FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

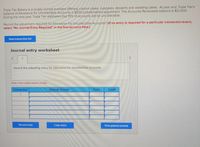

Transcribed Image Text:Triple Tier Bakery is a locally-owned business offering custom cakes, cupcakes, desserts and wedding cakes. At year end, Triple Tier's

balance of Allowance for Uncollectible Accounts is $530 (credit before adjustment. The Accounts Receivable balance is $21,500,

During the next year, Triple Tier estimates that 15% of accounts will be uncollectible.

Record the adjustment required for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event,

select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

Record the adjusting entry for Allowance for Uncollectible Accounts.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112.500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. Which of the following correctly states the effect of Loudoun's recording the restablishment of the receivable on April 4, Year 2? Cash 蛋蛋蛋白 NA a. b. NA C. NA d. NA Assets Multiple Choice + Net Realizable Value - 1,050 (1,050) (1,050) (1,050) 1,050 (1,050) Option A Option Balance Sheet Option C Liabilities + Accounts Payable + NA + NA (1,050) 1,050 + Stockholders' Equity Retained earnings NA (1,050) NA NA Common Stock NA NA NA (1,050) Revenue NA (1,050) NA NA Income Statement Expenses NA NA NA 1,050. = Net Income NA (1,050) NA (1,050) Statement of Cash Flows NA NA NA NAarrow_forwardDuring February 2020, Buffalo Massage Ltd. sells $12,000 of gift cards for Valentine's Day gifts. From reliable past experience, management estimates that 10% of the gift cards sold will not be redeemed. By the end of February, $3,000 was redeemed by customers. Prepare the journal entries for Buffalo Massage for February 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forwardGive me answerarrow_forward

- i need the answer quicklyarrow_forwardAt the end of the first year of operations, mayberry advertising had accounts receivable of $21100. Management of the company estimates that 8% of the accounts will not be collected What adjutment would mayberry advertising record to established allowance for uncollectible accounts Do the journal entry worksheetarrow_forwardOn July 10, 2020, Tamarisk Music sold CDs to retailers on account and recorded sales revenue of $657,000 (cost $538,740). Tamarisk grants the right to return CDs that do not sell in 3 months following delivery. Past experience indicates that the normal return rate is 15%. By October 11, 2020, retailers returned CDs to Tamarisk and were granted credit of $84,200.Prepare Tamarisk’s journal entries to record (a) the sale on July 10, 2020, and (b) $84,200 of returns on October 11, 2020, and on October 31, 2020. Assume that Tamarisk prepares financial statement on October 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation Debit Credit (a) enter an account title to record sales on July 10, 2017 enter a debit amount…arrow_forward

- i need the answer quicklyarrow_forwardPrepare the journal entries, with appropriate journal entry descriptions, for 2020, including any required year-end adjusting entries.The company prepares annual adjusting entries.arrow_forwardProvide the following independent journal entries: a. July 31, 2019. We had $1,000,000 of credit sales in July. We estimate that our bad debt expense will be 1% of credit sales. b. Aug. 15, 2019. We have an account receivable from Frank Farmworker for $500. On Aug. 15 we decide that we will not collect this account, so need to write it off. On Sept. 5 we get a check from Frank in the mail. c. Dec. 31, 2019. Allowance for Bad Debts currently has a credit balance of $7,200. We perform an aging of accounts receivable, and determine that the Allowance should have a balance of $10,100. d. Dec. 31, 2020. We age our accounts receivable: Age of accounts . Days: 1-30 31-60 61-9091+Total Accounts receivable$85,000$40,000$10,000$2,000$137,000 Estimate % uncollectible 1% 5% 20% 60% What balance should the…arrow_forward

- Focarrow_forwardAt year-end (December 31), Chan Company estimates its bad debts as 1% of its annual credit sales of $487,500. Chan records its Bad Debts Expense for that estimate. On the following February 1, Chan decides that the $580 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Prepare Chan's journal entries for the transactions. View transaction list Journal entry worksheet 1 2 3 4 Record the estimated bad debts expense. Note: Enter debits before credits. Debit Date General Journal Credit Dec 31arrow_forwardWant helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education