FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![[The following information applies to the questions displayed below.]

Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with

her condo:

Insurance

Advertising expense

Mortgage interest

Property taxes

Repairs & maintenance

Utilities

Depreciation

$ 1,000

500

3,500

900

650

950

8,500

During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the

condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than

the property taxes allocated to the rental use of the property.

Assume Tamar uses the IRS method of allocating expenses to rental use of the property.](https://content.bartleby.com/qna-images/question/4f4ed9b5-97b6-4b06-beaf-83d9b19122f9/a7e1d754-1d19-4546-a453-12ee108ceef8/irqu4of_thumbnail.png)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with

her condo:

Insurance

Advertising expense

Mortgage interest

Property taxes

Repairs & maintenance

Utilities

Depreciation

$ 1,000

500

3,500

900

650

950

8,500

During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the

condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than

the property taxes allocated to the rental use of the property.

Assume Tamar uses the IRS method of allocating expenses to rental use of the property.

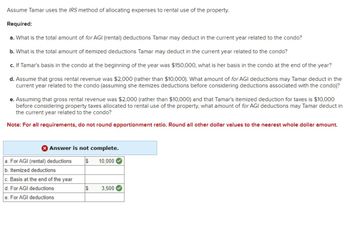

Transcribed Image Text:Assume Tamar uses the IRS method of allocating expenses to rental use of the property.

Required:

a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo?

b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo?

c. If Tamar's basis in the condo at the beginning of the year was $150,000, what is her basis in the condo at the end of the year?

d. Assume that gross rental revenue was $2,000 (rather than $10,000). What amount of for AGI deductions may Tamar deduct in the

current year related to the condo (assuming she itemizes deductions before considering deductions associated with the condo)?

e. Assuming that gross rental revenue was $2,000 (rather than $10,000) and that Tamar's itemized deduction for taxes is $10,000

before considering property taxes allocated to rental use of the property, what amount of for AGI deductions may Tamar deduct in

the current year related to the condo?

Note: For all requirements, do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount.

> Answer is not complete.

10,000

a. For AGI (rental) deductions $

b. Itemized deductions

c. Basis at the end of the year

d. For AGI deductions

e. For AGI deductions

69

3,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Working notes

VIEW Step 2: (a) Determine the total amount of for AGI (rental) deductions Tamar may deduct in the current year:

VIEW Step 3: (b) Determination of the total amount of itemized deductions T may deduct in the current year:

VIEW Step 4: (c) Determination of T’s basis assuming the basis at the beginning of the year was $150,000:

VIEW Solution

VIEW Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- tim is living with his spouse in California when he finds out that his wife is having an affair. Tim packs his bags and leaves the state to move to Indiana, intending on filing separately. Tim and his spouse cohabitated until June. He earned $50,000 during the year, $30,000 of which was in California. She earned $60,000 during the year. How much wage income does Tim have on his California return and from whom? (Remember, the return is being filed separately) He has $50,000 in state wages from his pay only, since he's no longer in a community property state. He has $45,000 in state wages, with $15,000 from half of his state-sourced pay and $30,000 from her half of pay. He has $55,000 in state wages, with $25,000 from half of his total pay and $30,000 from her half of pay. He has $30,000 in state wages from his state-sourced pay.arrow_forwardDetermine whether the individuals will qualify as the taxpayer's dependent in each of the following independent scenarios. Specify whether the dependent would come under the qualifying child category, the qualifying relative category, or "not applicable" (if the individual does not qualify as a dependent). a. Andy maintains a household that includes a cousin (age 12), a niece (age 18), and a son (age 26). All are full-time students. Andy furnishes all of their support, and all are "members of the household." Cousin Qualified dependent Niece Qualified dependent Son Qualified dependent Qualifying child Qualifying child Qualifying relative b. Mandeep provides all of the support of a family friend's son (age 20), who lives with her. She also furnishes most of the support of her stepmother, who does not live with her. Family friend's son Qualified dependent Stepmother Not a dependent Qualifying relative Qualifying relative c. Raul, a U.S. citizen, lives in Costa Rica. Raul's household…arrow_forwardRichard McCarthy (born 2/14/1966; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1968; Social security number 101-21-3434) have a 19-year-old son Jack, (born 10/2/2001; Social Security number 555-55-1212), who is a full-time student at the University of Key West. The McCarthys also have a 12-year-old daughter Justine, (Social Security number 444-23-1212), who lives with them. The McCarthys can claim a $2,000 child tax credit for Justine and a $500 other dependent credit for Jack. The McCarthys did not receive an EIP in 2020. Richard is the CEO at a paper company. His 2020 Form W-2 is provided. Christine is an optometrist and operates her own practice ("The Eyes of March") in town as a sole proprietor. The shop address is 1030 Morgan Highway, Clarks Summit, PA 18411 and the business code is 621320. Christine keeps her books on the accrual basis and her bookkeeper provided the following information: Gross sales $270,500 Returns 9,000 Inventory:…arrow_forward

- Will you consider a partnership as a taxpayer? Yes or No.arrow_forwardJermaine Watson is a single father with a son, Jamal, who qualifies as a dependent. They live at 5678 SE Stark St., Portland, OR 97233. Jermaine works at first bank of Oregon. Jamaal attends school and at the end of the school day he goes to a dependent care facility next-door to his school, where Jermaine picks him up after work. Jermaine pays $800 per month to the care facility (Portland Day Care, 4567 SE Stark St,. Portland, OR 97233. EIN 90-654-3210). Jermaine's W-2 from the first bank of Oregon is as follows: Wages (box 1) = $71,510.00 Federal W/H (Box 2) = $3,197.00 Social Security wages (box 3) = $71,510.00 Social Security W/H (box 4) = $4,433.62 Medicare wages (Box 5) = $71,510.00 Medicare W/H (Box 6) = $1,036.90 State Income Taxes (Box 17) = 1,134.90 Jermaine takes one class a semester at Portland State University towards an MBA degree. In 2019, he paid $1300 in tuition, $300 for books and $200 for a meal card. Jermaine has some investments in a New Zealand public…arrow_forwardWould you sign this return if you were Tom and Teri’s Paid Tax Preparer? Why or why not? Your clients, Tom (age 48) and Teri (age 45) Trendy, have a son, Tim (age 27). Tim lives in Hawaii, where he studies the effects of various sunscreens on his ability to surf. Last year, Tim was out of money and wanted to move back home and live with Tom and Teri. To prevent this, Tom lent Tim $20,000 with the understanding that he would stay in Hawaii and not come home. Tom had Tim sign a formal note, including a stated interest rate and due date. Tom has a substantial portfolio of stocks and bonds and has generated a significant amount of capital gains in the current year. He concluded that Tim is a deadbeat and the $20,000 note is worthless. Consequently, Tom wants to his son’s bad debt on his and Teri’s current tax return and net it against his other capital gains and losses. Tom is adamant about this!arrow_forward

- (6).arrow_forwardTim and Allison are married and have two children, ages 8 and 13. Allison is a "nonworking" spouse who devotes all of her time to household activities. Estimate how much life insurance Tim and Allison should carry to cover Allison. Life insurance needarrow_forwardShaan and Anita are married and have two children, ages 8 and 10. Anita is a "nonworking" spouse who devotes all of her time to household activities. Estimate how much life insurance Shaan and Anita should carry. Insurance needarrow_forward

- Margaret issues a promissory note payable to the order of Pancho. Pancho indroses the note toAdolfo, then Adolfo to Beatrice, then Beatrice back to Margaret. What happened to the obligationof Margaret?arrow_forwardHelp me please asap. Don't use AI. It's strictly prohibited.arrow_forwardJosef is an employee of ACME Equipment Rentals and Repair. To ensure that Josef is available to respond to service calls, the company provides Josef with an Apple I-phone. Josef, on occasion, will also use the phone for personal calls and to watch the occasional TikTok video on his breaks. Is this a taxable or nontaxable fringe benefit to Josef?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education