Concept explainers

Consider the following situations for Shocker:

a. On November 28, 2018, Shocker receives a $4,350 payment from a customer for services to be rendered evenly over the next three months. Deferred Revenue is credited.

b. On December 1, 2018, the company pays a local radio station $2,670 for 30 radio ads that were to be aired, 10 per month, throughout December, January, and February. Prepaid Advertising is debited.

c. Employee salaries for the month of December totaling $7,900 will be paid on January 7, 2016.

d. On August 31, 2018, Shocker borrows $69,000 from a local bank. A note is signed with principal and 8% interest to be paid on August 31, 2019.

Required:

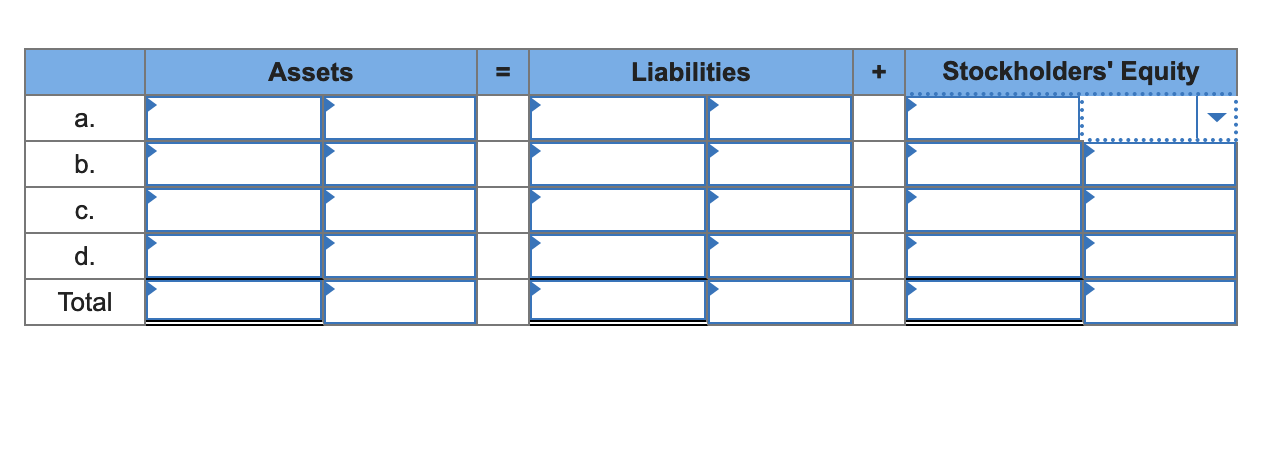

Indicate by how much the assets, liabilities, and

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

- On September 1, Wright Magazine Company receives annual subscriptions totaling $601,500. The first issue will be received by the subscriber one month after the money is received. Wright Magazine Company's fiscal year ends December 31. Required: How much revenue would Wright recognize from this amount for the current year?arrow_forwardThe following terms appeared on an invoice dated May 20, sent by a manufacturer to a retail store: 2/10, net 30. The amount of the invoice was $2,000. Assuming the retailer paid the invoice on May 30 (10 days after the products were delivered), how much should he have paid?arrow_forwardCaritas Publishing issues the Weekly Welder. The company's primary sources of revenue are sales of subscriptions to customers and sales of advertising in the Weekly Welder. Caritas owns its building and has excess office space that it leases to others. The following transactions involved the receipt of advance payments. Prepare the indicated journal entries for each set of transactions. 1) On September 1, 20X7, the company received a $48,000 payment from an advertising client for a 6-month advertising campaign. The campaign was to run from November, 20x7, through the end of April, 20X8. Prepare the journal entry on September 1, and the December 31 end-of-year adjusting entry. 2) The company began 20X7 with S360,000 in unearned revenue relating to sales of subscriptions for future issues. During 20X7, additional subscriptions were sold for $3,490,000. Magazines delivered during 20X7 under outstanding subscriptions totaled $3,060,000. Prepare a summary journal entry to reflect the sales…arrow_forward

- Lamplight Plus sells lamps to consumers. The company contracts with a supplier who provides them with lamp fixtures. There is an agreement that Lamplight Plus is not required to provide cash payment immediately and instead will provide payment within thirty days of the invoice date. Additional information: • Lamplight purchases 25 light fixtures for $25 each on August 1, invoice date August 1, with no discount terms. Lamplight returns 5 light fixtures (receiving a credit amount for the total purchase price per fixture of $25 each) on August 3. • Lamplight purchases an additional 15 light fixtures for $10 each on August 19, invoice date August 19, with no discount terms. • Lamplight pays $130 toward its account on August 22. What amount does Lamplight Plus still owe to the supplier on August 30? What account is used to recognize this outstanding amount?arrow_forwardTriple Tier Bakery is a locally-owned business offering custom cakes, cupcakes, desserts and wedding cakes. At year end, Triple Tier's balance of Allowance for Uncollectible Accounts is $530 (credit before adjustment. The Accounts Receivable balance is $21,500, During the next year, Triple Tier estimates that 15% of accounts will be uncollectible. Record the adjustment required for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardIn December, Northern Kiteboarding magazine collected $80,000 for subscriptions for the next calendar year. The company collects cash in advance and then downloads the magazines to subscribers each month Apply the recognition criteria for revenues to determine (a) when the company should record revenue for this situation and (b) the amount of revenue the company should record for the January through March downloads a Northern Kiteboarding should record revenue after b. The amount of revenue equals nof whenarrow_forward

- On March 1, Terrell & Associates provides legal services to Whole Grain Bakery regarding some recent food poisoning complaints. Legal services total $9,900. In payment for the services, Whole Grain Bakery signs a 8% note requiring the payment of the face amount and interest to Terrell & Associates on September 1. Required: For Whole Grain Bakery, record the issuance of the note payable on March 1 and the cash payment on September 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardA man received an invoice for washing machine for $455 dated April 17, with a sales term of 2/10 EOM. How much should he pay if he pay if he pays bill on April 28?arrow_forwardThe following transactions occurred during December 31, 2021, for the Microchip Company. On October 1, 2021, Microchip lent $90,000 to another company. A note was signed with principal and 8% interest to be paid on September 30, 2022. On November 1, 2021, the company paid its landlord $6,000 representing rent for the months of November through January. Prepaid rent was debited. On August 1, 2021, collected $12,000 in advance rent from another company that is renting a portion of Microchip’s factory. The $12,000 represents one year’s rent and the entire amount was credited to deferred rent revenue. Depreciation on office equipment is $4,500 for the year. Vacation pay for the year that had been earned by employees but not paid to them or recorded is $8,000. The company records vacation pay as salaries expense. Microchip began the year with $2,000 in its asset account, supplies. During the year, $6,500 in supplies were purchased and debited to supplies. At year-end, supplies costing…arrow_forward

- Office Depot has an invoice for $3,814 dated May 8, with terms of 3/10, 2/15, n/30. The invoice also has a 1% penalty per month for payment after 30 days. a. What amount is due if paid on May 12? b. What amount is due if paid on May 22? c. What amount is due if paid on June 7? d. What amount is due if paid on June 13?arrow_forwardRandy Inc. purchased $300,000 of athletic shoes on credit on April 15. On May 31, Randy askedfor financial assistance from its supplier because it could not pay the bill on time. The supplieragreed to extend the due day by 6 months, to November 30, in exchange for a note due onNovember 30 with 8% interest. Required:Prepare the necessary journal entries from April 15 through payment on November 3arrow_forwardOn December 1 Simpson marketing company received $6900 from a customer for a two month marketing plan to be completed January 31 of the following year. The cash receipt was recorded as unearned fees the adjustment entry for the year and then December 31 would include:arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education