find the income tax for a person filing single and has a taxable income reported as $81,600. Round your answer to the nearest whole dollar amount. Proper units on worksheet but: Do not include the $ sign in your answer here. Income Tax Rate The income between $0 and $27,272 2.59% The income between $27,272 and $54,544 3.34% The income between $54,544 and $163,632 4.17% The income above $163,632 4.50%arrow_forwardGive typing answer with explanation and conclusion Based on the 2021 tax brackets, If Brian and his wife have a taxable income of $70,000 and they receive a $7200 child credit (because they have 2 children under the age of 5), what is their total income tax liability? a. $6280 b. $802 c. $21,000arrow_forward

- Ms. White has net tax owing for 2017 of $4,500, net tax owing for 2018 of $8,000, and estimated net tax owing for 2019 of $7,500. If she wishes to pay the minimum total amount of instalments for the 2019 taxation year, her first payment on March 15 will be for what amount? Nil. $1,125.00 $1,875.00 $2,000.00arrow_forwardThe 2020 Arizona graduated tax rate is given in the table below for those filing status is single or married filing separate. To use this table you will calculate the amount of money to be taxed at each level and theri sum up the amount for each given tax rate. Find the income tax for a person filing single and has a taxable income reported as $75.700. Round your answer to the nearest whole dollar amount. Income The income between $0 and $27.272 Tax Rate 2.59% The income between $27.272 and $54.544 3.34% The income between $54,544 and $163.632 4.17% The income above $163.632 Your Answer: 4.50%arrow_forward3. Mr. So filed his 2022 income tax return on June 30, 2023. The BIR discovered a deficiency income tax on August 15, 2024. When should the deficiency tax assessment be served? a. On or before August 15, 2027 b. On April 15, 202 c. On or before June 30, 2026 d. On or before April 15, 2026arrow_forward

- Please solvearrow_forwardYanni, who is single, provides you with the following information for 2023: Salary State income taxes Mortgage interest expense on principal residence Charitable contributions Interest income a. Yanni's taxable income: Click here to access the exemption table. If required, round your answers to the nearest do Compute the following: b. Yanni's AMT base: c. Yanni's tentative minimum tax: LA $ SA $103,000 10,300 9,270 S 2,060 1,545 10,370 X 0 Xarrow_forwardThe gross income test for a dependent who is a qualifying relative mandates that the potential qualifying relative cannot have gross income over a certain amount. What is the gross income limit for Tax Year 2023? $0 $4,400 $4,700 $13,850arrow_forward

- Question 1 (Marks - 10) Calculate Total Assessable Income, Taxable Income, Tax Liability, Student loan (HECS), Medicare Levy, and Medicare Levy Surcharge if applicable, for the taxpayer (Susanne) with the information below: • Susanne is a single and an Australian resident plans to lodge a tax return for the tax year 2020 - 2021. • Her total taxable income is $90,000 (Including tax withheld). • She does not have private health insurance. • Susanne has a student loan HECS outstanding for her previous study at Sydney University of $53,000. • Her employer pays superannuation guarantee charge of 9.5% on top of her salary to her nominated fund. • Susanne earned a passive income of $10,000 from the investments in shares in the same tax year.arrow_forwardDetermine from the tax table the amount of the income tax for each of the following taxpayers for 2020: Taxpayer(s) Filing Status Taxable Income Income Tax Allen Single $ 30,000 $______________________ Boyd MFS 34,545 $______________________ Caldwell MFJ 55,784 $______________________ Dell H of H 67,450 $______________________ Evans Single 75,000 $______________________arrow_forward5Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education