FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

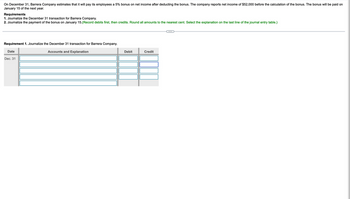

Transcribed Image Text:On December 31, Barrera Company estimates that it will pay its employees a 5% bonus on net income after deducting the bonus. The company reports net income of $52,000 before the calculation of the bonus. The bonus will be paid on

January 15 of the next year.

Requirements

1. Journalize the December 31 transaction for Barrera Company.

2. Journalize the payment of the bonus on January 15.(Record debits first, then credits. Round all amounts to the nearest cent. Select the explanation on the last line of the journal entry table.)

Requirement 1. Journalize the December 31 transaction for Barrera Company.

Date

Dec. 31

Accounts and Explanation

Debit

Credit

...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following transactions are from Ohlm Company. (Use 360 days a year.) Year 1 Dec. 16 Accepted a $10,700, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 Feb. 14 Received Todd’s payment of principal and interest on the note dated December 16. Mar. 2 Accepted a(n) $6,600, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Co. 17 Accepted a(n) $3,300, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Apr. 16 Privet dishonored her note. May 31 Midnight Co. dishonored its note. Aug. 7 Accepted a(n) $7,900, 90-day, 10% note in granting a time extension on the past-due account receivable of Mulan Co. Sep. 3 Accepted a(n) $3,210, 60-day, 11% note in granting Noah Carson a time extension on his past-due account…arrow_forwardRecording payroll and payroll taxes. Assume that the company is subject to a 2% state unemployment tax and 0.6% federal unemployment tax. REQUIRED: Record the following in general journal entry form on May 31. A. Accrual of monthly payroll B. Payment of the net payroll C. Accrual of employers payroll taxes(assume that the FICA matches the amount withhold) D. Payment of these payroll related liabilities. (assume that all are settled at the same time) The options for the shaded drop boxes are : Administrative salaries expense, cash, custodial salaries expense, federal income tax withholding payable, federal unemployment tax payable, FICA tax payable, payroll payable, payroll tax expense, sales salaries expense, state unemployment tax payable.arrow_forwardOn June 18, 2020, Woods Co. received from one of its customers, Webb Co., a 90 day, 11%, $6,000 note receivable, in exchange for contract services provided. Woods Co. has a March 31 year end. Webb Co. honoured the note at maturity. Prepare the entries for the issuance and the maturity of the note. Short Answer Toolbar navigation BIUSarrow_forward

- In January, the payroll supervisor determines that gross earnings for Pharoah Company are $64,000. All earnings are subject to 7.65% FICA taxes, 5.4% state unemployment taxes, and 0.6% federal unemployment taxes.Pharoah asks you to record a journal entry for the employer payroll taxes. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 12.25.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amountarrow_forwardLachgar Industries warrants its products for one year. The estimated product warranty is 4% of sales. Assume that sales were $210,000 for June. In July, a customer received warranty repairs requiring $140 of parts and $95 of labor. a. Journalize the adjusting entry required at June 30, the end of the first month of the current fiscal year, to record the accrued product warranty. b. Journalize the entry to record the warranty work provided in July.arrow_forwardJohnson Inc. has the following information available: On November 1, 20X1, Johnson lent $15,000 cash to one of its employees. The employee signed a one-year, 12%, promissory note. The note's principal plus interest is repaid to Johnson on November 1, 20X2. Interest calculations are rounded to the nearest whole month. Prepare journal entries to record the November 1, 20X1 transaction, the adjusting entry on 12/31/X1, and the November 1, 20X2 transaction.arrow_forward

- On July 8, Jones Inc. issued an $67,200, 9%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31. Using a 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? When required, round your answer to the nearest dollar. a. $6,048 b. $1,158 c. $386 d. $772arrow_forwardThe following transactions occurred during December 31, 2021, for the Microchip Company. On October 1, 2021, Microchip lent $90,000 to another company. A note was signed with principal and 8% interest to be paid on September 30, 2022. On November 1, 2021, the company paid its landlord $6,000 representing rent for the months of November through January. Prepaid rent was debited. On August 1, 2021, collected $12,000 in advance rent from another company that is renting a portion of Microchip’s factory. The $12,000 represents one year’s rent and the entire amount was credited to deferred rent revenue. Depreciation on office equipment is $4,500 for the year. Vacation pay for the year that had been earned by employees but not paid to them or recorded is $8,000. The company records vacation pay as salaries expense. Microchip began the year with $2,000 in its asset account, supplies. During the year, $6,500 in supplies were purchased and debited to supplies. At year-end, supplies costing…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education